ed and his wife have applied for a $350,000 mortgage to be amortized over of 2.8% and a term of 5 years. Payments will be monthly. The Bank of Can ed insured mortgage rate is 5.25%. The couple expect monthly heating and nt to $325. Their gross combined monthly income is $12,000. What is thei SDS) ratio?

ed and his wife have applied for a $350,000 mortgage to be amortized over of 2.8% and a term of 5 years. Payments will be monthly. The Bank of Can ed insured mortgage rate is 5.25%. The couple expect monthly heating and nt to $325. Their gross combined monthly income is $12,000. What is thei SDS) ratio?

Chapter8: Taxation Of Individuals

Section: Chapter Questions

Problem 64IIP

Related questions

Question

A6)

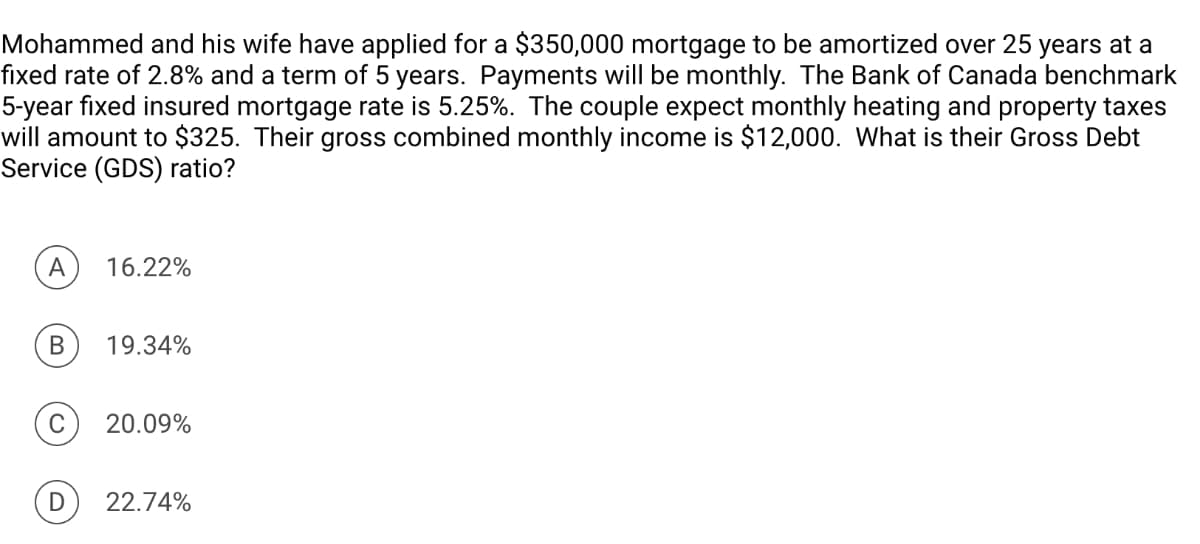

Transcribed Image Text:Mohammed and his wife have applied for a $350,000 mortgage to be amortized over 25 years at a

fixed rate of 2.8% and a term of 5 years. Payments will be monthly. The Bank of Canada benchmark

5-year fixed insured mortgage rate is 5.25%. The couple expect monthly heating and property taxes

will amount to $325. Their gross combined monthly income is $12,000. What is their Gross Debt

Service (GDS) ratio?

A

16.22%

B 19.34%

20.09%

D 22.74%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT