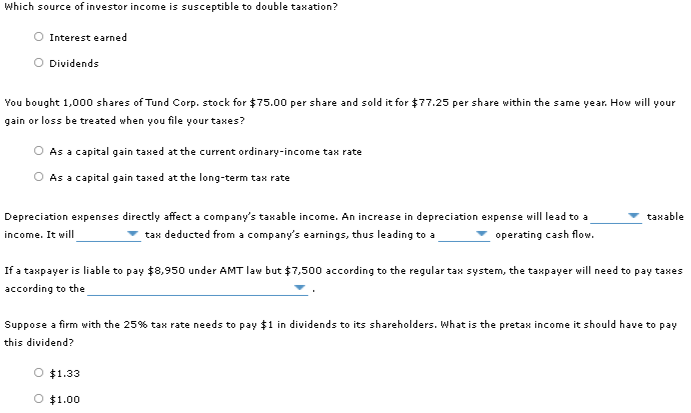

Which source of investor income is susceptible to double taxation? Interest earned O Dividends You bought 1,000 shares of Tund Corp. stock for $75.00 per share and sold it for $77.25 per share within the same year. How will your gain or loss be treated when you file your taxes? O As a capital gain taxed at the current ordinary-income tax rate As a capital gain taxed at the long-term tax rate Depreciation expenses directly affect a company's taxable income. An increase in depreciation expense will lead to a operating cash flow. taxable income. It will tax deducted from a company's earnings, thus leading to a

Which source of investor income is susceptible to double taxation? Interest earned O Dividends You bought 1,000 shares of Tund Corp. stock for $75.00 per share and sold it for $77.25 per share within the same year. How will your gain or loss be treated when you file your taxes? O As a capital gain taxed at the current ordinary-income tax rate As a capital gain taxed at the long-term tax rate Depreciation expenses directly affect a company's taxable income. An increase in depreciation expense will lead to a operating cash flow. taxable income. It will tax deducted from a company's earnings, thus leading to a

Chapter14: Property Transactions: Determination Of Gain Or Loss And Basis Considerations

Section: Chapter Questions

Problem 33P

Related questions

Question

4

Transcribed Image Text:Which source of investor income is susceptible to double taxation?

Interest earned

O Dividends

You bought 1,000 shares of Tund Corp. stock for $75.00 per share and sold it for $77.25 per share within the same year. How will your

gain or loss be treated when you file your taxes?

O As a capital gain taxed at the current ordinary-income tax rate

As a capital gain taxed at the long-term tax rate

Depreciation expenses directly affect a company's taxable income. An increase in depreciation expense will lead to a

taxable

income. It will

tax deducted from a company's earnings, thus leading to a

operating cash flow.

If a taxpayer is liable to pay $8,950 under AMT law but $7,500 according to the regular tax system, the taxpayer will need to pay taxes

according to the

Suppose a firm with the 25% tax rate needs to pay $1 in dividends to its shareholders. What is the pretax income it should have to pay

this dividend?

O $1.33

$1.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning