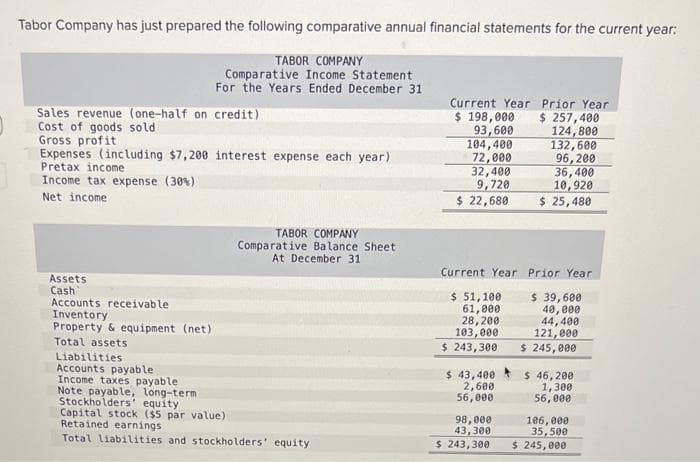

Tabor Company has just prepared the following comparative annual financial statements for the current year: TABOR COMPANY Comparative Income Statement For the Years Ended December 31 Sales revenue (one-half on credit) Cost of goods sold Gross profit Expenses (including $7,200 interest expense each year). Pretax income Income tax expense (30%) Net income Assets Cash Accounts receivable Inventory Property & equipment (net) Total assets TABOR COMPANY Comparative Balance Sheet At December 31 Liabilities Accounts payable Income taxes payable. Note payable, long-term Stockholders' equity Capital stock ($5 par value) Retained earnings Total liabilities and stockholders' equity Current Year Prior Year $ 198,000 $ 257,400 124,800 93,600 104,400 72,000 32,400 9,720 $ 22,680 Current Year $ 51,100 61,000 28,200 103,000 $ 243,300 $ 43,400 2,600 56,000 98,000 43,300 $ 243,300 132,600 96,200 36,400 10,920 $ 25,480 Prior Year $ 39,600 40,000 44,400 121,000 $ 245,000 $ 46,200 1,300 56,000 106,000 35,500 $ 245,000

Tabor Company has just prepared the following comparative annual financial statements for the current year: TABOR COMPANY Comparative Income Statement For the Years Ended December 31 Sales revenue (one-half on credit) Cost of goods sold Gross profit Expenses (including $7,200 interest expense each year). Pretax income Income tax expense (30%) Net income Assets Cash Accounts receivable Inventory Property & equipment (net) Total assets TABOR COMPANY Comparative Balance Sheet At December 31 Liabilities Accounts payable Income taxes payable. Note payable, long-term Stockholders' equity Capital stock ($5 par value) Retained earnings Total liabilities and stockholders' equity Current Year Prior Year $ 198,000 $ 257,400 124,800 93,600 104,400 72,000 32,400 9,720 $ 22,680 Current Year $ 51,100 61,000 28,200 103,000 $ 243,300 $ 43,400 2,600 56,000 98,000 43,300 $ 243,300 132,600 96,200 36,400 10,920 $ 25,480 Prior Year $ 39,600 40,000 44,400 121,000 $ 245,000 $ 46,200 1,300 56,000 106,000 35,500 $ 245,000

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 52E: Juroe Company provided the following income statement for last year: Juroes balance sheet as of...

Related questions

Question

Transcribed Image Text:Tabor Company has just prepared the following comparative annual financial statements for the current year:

TABOR COMPANY

Comparative Income Statement

For the Years Ended December 31

Sales revenue (one-half on credit)

Cost of goods sold.

Gross profit

Expenses (including $7,200 interest expense each year).

Pretax income

Income tax expense (30%)

Net income

Assets

Cash

Accounts receivable

Inventory

Property & equipment (net)

Total assets

Liabilities

Accounts payable

Income taxes payable

Note payable, long-term

Stockholders' equity

TABOR COMPANY

Comparative Balance Sheet

At December 31

Capital stock ($5 par value)

Retained earnings

Total liabilities and stockholders' equity

Current Year Prior Year

$ 198,000

$ 257,400

93,600

124,800

132,600

96,200

36,400

10,920

$ 25,480

104,400

72,000

32,400

9,720

$ 22,680

Current Year

$ 51,100

61,000

28,200

103,000

$ 243,300

$ 43,400

2,600

56,000

98,000

43,300

$ 243,300

Prior Year

$ 39,600

40,000

44,400

121,000

$ 245,000

$ 46,200

1,300

56,000

106,000

35,500

$ 245,000

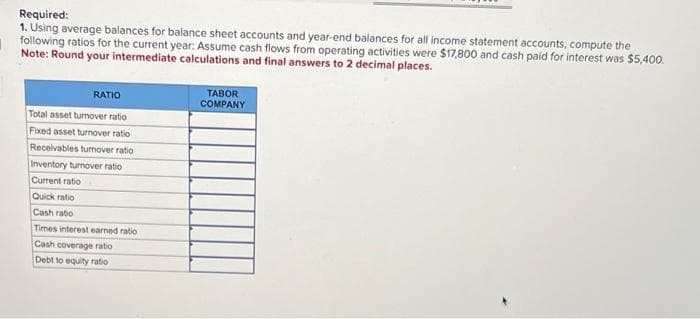

Transcribed Image Text:Required:

1. Using average balances for balance sheet accounts and year-end balances for all income statement accounts, compute the

following ratios for the current year: Assume cash flows from operating activities were $17,800 and cash paid for interest was $5,400.

Note: Round your intermediate calculations and final answers to 2 decimal places.

RATIO

Total asset turnover ratio

Fixed asset turnover ratio

Receivables tumover ratio

Inventory turnover ratio

Current ratio

Quick ratio

Cash ratio

Times interest earned ratio

Cash coverage ratio

Debt to equity ratio

TABOR

COMPANY

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning