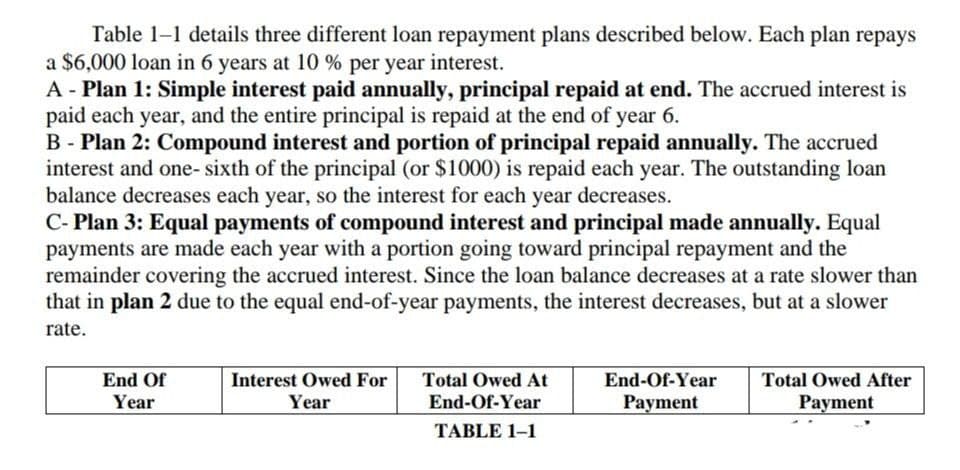

Table 1-1 details three different loan repayment plans described below. Each plan repays a $6,000 loan in 6 years at 10 % per year interest. A - Plan 1: Simple interest paid annually, principal repaid at end. The accrued interest is paid each year, and the entire principal is repaid at the end of year 6. B - Plan 2: Compound interest and portion of principal repaid annually. The accrued interest and one-sixth of the principal (or $1000) is repaid each year. The outstanding loan balance decreases each year, so the interest for each year decreases. C- Plan 3: Equal payments of compound interest and principal made annually. Equal payments are made each year with a portion going toward principal repayment and the remainder covering the accrued interest. Since the loan balance decreases at a rate slower than that in plan 2 due to the equal end-of-year payments, the interest decreases, but at a slower rate. End Of Year Interest Owed For Year Total Owed At End-Of-Year End-Of-Year Payment Total Owed After Payment TABLE 1-1

Table 1-1 details three different loan repayment plans described below. Each plan repays a $6,000 loan in 6 years at 10 % per year interest. A - Plan 1: Simple interest paid annually, principal repaid at end. The accrued interest is paid each year, and the entire principal is repaid at the end of year 6. B - Plan 2: Compound interest and portion of principal repaid annually. The accrued interest and one-sixth of the principal (or $1000) is repaid each year. The outstanding loan balance decreases each year, so the interest for each year decreases. C- Plan 3: Equal payments of compound interest and principal made annually. Equal payments are made each year with a portion going toward principal repayment and the remainder covering the accrued interest. Since the loan balance decreases at a rate slower than that in plan 2 due to the equal end-of-year payments, the interest decreases, but at a slower rate. End Of Year Interest Owed For Year Total Owed At End-Of-Year End-Of-Year Payment Total Owed After Payment TABLE 1-1

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 20P

Related questions

Question

Transcribed Image Text:Table 1-1 details three different loan repayment plans described below. Each plan repays

a $6,000 loan in 6 years at 10 % per year interest.

A - Plan 1: Simple interest paid annually, principal repaid at end. The accrued interest is

paid each year, and the entire principal is repaid at the end of year 6.

B - Plan 2: Compound interest and portion of principal repaid annually. The accrued

interest and one-sixth of the principal (or $1000) is repaid each year. The outstanding loan

balance decreases each year, so the interest for each year decreases.

C- Plan 3: Equal payments of compound interest and principal made annually. Equal

payments are made each year with a portion going toward principal repayment and the

remainder covering the accrued interest. Since the loan balance decreases at a rate slower than

that in plan 2 due to the equal end-of-year payments, the interest decreases, but at a slower

rate.

End Of

Year

Interest Owed For

Year

Total Owed At

End-Of-Year

TABLE 1-1

End-Of-Year

Payment

Total Owed After

Payment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning