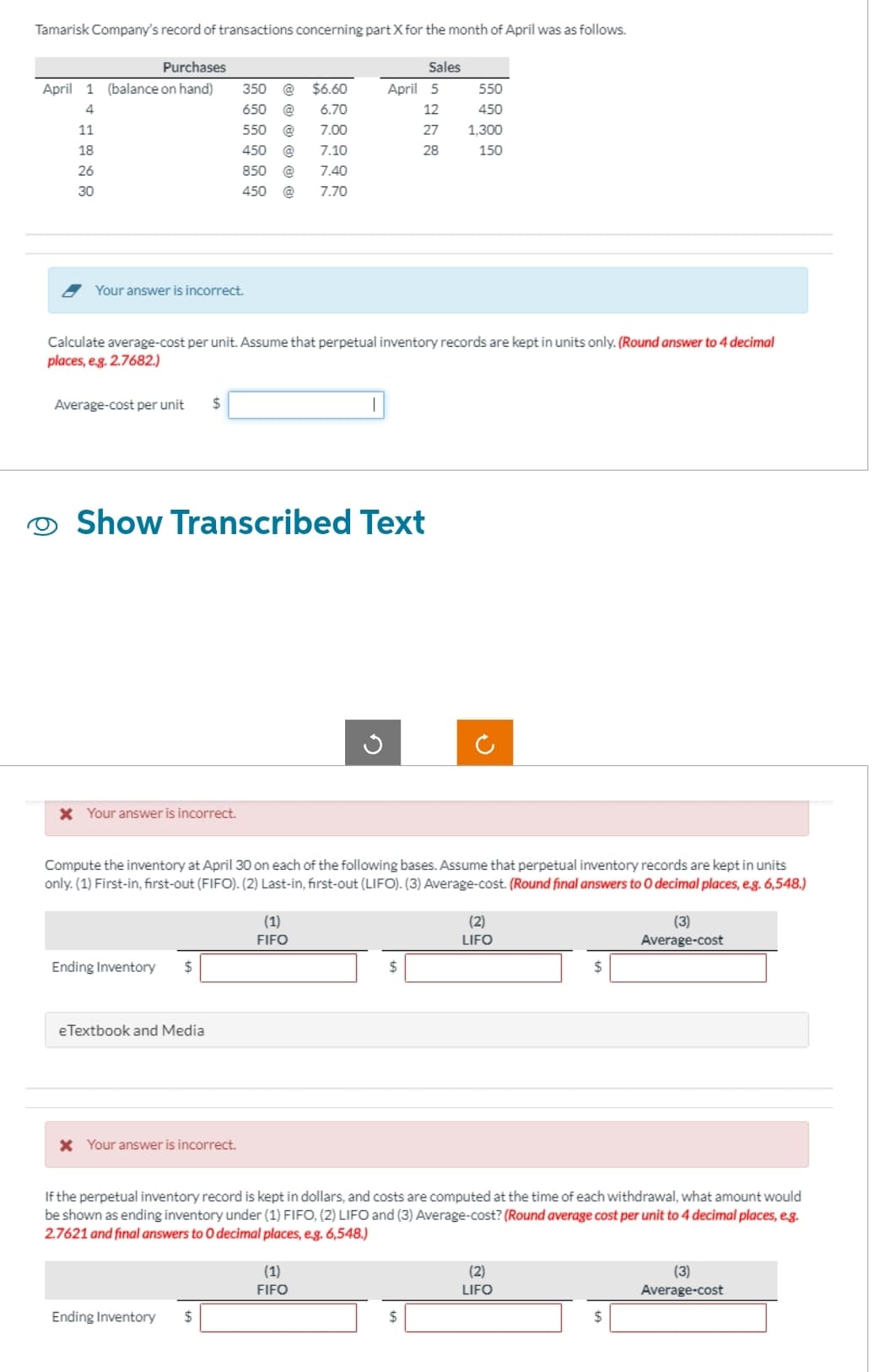

Tamarisk Company's record of transactions concerning part X for the month of April was as follows. Purchases April 1 (balance on hand) 4 11 18 26 30 Your answer is incorrect. Average-cost per unit $ * Your answer is incorrect. Calculate average-cost per unit. Assume that perpetual inventory records are kept in units only. (Round answer to 4 decimal places, e.g. 2.7682.) 350 @ $6.60 6.70 650 @ 550 @ 7.00 450 @ 7.10 850 @ 7.40 450 @ 7.70 O Show Transcribed Text Ending Inventory $ eTextbook and Media * Your answer is incorrect. Compute the inventory at April 30 on each of the following bases. Assume that perpetual inventory records are kept in units only. (1) First-in, first-out (FIFO). (2) Last-in, first-out (LIFO). (3) Average-cost. (Round final answers to O decimal places, e.g. 6,548.) Ending Inventory $ I (1) FIFO April 5 12 27 28 (1) FIFO Sales $ 550 450 1,300 150 $ (2) LIFO If the perpetual inventory record is kept in dollars, and costs are computed at the time of each withdrawal, what amount would be shown as ending inventory under (1) FIFO, (2) LIFO and (3) Average-cost? (Round average cost per unit to 4 decimal places, e.g. 2.7621 and final answers to O decimal places, e.g. 6,548.) $ (2) LIFO (3) Average-cost $ (3) Average-cost

Tamarisk Company's record of transactions concerning part X for the month of April was as follows. Purchases April 1 (balance on hand) 4 11 18 26 30 Your answer is incorrect. Average-cost per unit $ * Your answer is incorrect. Calculate average-cost per unit. Assume that perpetual inventory records are kept in units only. (Round answer to 4 decimal places, e.g. 2.7682.) 350 @ $6.60 6.70 650 @ 550 @ 7.00 450 @ 7.10 850 @ 7.40 450 @ 7.70 O Show Transcribed Text Ending Inventory $ eTextbook and Media * Your answer is incorrect. Compute the inventory at April 30 on each of the following bases. Assume that perpetual inventory records are kept in units only. (1) First-in, first-out (FIFO). (2) Last-in, first-out (LIFO). (3) Average-cost. (Round final answers to O decimal places, e.g. 6,548.) Ending Inventory $ I (1) FIFO April 5 12 27 28 (1) FIFO Sales $ 550 450 1,300 150 $ (2) LIFO If the perpetual inventory record is kept in dollars, and costs are computed at the time of each withdrawal, what amount would be shown as ending inventory under (1) FIFO, (2) LIFO and (3) Average-cost? (Round average cost per unit to 4 decimal places, e.g. 2.7621 and final answers to O decimal places, e.g. 6,548.) $ (2) LIFO (3) Average-cost $ (3) Average-cost

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 50E: Inventory Costing Methods Crandall Distributors uses a perpetual inventory system and has the...

Related questions

Question

Transcribed Image Text:Tamarisk Company's record of transactions concerning part X for the month of April was as follows.

Purchases

April 1 (balance on hand)

4

11

18

26

30

Your answer is incorrect.

Average-cost per unit $

* Your answer is incorrect.

Calculate average-cost per unit. Assume that perpetual inventory records are kept in units only. (Round answer to 4 decimal

places, e.g. 2.7682.)

Show Transcribed Text

350

$6.60

6.70

650 @

550 @ 7.00

450 @

7.10

850 @

7.40

450 @ 7.70

Ending Inventory $

eTextbook and Media

* Your answer is incorrect.

Compute the inventory at April 30 on each of the following bases. Assume that perpetual inventory records are kept in units

only. (1) First-in, first-out (FIFO). (2) Last-in, first-out (LIFO). (3) Average-cost. (Round final answers to O decimal places, e.g. 6,548.)

Ending Inventory $

(1)

FIFO

April 5

12

27

28

G

(1)

FIFO

Sales

$

550

450

1,300

150

$

If the perpetual inventory record is kept in dollars, and costs are computed at the time of each withdrawal, what amount would

be shown as ending inventory under (1) FIFO, (2) LIFO and (3) Average-cost? (Round average cost per unit to 4 decimal places, e.g.

2.7621 and final answers to O decimal places, e.g. 6,548.)

(2)

LIFO

(2)

LIFO

(3)

Average-cost

$

(3)

Average-cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT