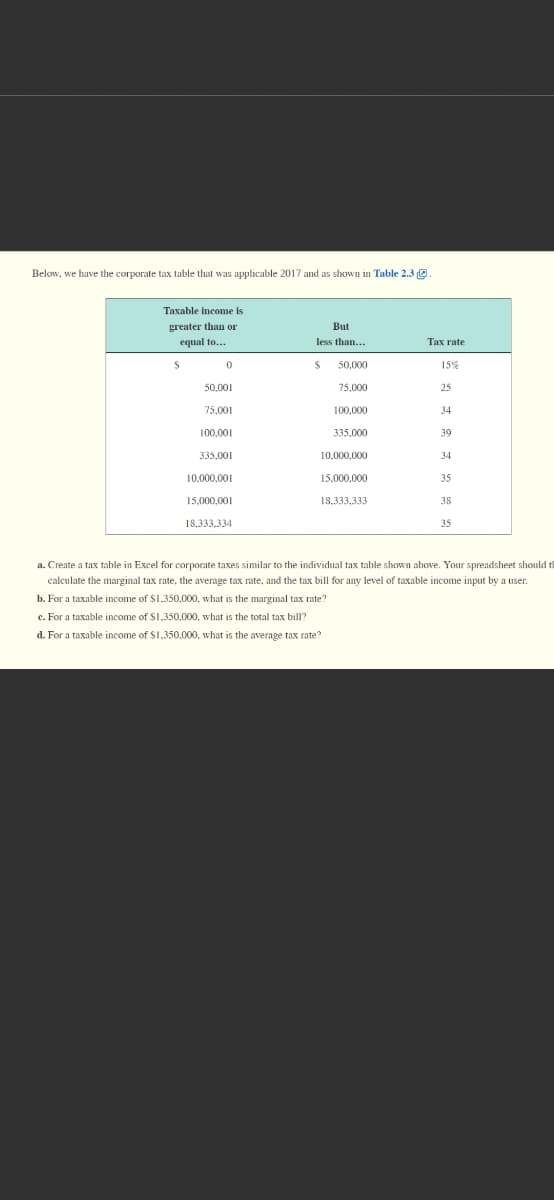

Taxable income is greater than or But equal to. less than... Tax rate $ 50,000 15% 50.001 75,000 25 75,001 100,000 34 100.001 335,000 39 335,001 10.000,000 34 10.000.001 15.000.000 35 15.000,001 18.333,333 38 18.333.334 35 a. Create a tax table in Excel for corporate taxes similar to the individual tax table shown above. Your spreadsheet should calculate the marginal tax rate, the average tax rate, and the tax bill for any level of taxable income input by a user. b. For a taxable income of S1.350,000, what is the marginal tax rate? c. For a taxable income of S1.350,000, what is the total tax bill? d. For a taxable income of SI.350.000, what is the average tax rate?

Reporting Cash Flows

Reporting of cash flows means a statement of cash flow which is a financial statement. A cash flow statement is prepared by gathering all the data regarding inflows and outflows of a company. The cash flow statement includes cash inflows and outflows from various activities such as operating, financing, and investment. Reporting this statement is important because it is the main financial statement of the company.

Balance Sheet

A balance sheet is an integral part of the set of financial statements of an organization that reports the assets, liabilities, equity (shareholding) capital, other short and long-term debts, along with other related items. A balance sheet is one of the most critical measures of the financial performance and position of the company, and as the name suggests, the statement must balance the assets against the liabilities and equity. The assets are what the company owns, and the liabilities represent what the company owes. Equity represents the amount invested in the business, either by the promoters of the company or by external shareholders. The total assets must match total liabilities plus equity.

Financial Statements

Financial statements are written records of an organization which provide a true and real picture of business activities. It shows the financial position and the operating performance of the company. It is prepared at the end of every financial cycle. It includes three main components that are balance sheet, income statement and cash flow statement.

Owner's Capital

Before we begin to understand what Owner’s capital is and what Equity financing is to an organization, it is important to understand some basic accounting terminologies. A double-entry bookkeeping system Normal account balances are those which are expected to have either a debit balance or a credit balance, depending on the nature of the account. An asset account will have a debit balance as normal balance because an asset is a debit account. Similarly, a liability account will have the normal balance as a credit balance because it is amount owed, representing a credit account. Equity is also said to have a credit balance as its normal balance. However, sometimes the normal balances may be reversed, often due to incorrect journal or posting entries or other accounting/ clerical errors.

![CHALLENGE

(Questions 20-22)

Net Fixed Assets and Depreciation [LO4] On the balance sheet, the net fixed assets (NFA) account is equal to the gross

20.

fixed assets (FA) account (which records the acquisition cost of fixed assets) minus the accumulated depreciation (AD)

account (which records the total depreciation taken by the firm against its fixed assets). Using the fact that NFA = FA –

AD, show that the expression given in the chapter for net capital spending. NFAcad - NFAeg + D (where D is the

depreciation expense during the year), is equivalent to FAend - FAser

Use the following information for Taco Swell, Inc., for Problems 21 and 22 (assume the tax rate is 21 percent):

2017

2018

Sales

S16,549

SI8,498

Depreciation

2.376

2.484

Cost of goods sold

5.690

6,731

Orher expenев

1,353

1,178

Interest

1.110

1.325

Cash

8.676

9.247

Accounts receivable

I1.4SS

13,482

Short-term notes payable

1,674

1.641

Long-term debt

29.060

35.229

Net fixed asseta

72.770

77.610

Accounts payable

6,269

6.640

Inventory

20,424

21,862

Dividends

1.979

2.314

21.

Financial Statements [LO1) Draw up an income statement and balance sheet for this company for 2017 and 2018.

22.

Calenlating Cash Flow [LO4] For 2018, calculate the cash flow from assets, cash flow to creditors, and cash flow to

stockholders.

Excel Master It! Problem

xlsx Using Excel to find the marginal tax rate can be accomplished using the VLOOKUP function. However, calculating the

total tax bill is a little more difficult. Below we have shown a copy of the IRS tax table for an unmarried individual for

2018. Often, tax tables are presented in this format.

If taxable

income is

But not

over ...

The tax is:

over ...

$ 9,525

10% of the amount over S0

9,526

38,700 $952.50 plus 15% of the amount over $9,525

38,701

93.700

$5,328.75 plus 25% of the amount over $38,700

93,701

195,450

$19.078.75 plus 28% of the amount over $93,700

195,451

424,950

$47,568.75 plus 33% of the amount over $195,450

424,951

426,700

$123,303.75 plus 35% of the amount over $424.950

426,701

$123,916.25 plus 39.6% of the amount over $426.700

In reading this table, the marginal tax rate for taxable income less than S9,525 is 10 percent. If the taxable income is between

$9,525 and $38,700, the tax bill is $952.50 plus the marginal taxes. The marginal taxes are calculated as the taxable

income minus S9.525 times the marginal tax rate of 15 percent.

Page](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F291d7af6-5c95-48bd-a4ac-1cfc8983e8c2%2Ff696159a-d3a1-4dee-aac8-e78477f0c30e%2F3pul3d_processed.jpeg&w=3840&q=75)

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images