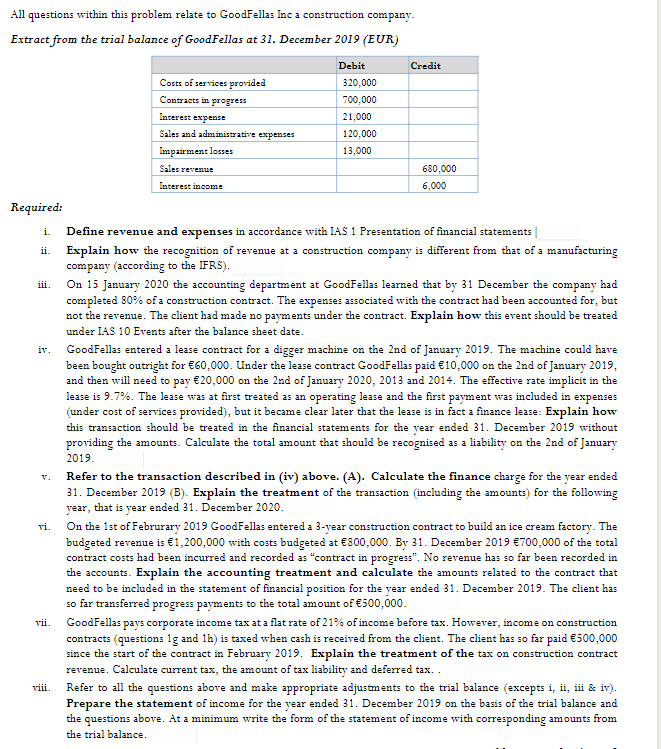

tract from the trial balance of GoodFellas at 31. December 2019 (EUR) Debit Credit Costs of services provided 320,000 Conracts in progress 700,000 Interest expense 21,000 Sales and administrative expenses 120,000 Impairment losses 13,000 Sales revenue 680,000 Interest income 6,000 quired: i. Define revenue and expenses in accordance with IAS 1 Presentation of financial statements

tract from the trial balance of GoodFellas at 31. December 2019 (EUR) Debit Credit Costs of services provided 320,000 Conracts in progress 700,000 Interest expense 21,000 Sales and administrative expenses 120,000 Impairment losses 13,000 Sales revenue 680,000 Interest income 6,000 quired: i. Define revenue and expenses in accordance with IAS 1 Presentation of financial statements

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter3: Review Of A Company's Accounting System

Section: Chapter Questions

Problem 11E: Worksheet for Service Company Whitaker Consulting Company has prepared a trial balance on the...

Related questions

Concept explainers

Depreciation Methods

The word "depreciation" is defined as an accounting method wherein the cost of tangible assets is spread over its useful life and it usually denotes how much of the assets value has been used up. The depreciation is usually considered as an operating expense. The main reason behind depreciation includes wear and tear of the assets, obsolescence etc.

Depreciation Accounting

In terms of accounting, with the passage of time the value of a fixed asset (like machinery, plants, furniture etc.) goes down over a specific period of time is known as depreciation. Now, the question comes in your mind, why the value of the fixed asset reduces over time.

Topic Video

Question

Transcribed Image Text:All questions within this problem relate to GoodFellas Inc a construction company.

Extract from the trial balance of GoodFellas at 31. December 2019 (EUR)

Debit

Credit

Costs of services provided

320,000

Contracts in progress

700,000

Interest expense

21,000

Sales and administrative expenses

120,000

Impairment losses

13,000

Sales revenue

680,000

Interest income

6,000

Required:

i.

Define revenue and expenses in accordan

with IAS 1 Presentation of financial statenments |

Explain how the recognition of revenue at a construction company is different from that of a manufacturing

company (according to the IFRS).

On 15 January 2020 the accounting department at GoodFellas learned that by 31 December the company had

completed 80% of a construction contract. The expenses associated with the contract had been accounted for, but

not the revenue. The client had made no payments under the contract. Explain how this event should be treated

ii.

iii.

under IAS 10 Events after the balance sheet date.

GoodFellas entered a lease contract for a digger machine on the 2nd of January 2019. The machine could have

been bought outright for €60,000. Under the lease contract GoodFellas paid €10,000 on the 2nd of January 2019,

and then will need to pay €20,000 on the 2nd of January 2020, 2013 and 2014. The effective rate implicit in the

lease is 9.7%. The lease was at first treated as an operating lease and the first payment was included in expenses

(under cost of services provided), but it became clear later that the lease is in fact a finance lease: Explain how

iv.

this transaction should be treated in the financial statements for the year ended 31. December 2019 without

providing the amounts. Calculate the total amount that should be recognised as a liability on the 2nd of January

2019.

Refer to the transaction described in (iv) above. (A). Calculate the finance charge for the year ended

31. December 2019 (B). Explain the treatment of the transaction (including the amounts) for the following

year, that is year ended 31. December 2020.

On the 1st of Februrary 2019 GoodFellas entered a 3-year construction contract to build an ice cream factory. The

budgeted revenue is €i,200,000 with costs budgeted at €800,000. By 31. December 2019 €700,000 of the total

contract costs had been incurred and recorded as "contract in progress". No revenue has so far been recorded in

vi.

the accounts. Explain the accounting treatment and calculate the amounts related to the contract that

need to be included in the statement of financial position for the year ended 31. December 2019. The client has

so far transferred progress payments to the total amount of €500,000.

vii. GoodFellas pays corporate income tax at a flat rate of 21% of income before tax. However, income on construction

contracts (questions 1g and 1h) is taxed when cash is received from the client. The client has so far paid €500,000

since the start of the contract in February 2019. Explain the treatment of the tax on construction contract

revenue. Calculate current tax, the amount of tax liability and deferred tax. .

Refer to all the questions above and make appropriate adjustments to the trial balance (excepts i, ii, i & iv).

Prepare the statement of income for the year ended 31. December 2019 on the basis of the trial balance and

the questions above. At a minimum write the form of the statement of income with corresponding amounts from

viii.

the trial balance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT