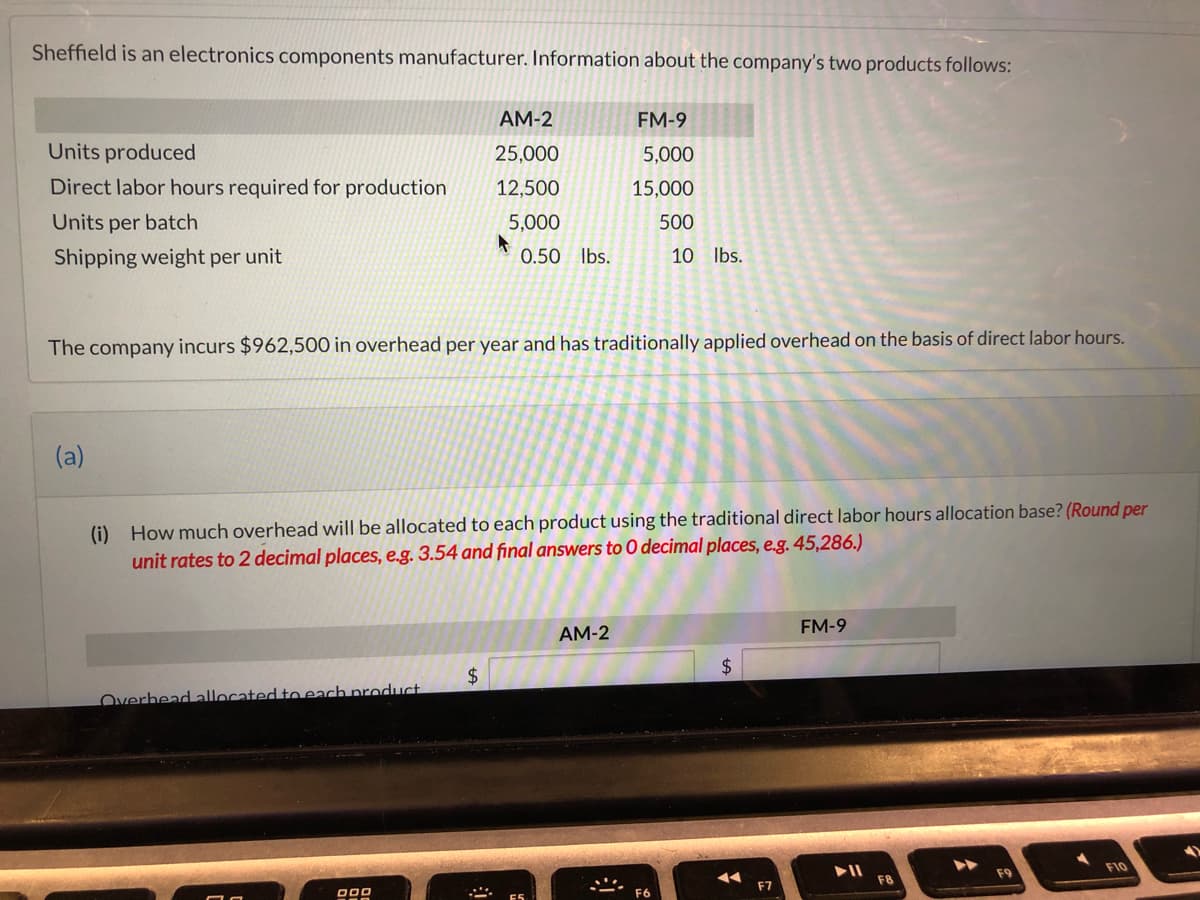

Sheffield is an electronics components manufacturer. Information about the company's two products follows: AM-2 FM-9 Units produced 25,000 5,000 Direct labor hours required for production 12,500 15,000 Units per batch 5,000 500 Shipping weight per unit 0.50 lbs. 10 Ibs. The company incurs $962,500 in overhead per year and has traditionally applied overhead on the basis of direct labor hours. (a) (i) How much overhead will be allocated to each product using the traditional direct labor hours allocation base? (Round per unit rates to 2 decimal places, e.g. 3.54 and final answers to 0 decimal places, e.g. 45,286.)

Sheffield is an electronics components manufacturer. Information about the company's two products follows: AM-2 FM-9 Units produced 25,000 5,000 Direct labor hours required for production 12,500 15,000 Units per batch 5,000 500 Shipping weight per unit 0.50 lbs. 10 Ibs. The company incurs $962,500 in overhead per year and has traditionally applied overhead on the basis of direct labor hours. (a) (i) How much overhead will be allocated to each product using the traditional direct labor hours allocation base? (Round per unit rates to 2 decimal places, e.g. 3.54 and final answers to 0 decimal places, e.g. 45,286.)

Chapter4: Job Order Costing

Section: Chapter Questions

Problem 6PA: During the year, a company purchased raw materials of $77,321, and incurred direct labor costs of...

Related questions

Question

I could use a hand with this problem

Transcribed Image Text:Sheffield is an electronics components manufacturer. Information about the company's two products follows:

AM-2

FM-9

Units produced

25,000

5,000

Direct labor hours required for production

12,500

15,000

Units per batch

5,000

500

Shipping weight per unit

0.50 Ibs.

10 Ibs.

The company incurs $962,500 in overhead per year and has traditionally applied overhead on the basis of direct labor hours.

(a)

(i) How much overhead will be allocated to each product using the traditional direct labor hours allocation base? (Round per

unit rates to 2 decimal places, e.g. 3.54 and final answers to 0 decimal places, e.g. 45,286.)

AM-2

FM-9

$4

24

Overhead allocated to each product.

F10

F9

F8

F7

F6

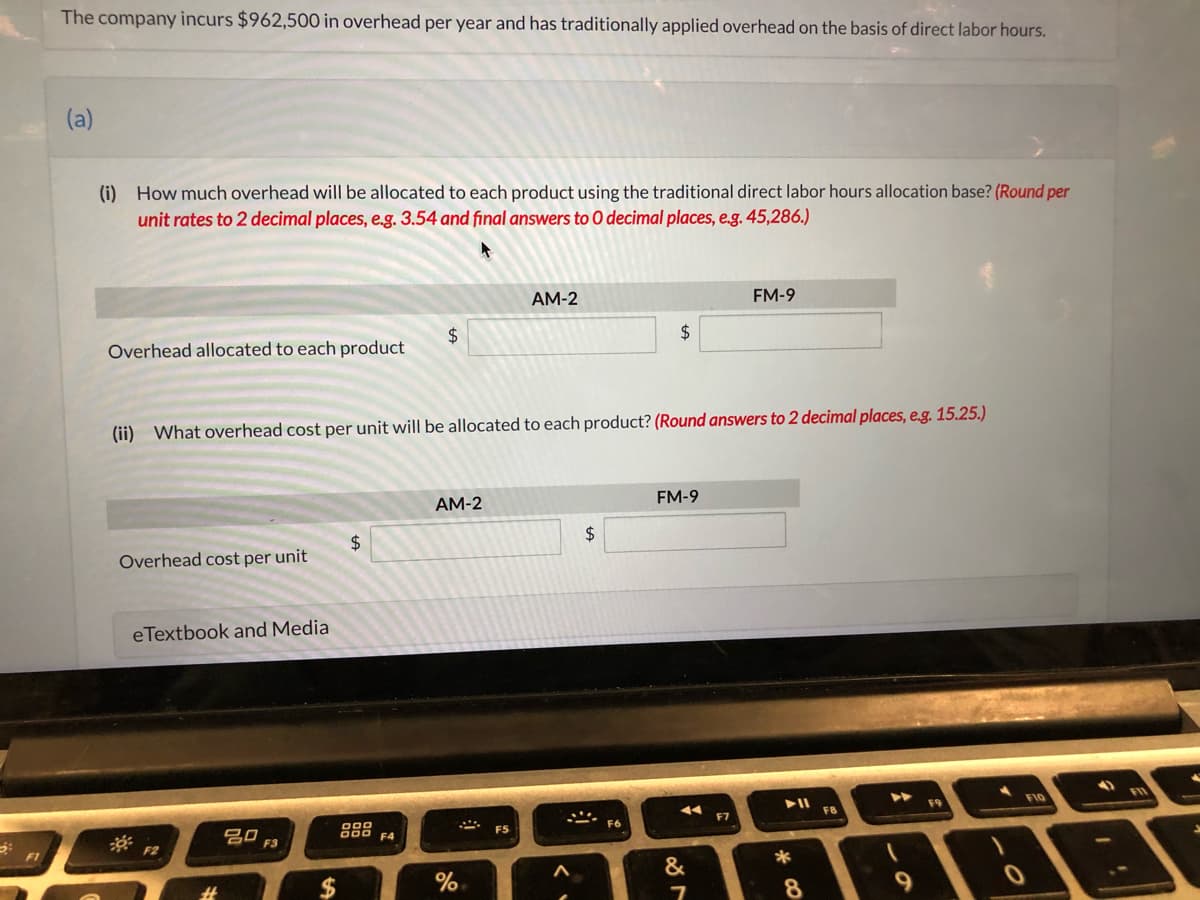

Transcribed Image Text:The company incurs $962,500 in overhead per year and has traditionally applied overhead on the basis of direct labor hours.

(a)

(i) How much overhead will be allocated to each product using the traditional direct labor hours allocation base? (Round per

unit rates to 2 decimal places, e.g. 3.54 and final answers to O decimal places, e.g. 45,286.)

AM-2

FM-9

Overhead allocated to each product

2$

2$

(ii) What overhead cost per unit will be allocated to each product? (Round answers to 2 decimal places, e.g. 15.25.)

AM-2

FM-9

2$

2$

Overhead cost per unit

eTextbook and Media

F9

F10

F8

F7

吕口

800 F4

FS

F6

F3

F1

&

8

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,