Please help me

Q: YES Partnership started operations on January 1 , 2016 with the following capital balances : Yves P8...

A: Profit Sharing Ratio (PSR) is the ratio in which partners distribute their Profits and Losses and ot...

Q: TRUE OR FALSE 1. Subsequent to the date of acquisition worksheet elimination number 1 will not comp...

A: 1. True In consolidated balance sheet, Cost of investment in subsidiary is compared to fair value of...

Q: please classified whether they belong in deductible and nondeductible expense for each condition tha...

A: Business Expenses: Business expenses are a measure of cash spent to complete one's work and which ca...

Q: Ayo Company started 2022 with P94,000 of merchandise inventory on hand. During 2022, P400,000 in mer...

A: Note: 1/15, n/45: Here, 1 represent the discount rate if payment is made within 15 days. And if paym...

Q: Matuku’s Fishing Supplies has two divisions, Basic and Deep Sea. Each division manager is evaluated ...

A: In the first solution, we will use a general pricing rule and we will find out the optimal transfer ...

Q: On January 1, 2022. TGIG sold equipment with historical cost of P10,000,000 and accumulated deprecia...

A: Carrying amount of the Note = Present value of the annual instalments where, Present value of the an...

Q: Net income for the year was $45,500. Accounts receivable increased by $5,500, and accounts payable i...

A: Cash flow from operations = Net income + Increase/Decrease in Current liabilities/assets - Increase/...

Q: Silver Company makes a product that is very popular as a Mother's Day gift. Thus, peak sales occur i...

A: Sales means the amount recorded in books as revenue earned by selling the goods or services. Account...

Q: 1. A company has a fiscal year-end of December 31: (1) on October 1, $13,000 was paid for a one-year...

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in...

Q: retained earnings statement, a balance statement, a comprehensive income statement and calculate the...

A: Note: Preparation of balance sheet requires the trial balance or previous year balances and their ad...

Q: 31. In an operating lease, the lessor records Select one or more: a) Lease revenue only b) Depreciat...

A: In operating lease, only the right to use assets is transferred to the lessee and the ownership of t...

Q: D. Information concerning Zian Company's manufacturing activities for November follows: Inventories ...

A:

Q: 16 Hurawalhi Company uses machine-hours (MHs) to allocate their manufacturing overhead (MOH) cost wi...

A: Solution Formula used Plant wide overhead rate is denoted by (POHR) POHR using traditional method ...

Q: Eisha Company conducted a physical count on December 31, 2021 which showed inventory with a total co...

A: Under FOB destination, titles of goods are transferred to the buyer only when goods are delivered to...

Q: Use the Goretex case to explain how the P.R.O.F.I.T. supports the assertion that it’s managerial pra...

A: P.R.O.F.I.T. is a popular acronym for Providing Real Opportunities For Income Transformation in gene...

Q: Complete the accounting equation, and journal entries for the transactions given below. • Complete ...

A: Accounting equation is the equation that which says that total assets must be equal to total liabili...

Q: Use the following information for Meeker Corp. to determine the amount of equity to report. $ 68,000...

A: D. $250,000 Assets - Liabilities = Owner's Equity Cash + Equipment + Land - Liabilities = Owner's Eq...

Q: "The current month's bank statement for your account arrives in the mail. In reviewing the statemen...

A: Answer: Case: "The current month's bank statement for your account arrives in the mail. In reviewin...

Q: „250,000, and P1,250,000, respectively. Six percent (6%) interest per a any excess or deficiency in ...

A:

Q: Larkspur, Inc. has entered an agreement to lease an old warehouse with a useful life of 5 years and ...

A: Journal entry - It refers to the process where the business transactions are recorded in the books o...

Q: On December 1, Orenthal Marketing Company received $7,500 from a customer for a 2-month marketing pl...

A: Lets understand the meaning of unearned revenue. When receipt is received in prior to service or goo...

Q: On May 1, a two-year insurance policy was purchased for $9,600 with coverage to begin immediately. W...

A: Insurance expense is the amount of insurance premium which is expired in the given time period. It i...

Q: 8. Which of the following is true regarding a general partnership? A.Partnership debt must be apport...

A: Answer: As per Q/A guideline, first question has been answered. Please repost remaining question. Pa...

Q: Statement 1: Dividends earned by a resident from a foreign corporation doing business outside the Ph...

A: Statement 1: Any income earned in the form of royalties, interests and dividends from a corporation ...

Q: A forklift is worth 3.2M Php. It has a lifetime of 12 years and has a SV=1.1M. How much is it wortg...

A: Major methods of computing depreciation are: 1. straight line method 2. declining balance method 3. ...

Q: A company has the following transactions during March: March 3 Purchases inventory on account for $3...

A: Solution Concept Under perpetual inventory system the inventory records is updated regularly This sy...

Q: Gil Co. purchased four items of inventory at a bulk price of P9,000,000. The fair value of each item...

A: Cost to be allocated to Inventory = Bulk price X fair value of individual inventory / Total fair val...

Q: A sports complex is to be constructed. Two plans are under consideration. Plan A is to construct a t...

A:

Q: Cara Company provided the following information for the current year: January 1 December 31 Current ...

A: Working capital = Total current assets - Total current liabilities Shareholders equity = Total asset...

Q: YNA Inc. operates a jewelry store. On the morning of February 14, an inventory was conducted after d...

A: In the given question theft occured on February 14, and in that date Inventory was P5500000. The oth...

Q: Thank you, but now, the total current assets is incorrect..

A: Solution Concept In a balance sheet there are two sides assets and liabilities+ equity Balance sheet...

Q: BIR made disbursements for travel expenses of its personnel. Such would most likely be classified as...

A: BIR is Burau of Internal Revenue of Phillipines regulates rule and regulations for taxat...

Q: Epon Corporation uses a process costing system based on the weighted average method. The production ...

A: Equivalent units concept is used when opening or ending work in progress is not 100% complete but pa...

Q: Indicate whether each of the following expenditure items should be classified as a function (F), org...

A: The classification of the expenditure is based on their characteristic . Where the expenditure is do...

Q: Page 4 of 4 12. Mr. Bean receives a monthly basic salary of P38,000. He also receives P2,0O00 monthl...

A: Total Compensation = 38000 +2000 +2000 +500 = php 42,500 A) Gover...

Q: Freddy is a director of Ace Finance Ltd. The board of directors for Ace Finance Ltd have unanimousl...

A: The Corporation Act is the act which impose or levy number of additional fiduciary duties on the dir...

Q: Activity 4: Directions: For each transaction, tell whether the assets, liabilities, anco equity will...

A: The accounting equation shows the relationship between assets, liabilities and equity. When a comp...

Q: On January 1, 2022. TGIG sold equipment with historical cost of P10,000,000 and accumulated deprecia...

A: Carrying amount of the Note = Present value of the annual instalments where, Present value of the an...

Q: The stockholders' equity section of Meyer Corporation's balance sheet as of December 31, 2018 is as ...

A: Shareholders' equity section of a company represents the amount related to its shareholders. It incl...

Q: geted al o ctec ctec rear, s pr ct m et la ct la emb ishir nine emb ishir - dep

A:

Q: One advantage of switching from a partnership to the corporate form of organization is the following...

A: It makes it easier for the firm to raise additional capital

Q: Morrison Company Balance Sheet January 1 Assets Cash $ 40,950 Raw materials Work in process Finished...

A: Introduction- A balance sheet (also known as a statement of financial position or a statement of fin...

Q: Direct materials Direct labour Variable overhead: Supplies Maintenance Power $5.50 2.8 0.65 0.25 0.1...

A: Solution Concept Flexible budget is a budget which is prepared by adjusting the variable cost as per...

Q: bor Cost Budget Rip Court Racket Company manufactures two types of tennis rackets, the Junior and P...

A: Rip Court Racket Company manufactures two types of tennis rackets, the Junior and Pro Striker models...

Q: To eliminated the deficit, ABC should reduce the ordinary share capital by

A: Quasi reorganization is the recommended process when an organization is facing losses for a long tim...

Q: Kula Company Ltd manufactures two products, Flora and Fauna. Estimates for the company's products fo...

A: Calculation of activity rates : Order Processing = Order processing costNumber of order processed =...

Q: Scouts Corp. projects its sales to be 1,000 units this year. As a result of holding inventories, ins...

A: Part 1:-Reorder Point It is the level of inventory at which we need to replenish the inventory stock...

Q: Gil Co. purchased four items of inventory at a bulk price of P9,000,000. The fair value of each item...

A: Total fair value of all inventory = 4,000,000 + 3,000,000 + 2,000,000 + 1,000,000 Total fair value o...

Q: The following facts pertain to a non-cancelable lease agreement between Faldo Leasing Company and Pi...

A: A table that shows the complete periodic loan payments, the principal loan amount, and the interest ...

Q: You are assigned to prepare the financial statements of LIVA Company for the year 2021. The followin...

A: Calculation of Net Sales Net Sales = Gross Sales - Sales Discount Net Sales = 2,843,000 - 16,000 Net...

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

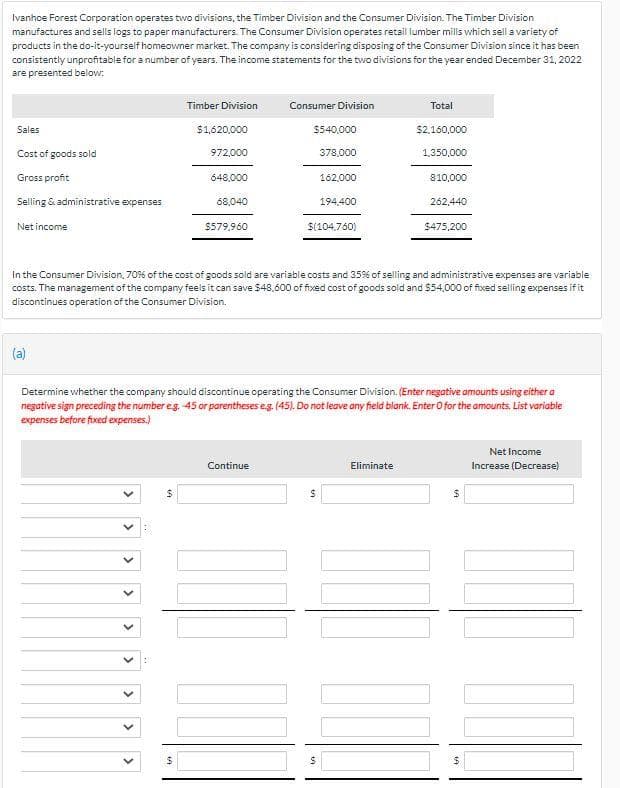

- Last Resort Industries Inc. is a privately held diversified company with five separate divisions organized as investment centers. A condensed income statement for the Specialty Products Division for the past year, assuming no support department allocations, along with asset information is as follows: The manager of the Specialty Products Division was recently presented with the opportunity to add an additional product line, which would require invested assets of 14,400,000. A projected income statement for the new product line is as follows: The Specialty Products Division currently has 27,000,000 in invested assets, and Last Resort Industries Inc.s overall return on investment, including all divisions, is 10%. Each division manager is evaluated on the basis of divisional return on investment. A bonus is paid, in 8,000 increments, for each whole percentage point that the divisions return on investment exceeds the company average. The president is concerned that the manager of the Specialty Products Division rejected the addition of the new product line, even though all estimates indicated that the product line would be profitable and would increase overall company income. You have been asked to analyze the possible reasons the Specialty Products Division manager rejected the new product line. a. Determine the return on investment for the Specialty Products Division for the past year. b. Determine the Specialty Products Division managers bonus for the past year. c. Determine the estimated return on investment for the new product line. Round percentages to one decimal place and the investment turnover to two decimal places. d. Why might the manager of the Specialty Products Division decide to reject the new product line? Support your answer by determining the projected return on investment for 20Y6, assuming that the new product line was launched in the Specialty Products Division and 20Y6 actual operating results were similar to those of 20Y5. e. Suggest an alternative performance measure for motivating division managers to accept new investment opportunities that would increase the overall company income and return on investment.Renslen, Inc., a truck manufacturing conglomerate, has recently purchased two divisions: Meyers Service Company and Wellington Products, Inc. Meyers provides maintenance service on large truck cabs for 10-wheeler trucks, and Wellington produces air brakes for the 10-wheeler trucks. The employees at Meyers take pride in their work, as Meyers is proclaimed to offer the best maintenance service in the trucking industry. The management of Meyers, as a group, has received additional compensation from a 10 percent bonus pool based on income before income taxes and bonus. Renslen plans to continue to compensate the Meyers management team on this basis as it is the same incentive plan used for all other Renslen divisions, except for the Wellington division. Wellington offers a high-quality product to the trucking industry and is the premium choice even when compared to foreign competition. The management team at Wellington strives for zero defects and minimal scrap costs; current scrap levels are at 2 percent. The incentive compensation plan for Wellington management has been a 1 percent bonus based on gross margin. Renslen plans to continue to compensate the Wellington management team on this basis. The following condensed income statements are for both divisions for the fiscal year ended May 31, 20x1: Renslen, Inc. Divisional Income Statements For the Year Ended May 31, 20x1 Each division has 1,000,000 of management salary expense that is eligible for the bonus pool. Renslen has invited the management teams of all its divisions to an off-site management workshop in July where the bonus checks will be presented. Renslen is concerned that the different bonus plans at the two divisions may cause some heated discussion. Required: 1. Determine the 20x1 bonus pool available for the management team at: a. Meyers Service Company b. Wellington Products, Inc. 2. Identify at least two advantages and disadvantages to Renslen, Inc., of the bonus pool incentive plan at: a. Meyers Service Company b. Wellington Products, Inc. 3. Having two different types of incentive plans for two operating divisions of the same corporation can create problems. a. Discuss the behavioral problems that could arise within management for Meyers Service Company and Wellington Products, Inc., by having different types of incentive plans. b. Present arguments that Renslen, Inc., can give to the management teams of both Meyers and Wellington to justify having two different incentive plans.Trump Forest Corporation operates two divisions, the Timber Division and the Consumer Division. The Timber Division manufactures and sells logs to paper manufacturers. The Consumer Division operates retail lumber mills which sell a variety of products in the do-it-yourself homeowner market. The company is considering disposing of the Consumer Division since it has been consistently unprofitable for a number of years. The income statements for the two divisions for the year ended December 31, 2019 are presented below: Timber Division Consumer Division Total Sales $1,500,000 $500,000 $2,000,000 Cost of goods sold 900,000 350,000…

- Grael Technology has two divisions, Consumer and Commercial, and two corporate service departments, Tech Support and Purchasing. The corporate costs for the year ended December 31, 20Y7, are as follows: Tech Support Department $336,000 Purchasing Department 67,500 Other corporate administrative costs 448,000 Total corporate costs $851,500 The other corporate administrative costs include officers’ salaries and miscellaneous smaller costs required by the corporation. The Tech Support Department allocates the divisions for services rendered, based on the number of computers in the department, and the Purchasing Department allocates divisions for services, based on the number of purchase orders for each department. The usage of service by the two divisions is as follows: Tech Support Purchasing Consumer Division 300 computers 1,800 purchase orders Commercial Division 180 2,700 Total 480 computers 4,500 purchase orders The service department allocations…The Star Paper Division of Royal Industries is located near Los Angeles. A major expansion of the division’s only plant was completed in April 2007. The expansion consisted of an addition to the existing building, additions to the production-line machinery, and the replacement of obsolete and fully depreciated equipment that was no longer efficient or cost effective.On May 1, 2007, George Harris became manager of Star. Harris had a meeting with Marie Fortner, vice president of operations for Royal, who explained to Harris that the company measured the performance of divisions and division managers on the basis of return on gross assets (ROA). When Harris asked if othermeasures were used in conjunction with ROA, Fortner replied, ‘‘Royal’s top management prefers to use a single performance measure. Star should do well this year now that it has expanded and replaced all of that old equipment. You should have no problem exceeding the division’s historical rate. I’ll check with you at the…Velstrom Ltd is considering outsourcing one of its products rather than producing it in its factory. The business allocates part of the total rental charge of the factory, based on floor area, on the section responsible for making the product. The section bears a charge of £20,000 per year. If the section were closed, the floor space released would be used for warehousing and, as a result, the business would give up the tenancy of an existing warehouse for which it is paying £25,000 a year. SO what is the answer

- Velstrom Ltd is considering outsourcing one of its products rather than producing it in its factory. The business allocates part of the total rental charge of the factory, based on floor area, on the section responsible for making the product. The section bears a charge of £20,000 per year. If the section were closed, the floor space released would be used for warehousing and, as a result, the business would give up the tenancy of an existing warehouse for which it is paying £25,000 a year. A business has approached Velstrom Ltd to offer £22,000 a year to sublet the released factory space. What will be the relevant benefit of releasing the factory space?Betty’s Fashions operates retail stores in both downtown and suburban locations. The company has two responsibility centers: the City Division, which contains stores in downtown locations, and the Mall Division, which contains stores in suburban locations. Betty’s CEO is concerned about the profitability of the City Division, which has been operating at a loss for the last several years. The most recent City Division income statement follows. The CEO has asked for your advice on shutting down the City Division’s operations. If the City Division is eliminated, corporate administration is not expected to change, nor are any other changes expected in the operations or costs of the Mall Division.Yozamba Technology has two divisions, Consumer and Commercial, and two corporate service departments, Tech Support and Purchasing. The corporate expenses for the year ended December 31, 20Y7, are as follows: Tech Support Department $567,000 Purchasing Department 96,900 Other corporate administrative expenses 590,000 Total corporate expense $1,253,900 The other corporate administrative expenses include officers’ salaries and other expenses required by the corporation. The Tech Support Department charges the divisions for services rendered, based on the number of computers in the department, and the Purchasing Department charges divisions for services, based on the number of purchase orders for each department. The usage of service by the two divisions is as follows: Tech Support Purchasing Consumer Division 360 computers 1,990 purchase orders Commercial Division 270 3,710 Total 630 computers 5,700 purchase orders The service department charges of…

- Grael Technology has two divisions, Consumer and Commercial, and two corporate service departments, Tech Support and Purchasing. The corporate expenses for the year ended December 31, 20Y7, are as follows: Tech Support Department $ 560,700 Purchasing Department 89,600 Other corporate administrative expenses 585,000 Total corporate expense $1,235,300 The other corporate administrative expenses include officers’ salaries and other expenses required by the corporation. The Tech Support Department charges the divisions for services rendered, based on the number of computers in the department, and the Purchasing Department charges divisions for services, based on the number of purchase orders for each department. The usage of service by the two divisions is as follows: Tech Support Purchasing Consumer Division 320 computers 1,940 purchase orders Commercial Division 310 3,660 Total 630 computers 5,600 purchase orders The service department charges of…The Kelly-Elias Corporation, manufacturer of tractors and other heavy farm equipment, is organized along decentralized product lines, with each manufacturing division operating as a separate profit center. Each division manager has been delegated full authority on all decisions involving the sale of that division’s output both to outsiders and to other divisions of Kelly-Elias. Division C has in the past always purchased its requirement of a particular tractor-engine component from division A. However, when informed that division A is increasing its selling price to $135, division C’s manager decides to purchase the engine component from external suppliers. Division C can purchase the component for $115 per unit in the open market. Division A insists that, because of the recent installation of some highly specialized equipment and the resulting high depreciation charges, it will not be able to earn an adequate return on its investment unless it raises its price. Division A’s manager…The Kelly-Elias Corporation, manufacturer of tractors and other heavy farm equipment, is organized along decentralized product lines, with each manufacturing division operating as a separate profit center. Each division manager has been delegated full authority on all decisions involving the sale of that division’s output both to outsiders and to other divisions of Kelly-Elias. Division C has in the past always purchased its requirement of a particular tractor-engine component from division A. However, when informed that division A is increasing its selling price to $135, division C’s manager decides to purchase the engine component from external suppliers. Division C can purchase the component for $115 per unit in the open market. Division A insists that, because of the recent installation of some highly specialized equipment and the resulting high depreciation charges, it will not be able to earn an adequate return on its investment unless it raises its price. Division A’s manager…