TASK 1: CREATE A BUSINESS (STARTS IN JANUARY 2020) Must be a trading business Describe your business: Product – Choose only 1 product (What and why) Name of business and location (Where and why) List of managers List of assets (at least 2; state the cost and depreciation policy) TASK 2: TRANSACTIONS FOR DECEMBER 2020 Create business transactions and include the following: • 2 cash purchase transactions (1 with trade discounts) • 2 credit purchase transactions 2 cash sale transactions (1 with trade discounts)

TASK 1: CREATE A BUSINESS (STARTS IN JANUARY 2020) Must be a trading business Describe your business: Product – Choose only 1 product (What and why) Name of business and location (Where and why) List of managers List of assets (at least 2; state the cost and depreciation policy) TASK 2: TRANSACTIONS FOR DECEMBER 2020 Create business transactions and include the following: • 2 cash purchase transactions (1 with trade discounts) • 2 credit purchase transactions 2 cash sale transactions (1 with trade discounts)

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter3: The Double-entry Framework

Section: Chapter Questions

Problem 6SEB: TRANSACTION ANALYSIS George Atlas started a business on June 1,20--. Analyze the following...

Related questions

Question

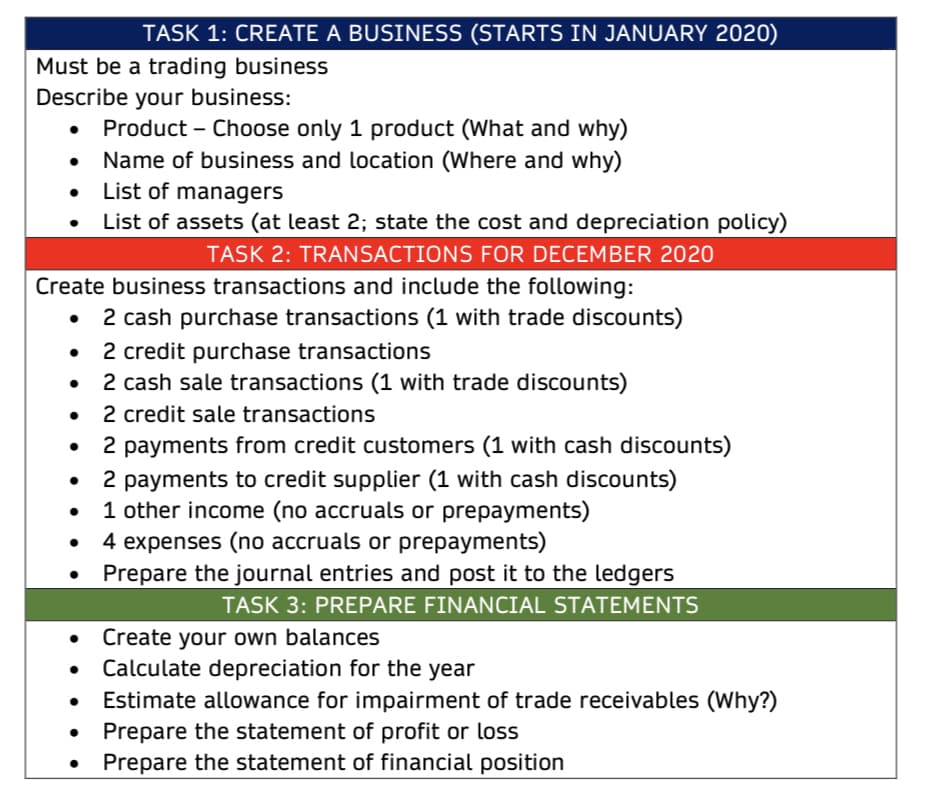

Transcribed Image Text:TASK 1: CREATE A BUSINESS (STARTS IN JANUARY 2020)

Must be a trading business

Describe your business:

Product – Choose only 1 product (What and why)

Name of business and location (Where and why)

List of managers

List of assets (at least 2; state the cost and depreciation policy)

TASK 2: TRANSACTIONS FOR DECEMBER 2020

Create business transactions and include the following:

2 cash purchase transactions (1 with trade discounts)

• 2 credit purchase transactions

2 cash sale transactions (1 with trade discounts)

2 credit sale transactions

2 payments from credit customers (1 with cash discounts)

2 payments to credit supplier (1 with cash discounts)

1 other income (no accruals or prepayments)

4 expenses (no accruals or prepayments)

Prepare the journal entries and post it to the ledgers

TASK 3: PREPARE FINANCIAL STATEMENTS

• Create your own balances

Calculate depreciation for the year

• Estimate allowance for impairment of trade receivables (Why?)

Prepare the statement of profit or loss

Prepare the statement of financial position

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning