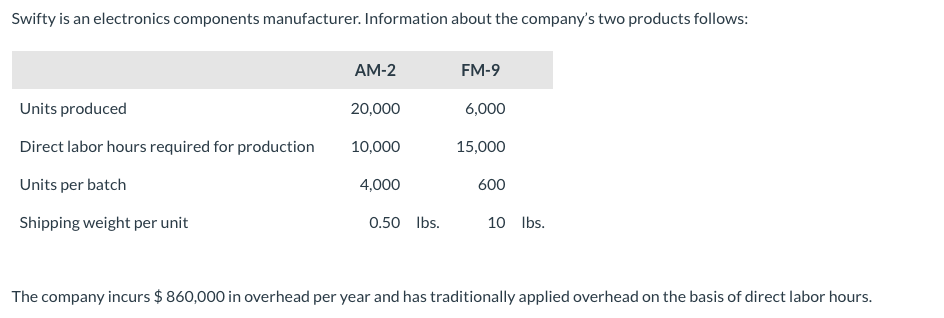

Swifty is an electronics components manufacturer. Information about the company's two products follows: AM-2 FM-9 Units produced 20,000 6,000 Direct labor hours required for production 10,000 15,000 Units per batch 4,000 600 Shipping weight per unit 0.50 Ibs. 10 Ibs. The company incurs $ 860,000 in overhead per year and has traditionally applied overhead on the basis of direct labor hours.

Swifty is an electronics components manufacturer. Information about the company's two products follows: AM-2 FM-9 Units produced 20,000 6,000 Direct labor hours required for production 10,000 15,000 Units per batch 4,000 600 Shipping weight per unit 0.50 Ibs. 10 Ibs. The company incurs $ 860,000 in overhead per year and has traditionally applied overhead on the basis of direct labor hours.

Chapter6: Activity-based, Variable, And Absorption Costing

Section: Chapter Questions

Problem 1MC: Active Frame, Inc., manufactures clear and tinted sport glasses. The manufacturing of clear glasses...

Related questions

Question

Assume that Swifty has identified three activity cost pools.

Transcribed Image Text:Swifty is an electronics components manufacturer. Information about the company's two products follows:

AM-2

FM-9

Units produced

20,000

6,000

Direct labor hours required for production

10,000

15,000

Units per batch

4,000

600

Shipping weight per unit

0.50 Ibs.

10 Ibs.

The company incurs $ 860,000 in overhead per year and has traditionally applied overhead on the basis of direct labor hours.

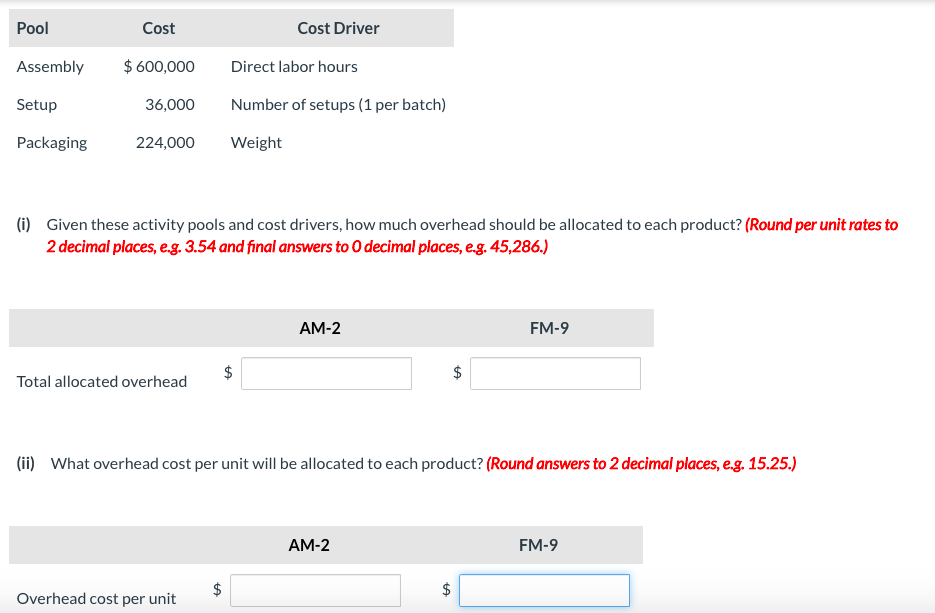

Transcribed Image Text:Pool

Cost

Cost Driver

Assembly

$ 600,000

Direct labor hours

Setup

36,000

Number of setups (1 per batch)

Packaging

224,000

Weight

(i) Given these activity pools and cost drivers, how much overhead should be allocated to each product? (Round per unit rates to

2 decimal places, e.g. 3.54 and final answers to O decimal places, eg. 45,286.)

AM-2

FM-9

$

Total allocated overhead

(ii) What overhead cost per unit will be allocated to each product? (Round answers to 2 decimal places, e.g. 15.25.)

AM-2

FM-9

Overhead cost per unit

%24

%24

%24

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning