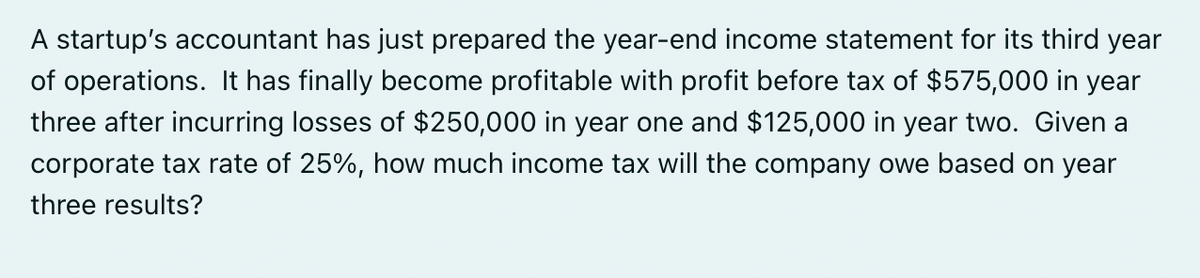

tartup's accountant has just prepared the year-end income statement for its third operations. It has finally become profitable with profit before tax of $575,000 in ee after incurring losses of $250,000 in year one and $125,000 in year two. Give porate tax rate of 25%, how much income tax will the company owe based on ye ee results?

Q: 3-July Purchased land for golf course, put 10% down and agreed to pay the balance in six months, by…

A: Introduction: Journal entries: Recording of a business transactions in a chronological order. First…

Q: Henry-K Company purchased a computer system for €21,600 on January 1, 2020. The company expects to…

A: Financial statements are those statements and reports which are prepared at the end of accounting…

Q: MedServices Inc. is divided into two operating departments: Laboratory and Tissue Pathology.The…

A: Answer 1) Direct Method: Under direct method, service department costs are allocated to production…

Q: a) Appraise the two Project using the following methods of investment appraisal: i. Payback period…

A: Payback period is the period which are required by the company in order to recover the costs which…

Q: Apex Chemicals Ltd acquires a delivery truck at a cost of $36,500 on 1 January 2016. The truck is…

A: Introduction: Depreciation: Decreasing value of fixed assets over its useful life period called as…

Q: 30. T/F. GAO stands for Government Accounting Office

A: The question is related to true or false.

Q: Curtis Salter, the president of Kasimer Computer Services, needs your help. He wonders about the…

A: Introduction: The master budget includes budgeted financial statements, a cash projection, and a…

Q: The glue is not a significant cost, so it is treated as indirect materials (factory overhead). a.…

A: Job costing is a way of accounting that allows you to keep track of the costs of different projects…

Q: Question 1 The following is the Trial Balance for Axos Enterprise as at 31 December 2021: Debit ($)…

A: Income statement and Balance sheet are part of Financial statements. Income statement represents…

Q: 1. (For items 1 and 2). Read and analyze the following transactions taken from the book of XYZ…

A: Journal entries: Journal entries are recorded for showing the monetary transactions initiated by a…

Q: Using the MACRS rates from the following table, what is the book value of a $3,500 computer after 3…

A: Answer:- Book value:- In accounting, the book value is that value of an asset which is based on its…

Q: Below are transactions completed by Bijan Sdn Bhd in August 2019. Bijan Sdn Bhd uses the perpetual…

A: Journal entries are the primary step of recording the transaction in the books of account. Journal…

Q: During 2021, a company sells 359 units of inventory for $86 each. The company has the following…

A: Formula: Cost of goods sold = Cost of goods available for sale - Ending inventory value

Q: Taraz Company has assembled the following dato with respect to eight projects. Project 1. Initiol…

A: PI is the best measure to determine the best project basis the initial cost and cash inflows. PI=…

Q: If Rita receives $39.24 interest for a deposit earning 6% simple interest for 110 days, what is the…

A: The amount of deposit can be calculated with the help of simple interest rate function

Q: Required: (a) The business needs to have a sense of its future cash flows and therefore requires the…

A: A statement of estimation of cash inflows into and outflows from a business for a specific period is…

Q: Total current Assets in the balance sheet?

A: Introduction: Balance sheet: All assets and liabilities are shown in balance sheet. It tells the net…

Q: The following transactions took place during 2020 for Webb Industries.

A: Many organisations follow Allowance Method for writing off Accounts Receivable…

Q: Westerville Company reported the following results from last year’s operations: Sales $ 1,500,000…

A: Solution... (1). Last year's margin = Net income ÷ sales = $375,000 ÷ $1,500,000 = 0.25 =…

Q: 29. T/F. Only Comprehensive and Value-for-Money audits are true performance audits.

A: Value for money audit is done for non profit organization to ensure whether they operate effective…

Q: Last week, 13 Mexican pesos could purchase one U.S. dollar. This week, it takes 11 Mexican pesos to…

A: The change in the exchange rate of one currency with another currency influences the purchasing…

Q: The measurement of the efficiency of investment in inventory is referred to as: Question 6 options:…

A: The effectiveness with which one can use inventory to balance consumer demand and warehouse…

Q: Required Record the transactions in T-accounts.

A: Fanning Cola Corporation produces a new soft drink brand, Sweet Spring, using two production…

Q: I'm having some trouble on the Trial Balance, I believe I entered the entries in incorrectly but I'm…

A: A trial balance is a statement prepared third in the accounting cycle by recording balances from…

Q: Retailers need merchandise to make sales. In fact, a retailer’s inventory is its biggest asset. Not…

A: Stock turnover rate is the rate which a business computes in order to determine and know about how…

Q: a) On January 1, 2022, Dymaxium Inc. a Canadian company, sold Alberta beef to a foreign company for…

A: The forward contract is based on the amount it will receive on March 1, 2022, on which the spot rate…

Q: Management has allocated common fixed expenses to the Divisions based on their sales. The break-even…

A: Breakeven Point It is the point of sales where company recovers its fixed cost and where profit of…

Q: The Sahota's agreed to monthly payments on a mortgage of $633,000.00 amortized over 25 years. They…

A: Introduction:- The term "amortization" refers to the process of spreading payments out over time.…

Q: An item originally cost S$20 and its current replacement cost is $13. Its NRV is $18 and the normal…

A: Inventory is valued at Lower of cost or market value NRV= Net selling price - Cost to complete the…

Q: If you were employed by the venture capital fund, based on this information alone, would you…

A: Venture Capital fund considering investment proposal for investing $ 1500000 Venture capital fund…

Q: TRUE OR FALSE The main difference between the function and the nature of expense methods is the…

A: Salaries, rent, supplies, and travel are all examples of natural expense classifications whereas in…

Q: LDR Manufacturing produces a pesticide chemical and uses process costing. processing departments -…

A: The equivalent units are calculated on the basis of percentage of work completed during the period.

Q: What are the assets needed by the jollibee for its daily operation?

A: Assets which are required for the day to day operations are the assets which are in the current…

Q: Concord Distribution markets CDs of the performing artist Fishe. At the beginning of October,…

A: Weighted average cost per unit = Total cost of goods available for sale / Total no. of units…

Q: fiscal year end is November 30. Accounts Payable-$3,500, Accounts Receivable-$2,300, Cash-$5000,…

A: Balance sheet is considered to be important part of financial statement which shows the entities…

Q: Lenning Corporation uses the FIFO method in its process costing. The following data pertain to its…

A: Total units Material Conversion % Units % Units Beginning Wip 250 50% 125 60% 150…

Q: Overhead Assignment: Actual and Normal Activity ComparedReynolds Printing Company specializes in…

A: Overhead costs, also known as waste or operational expenses, are corporate expenses that are not…

Q: A furniture manufacturing company has two main processes. Process Alpha that makes dinning table and…

A: Answer:- False Explanation:- Process beta should be selected for the very large production volume…

Q: Lemon Company bought a machine on January 1, 2019. The machine cost $72,000 and had an expected…

A: Depreciation is considered as an expense charge on the value of the Asset. It can be calculated by…

Q: 1. Compute the (a) cost of products transferred from weaving to sewing. (b) cost of products…

A: As per the honor code, We’ll answer the first question since the exact one wasn’t specified. Please…

Q: B. Last year, Nikkola Company had net sales of P2,299,500, and cost of goods sold of P1,755,000.…

A: Lets understand the basics. Account receivable turnover ratio indicates how efficiently company is…

Q: 6. In partnership liquidation the first cash distribution should be made for A) partner capital B)…

A: Answer:- Partnership liquidation meaning:- Liquidation of partnership takes place when partners…

Q: For each of the following projects calculate: i. Payback period ii. Net present value when…

A: i. Calculation of Payback Period Project A Year Cashflows Cumulative Cashflows Payback period 0…

Q: Davison Corporation, which has only one product, has provided the following data concerning its most…

A: Variable costing includes the cost which vary from output to ouput. It does not include the fixed…

Q: en 7 percent per y - stock.currently s

A: Yield to maturity is the current interest rate of the bond which is used for discounted the bond's…

Q: The objective of profit maximization should be constrained by the requirement thatprofits be…

A: The ultimate purpose of any firm is to raise profits, which can lead to profit-motivation conflicts…

Q: The total expenses in the flexible budget for May would have been closest to:

A: Flexible Budget It is the budget which changes according to level of production. In this budget,…

Q: for November. Variable Actual Fixed Element Element per Total for per Month Well Serviced November…

A: A spending variance seems to be the difference between the estimated cost and the real cost of an…

Q: During December, Moulding Corporation incurred $86,000 of actual Manufacturing Ooverhead costs.…

A: Under applied (overapplied) manufacturing overhead costs = Actual manufacturing overhead costs -…

Q: The following information is for Leer Company: Using the direct method for operating cash flows,…

A: A cash flow statement, also known as just a statement of cash flows, is a statement that shows how…

Step by step

Solved in 2 steps

- Over the last five years, corporation A has been consistently profitable. Its earnings before taxes were as follows: Year 1 2 3 4 5 Earnings $1,300 $3,000 $4,000 $5,300 $4,800 If the corporate tax rate was 29 percent, what were the firm's income taxes for each year? Round your answers to the nearest dollar. Year 1 2 3 4 5 Taxes $ $ $ $ $ Unfortunately, in year 6 the firm experienced a major decline in sales, which resulted in a loss of $10,300. What impact will the loss have on the firm's taxes for each year if the permitted carry-back is two years? If the answer is zero, enter "0". Round your answers to the nearest dollar. Year 1 2 3 4 5 New Taxes $ $ $ $ $ Total tax refund: $Bed Bug Inn has annual sales of $137,000. Earnings before interest and taxes are equal to 5.8 percent of sales. For the period, the firm paid $4,700 in interest. What is the profit margin if the tax rate is 34 percent? Can you provide the formula?Soenen Inc. had the following data for 2012 (in millions). The new CFO believes that the company could improve its working capital management sufficiently to bring its net working capital and cash conversion cycle up to the benchmark companies' level without affecting either sales or the costs of goods sold. Soenen finances its net working capital with a bank loan at an 8% annual interest rate, and it uses a 365-day year. If these changes had been made, by how much would the firm's pre-tax income have increased? Original Data Related CCC Benchmarks' CCC Sales $108,000 Cost of goods sold $80,000 Inventory (ICP) $20,000 91.25 38.00 Receivables (DSO) $16,000 54.07 20.00 Payables (PDP) $5,000 22.81 30.00 122.51 28.00

- RJS generated $65,000 net income this year. The firm's financial statements also show that its interest expense was $80,000, its marginal tax rate was 35 percent, and its invested capital was $1,200,000. If its average cost of funds is 14 percent, what was RJS's economic value added (EVA) this year? Round your answer to the nearest dollar. Use a minus sign to enter a negative value, if any.The S&H construction company expects to have total sales next year totaling $14,500,00 In addition, the firm pays taxes at 35 percent and will owe $318,000 in interest expenses. Based on last year’s operations the firm’s management predicts that its cost of goods sold will be 58 percent of sales and operating expenses will total 32 percent. What is your estimate of the firm’s net income after taxes for the coming year ? Complete the pro-forma income statement below Round to the nearest dollar Pro-forma income statement Sales Cost of goods sold Gross profit Operating expenses Net operating expenses Interested expenses Earnings before taxes Taxes Net incomeTo estimate Missed Places Inc.'s (MP) external financing needs, the CFO needs to figure out how much equity her firm will have at the end of next year. At the end of the most recent fiscal year, MP's retained earnings were $158,000. The Controller has estimated that over the next year, gross profits will be $360,700, earnings after tax will total $21,400, and MP will pay $12,400 in dividends. What are the estimated retained earnings at the end of next year? (Please show work and explain) Intellus has long-term debt of $5 million, owners' equity of $7.75 million, current assets of $1 million, gross fixed assets of $20 million, and accumulated depreciation of $7 million. What is the firm’s net working capital? (Please show work and explain)

- The S&H construction company expects to have total sales next year totaling $15,300. In addition, the firm pays taxes at 35 percent and will owe $280,000 in interest expense. Based on last year’s operations the firm’s management predicts that its cost of goods sold will be 57 percent of sales and operating expenses will total 32 percent. What is your estimate of firm’s net income after taxes for the coming year? Complete the forma income statement below Round to the nearest dollar Pro-forma income statement Sales Cost of goods sold Gross profit Operating expenses Net operating income Interest expenses Earnings before taxes Taxes Net incomeManalo Inc. had the following data for 2019 (in millions). The new CFO believes that the company could improve its working capital management sufficiently to bring its NWC and CCC up to the benchmark companies' level without affecting either sales or the costs of goods sold. Manalo finances its net working capital with a bank loan at an 8% annual interest rate, and it uses a 365-day year. If these changes had been made, by how much would the firm's pre-tax income have increased?Last year, Roswin Robotics have $5,000,000.00 in operating income (EBIT). Its depreciation expense was $1,000,000.00, its interest expense was $1,000,000.00 and its corporate tax rate was 40%. At year-end, it had $14,000,000.00 in current assets, $3,000,000.00 in accounts payable, $1,000,000.00 in accruals, $2,000,000.00 in notes payable and $15,000,000.00 in net PPE. Roswin had no other current liabilities. Assume that Roswin's only non-cash item was depreciation. Compute for the following: 1. Net Income 2. Net Operating Working Capital (NOWC) 3. Net Working Capital (NWC)

- The newspaper reported last week that Bennington Enterprises earned $17 million this year. The report also stated that the firm’s ROE is 14 percent. Bennington retains 70 percent of its earnings. a. What is the firm's earnings growth rate? (Round the answer to 2 decimal places.) Earnings growth rate % b. What will next year's earnings be? (Enter the answer in dollars, not millions of dollars. Omit $ sign in your response.) Next year's earnings $The Bookbinder Company had $550,000 cumulative operating losses prior to the beginning of last year. It had $110,000 in pre-tax earnings last year before using the past operating losses and has $330,000 in the current year before using any past operating losses. It projects $360,000 pre-tax earnings next year. Enter your answers as positive values. If an amount is zero, enter "0". Round your answers to the nearest dollar. How much taxable income was there last year? $ How much, if any, cumulative losses remained at the end of the last year? $ What is the taxable income in the current year? $ How much, if any, cumulative losses remain at the end of the current year? $ What is the projected taxable income for next year? $ How much, if any, cumulative losses are projected to remain at the end of next year?A firm purchased $35,000 in office furniture this year. The firm has $150,000 in earnings before depreciation and taxes each year, and the tax obligation is $55,000 each year. a) According to the lecture, what MACRS schedule should be used? b) Using the half-year convention, over how many years will the furniture be depreciated? c) What is the difference between the accounting flows and the cash flows for the first year? d) What is the difference between the accounting flows and the cash flows for the second year?