TAMARISK COMPANY (Lessee) Lease Amortization Schedule Annual Lease Interest on Reduction of Lease Date Payment Liability Liability Lease Liability 1/1/20 1/1/20 1/1/21 1/1/22 2$ %24 %24 %24 %4 %24 %24 Date Account Titles and Explanation Debit Credit (To record the lease) (To record lease payment) (To record interest expense) (To record amortization of the right-of-use asset)

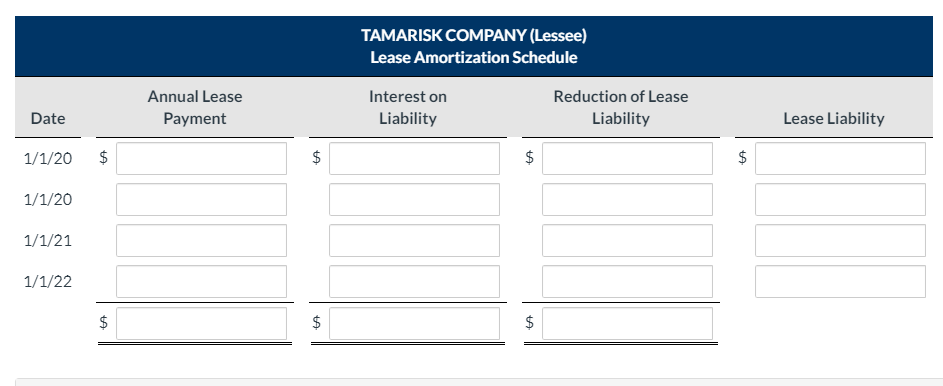

Laura Leasing Company signs an agreement on January 1, 2020, to lease equipment to Tamarisk Company. The following information relates to this agreement.

| 1. | The term of the non-cancelable lease is 3 years with no renewal option. The equipment has an estimated economic life of 5 years. | |

| 2. | The fair value of the asset at January 1, 2020, is $85,000. | |

| 3. | The asset will revert to the lessor at the end of the lease term, at which time the asset is expected to have a residual value of $5,000, none of which is guaranteed. | |

| 4. | The agreement requires equal annual rental payments of $27,911 to the lessor, beginning on January 1, 2020. | |

| 5. | The lessee’s incremental borrowing rate is 5%. The lessor’s implicit rate is 4% and is unknown to the lessee. | |

| 6. | Tamarisk uses the |

Prepare an amortization schedule that would be suitable for the lessee for the lease term. (Round answers to 0 decimal places, e.g. 5,265.)

|

TAMARISK COMPANY (Lessee)

Lease Amortization Schedule |

||||||||

|---|---|---|---|---|---|---|---|---|

|

Date

|

Annual Lease

Payment |

Interest on

Liability |

Reduction of Lease

Liability |

Lease Liability

|

||||

|

1/1/20

|

$enter a dollar amount

|

$enter a dollar amount

|

$enter a dollar amount

|

$enter a dollar amount

|

||||

|

1/1/20

|

enter a dollar amount

|

enter a dollar amount

|

enter a dollar amount

|

enter a dollar amount

|

||||

|

1/1/21

|

enter a dollar amount

|

enter a dollar amount

|

enter a dollar amount

|

enter a dollar amount

|

||||

|

1/1/22

|

enter a dollar amount

|

enter a dollar amount

|

enter a dollar amount

|

enter a dollar amount

|

||||

|

|

$enter a total amount for this column

|

$enter a total amount for this column

|

$enter a total amount for this column

|

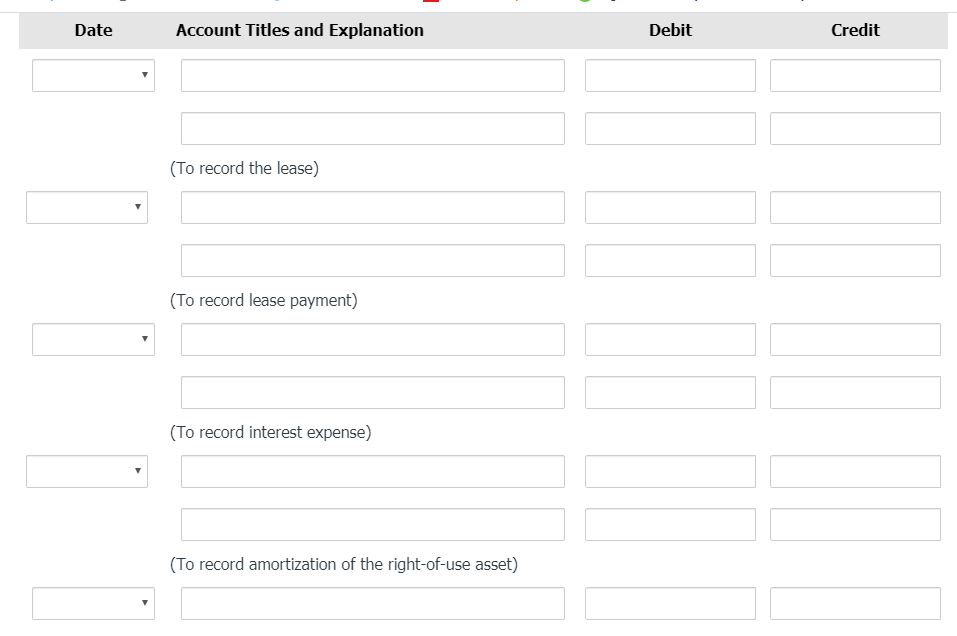

Prepare all of the

|

Date

|

Account Titles and Explanation

|

Debit

|

Credit

|

|

|---|---|---|---|---|

| Enter transaction date | ||||

|

(To record the lease)

|

||||

|

Enter a transaction date

|

||||

|

(To record lease payment)

|

||||

|

Enter transaction date

|

||||

|

(To record interest expense)

|

||||

|

Enter transaction date

|

||||

|

(To record amortization of the right-of-use asset)

|

||||

|

Enter transaction date

|

||||

|

(To reverse interest expense)

|

||||

|

||||

|

(To record lease payment)

|

||||

|

Enter transaction date

|

||||

|

(To record interest expense)

|

||||

|

Enter transaction date

|

||||

|

(To record amortization of the right-of-use asset)

|

- This is a list of the accounts that can be used:

- Accounts Payable

Accumulated Depreciation -Buildings- Accumulated Depreciation-Leased Buildings

- Accumulated Depreciation-Capital Leases

- Accumulated Depreciation-Equipment

- Accumulated Depreciation-Leased Equipment

- Accumulated Depreciation-Leased Machinery

- Accumulated Depreciation-Machinery

- Accumulated Depreciation-Right-of-Use Asset

- Advertising Expense

- Amortization Expense

- Airplanes

- Buildings

- Cash

- Cost of Goods Sold

- Deferred Gross Profit

- Deposit Liability

- Depreciation Expense

- Equipment

- Executory Costs

- Executory Costs Payable

- Gain on Disposal of Equipment

- Gain on Disposal of Plant Assets

- Gain on Lease

- Gain on Sale of Buildings

- Insurance Expense

- Interest Expense

- Interest Payable

- Interest Receivable

- Interest Revenue

- Inventory

- Land

- Leased Asset

- Leased Buildings

- Leased Equipment

- Lease Expense

- Leased Land

- Lease Liability

- Lease Receivable

- Lease Revenue

- Legal Expense

- Loss on Capital Lease

- Machinery

- Maintenance and Repairs Expense

- Notes Payable

- Prepaid Lease Executory Costs

- Prepaid Legal Fees

- Property Tax Expense

- Property Tax Payable

- Rent Expense

- Rent Payable

- Rent Receivable

- Rent Revenue

- Revenue from Sale-Leaseback

- Right-of-Use Asset

- Salaries and Wages Expense

- Sales Revenue

- Selling Expenses

- Trucks

- Unearned Profit on Sale-Leaseback

- Unearned Lease Revenue

- Unearned Service Revenue

(The second attached image with the account journalization is missing some of the titles but there are a total of 17 account titles. the text above is probably more accurate in that regard.)

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 6 images