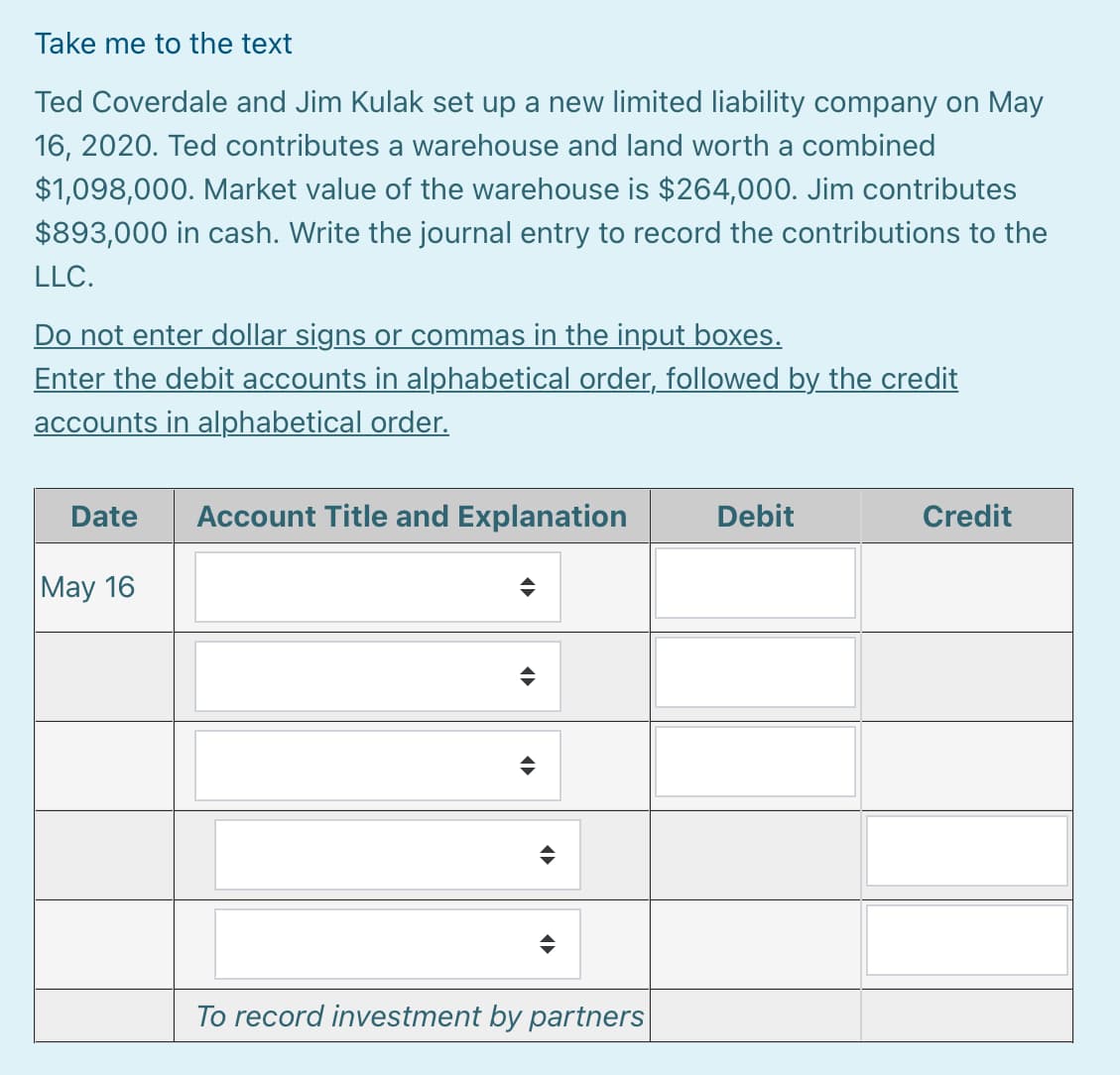

Ted Coverdale and Jim Kulak set up a new limited liability company on May 16, 2020. Ted contributes a warehouse and land worth a combined $1,098,000. Market value of the warehouse is $264,000. Jim contributes $893,000 in cash. Write the journal entry to record the contributions to the LLC. Do not enter dollar signs or commas in the input boxes. Enter the debit accounts in alphabetical order, followed by the credit accounts in alphabetical order. Date Account Title and Explanation Debit Credit |Мay 16 To record investment by partners

Ted Coverdale and Jim Kulak set up a new limited liability company on May 16, 2020. Ted contributes a warehouse and land worth a combined $1,098,000. Market value of the warehouse is $264,000. Jim contributes $893,000 in cash. Write the journal entry to record the contributions to the LLC. Do not enter dollar signs or commas in the input boxes. Enter the debit accounts in alphabetical order, followed by the credit accounts in alphabetical order. Date Account Title and Explanation Debit Credit |Мay 16 To record investment by partners

Chapter5: Gross Income: Exclusions

Section: Chapter Questions

Problem 2BCRQ

Related questions

Question

100%

C4.1

Transcribed Image Text:Take me to the text

Ted Coverdale and Jim Kulak set up a new limited liability company on May

16, 2020. Ted contributes a warehouse and land worth a combined

$1,098,000. Market value of the warehouse is $264,000. Jim contributes

$893,000 in cash. Write the journal entry to record the contributions to the

LLC.

Do not enter dollar signs or commas in the input boxes.

Enter the debit accounts in alphabetical order, followed by the credit

accounts in alphabetical order.

Date

Account Title and Explanation

Debit

Credit

May 16

To record investment by partners

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT