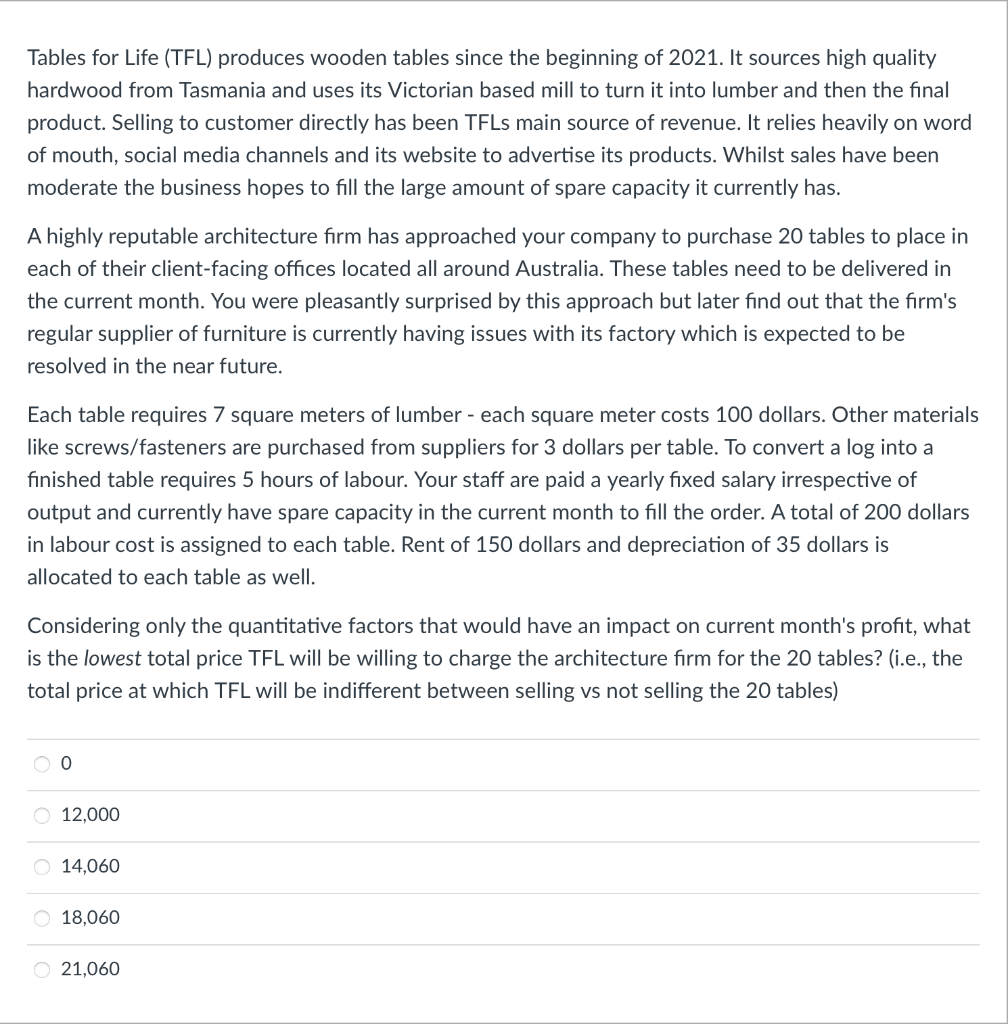

Tables for Life (TFL) produces wooden tables since the beginning of 2021. It sources high quality hardwood from Tasmania and uses its Victorian based mill to turn it into lumber and then the final product. Selling to customer directly has been TFLs main source of revenue. It relies heavily on word of mouth, social media channels and its website to advertise its products. Whilst sales have been moderate the business hopes to fill the large amount of spare capacity it currently has. A highly reputable architecture firm has approached your company to purchase 20 tables to place in each of their client-facing offices located all around Australia. These tables need to be delivered in the current month. You were pleasantly surprised by this approach but later find out that the firm's regular supplier of furniture is currently having issues with its factory which is expected to be resolved in the near future. Each table requires 7 square meters of lumber - each square meter costs 100 dollars. Other materials like screws/fasteners are purchased from suppliers for 3 dollars per table. To convert a log into a finished table requires 5 hours of labour. Your staff are paid a yearly fixed salary irrespective of output and currently have spare capacity in the current month to fill the order. A total of 200 dollars in labour cost is assigned to each table. Rent of 150 dollars and depreciation of 35 dollars is allocated to each table as well. Considering only the quantitative factors that would have an impact on current month's profit, what is the lowest total price TFL will be willing to charge the architecture firm for the 20 tables? (i.e., the total price at which TFL will be indifferent between selling vs not selling the 20 tables) 0 O 12,000 O 14,060 O 18,060 21,060

Tables for Life (TFL) produces wooden tables since the beginning of 2021. It sources high quality hardwood from Tasmania and uses its Victorian based mill to turn it into lumber and then the final product. Selling to customer directly has been TFLs main source of revenue. It relies heavily on word of mouth, social media channels and its website to advertise its products. Whilst sales have been moderate the business hopes to fill the large amount of spare capacity it currently has. A highly reputable architecture firm has approached your company to purchase 20 tables to place in each of their client-facing offices located all around Australia. These tables need to be delivered in the current month. You were pleasantly surprised by this approach but later find out that the firm's regular supplier of furniture is currently having issues with its factory which is expected to be resolved in the near future. Each table requires 7 square meters of lumber - each square meter costs 100 dollars. Other materials like screws/fasteners are purchased from suppliers for 3 dollars per table. To convert a log into a finished table requires 5 hours of labour. Your staff are paid a yearly fixed salary irrespective of output and currently have spare capacity in the current month to fill the order. A total of 200 dollars in labour cost is assigned to each table. Rent of 150 dollars and depreciation of 35 dollars is allocated to each table as well. Considering only the quantitative factors that would have an impact on current month's profit, what is the lowest total price TFL will be willing to charge the architecture firm for the 20 tables? (i.e., the total price at which TFL will be indifferent between selling vs not selling the 20 tables) 0 O 12,000 O 14,060 O 18,060 21,060

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter3: Cost Behavior

Section: Chapter Questions

Problem 31P: Rolertyme Company manufactures roller skates. With the exception of the rollers, all parts of the...

Related questions

Question

100%

Transcribed Image Text:Tables for Life (TFL) produces wooden tables since the beginning of 2021. It sources high quality

hardwood from Tasmania and uses its Victorian based mill to turn it into lumber and then the final

product. Selling to customer directly has been TFLs main source of revenue. It relies heavily on word

of mouth, social media channels and its website to advertise its products. Whilst sales have been

moderate the business hopes to fill the large amount of spare capacity it currently has.

A highly reputable architecture firm has approached your company to purchase 20 tables to place in

each of their client-facing offices located all around Australia. These tables need to be delivered in

the current month. You were pleasantly surprised by this approach but later find out that the firm's

regular supplier of furniture is currently having issues with its factory which is expected to be

resolved in the near future.

Each table requires 7 square meters of lumber - each square meter costs 100 dollars. Other materials

like screws/fasteners are purchased from suppliers for 3 dollars per table. To convert a log into a

finished table requires 5 hours of labour. Your staff are paid a yearly fixed salary irrespective of

output and currently have spare capacity in the current month to fill the order. A total of 200 dollars

in labour cost is assigned to each table. Rent of 150 dollars and depreciation of 35 dollars is

allocated to each table as well.

Considering only the quantitative factors that would have an impact on current month's profit, what

is the lowest total price TFL will be willing to charge the architecture firm for the 20 tables? (i.e., the

total price at which TFL will be indifferent between selling vs not selling the 20 tables)

0

O 12,000

O 14,060

O 18,060

21,060

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning