tempts Keep the Highest/2 . Inflation-induced tax distortions Felix receives a portion of his income from his holdings of interest-bearing U.S. government bonds. The bonds offer a real interest rat wear. The nominal interest rate on the bonds adjusts automatically to account for the inflation rate. The government taxes nominal interest income at a rate of 10%. The following table shows two scenarios: a low-inflation scenario ar inflation scenario. Given the real interest rate of 4.5% per year, find the nominal interest rate on Felix's bonds, the after-tax nominal interest rate, and th interest rate under each inflation scenario. Inflation Rate Real Interest Rate Nominal Interest Rate (Percent) (Percent) 4.5 4.5 (Percent) 2.0 9.5 After-Tax Nominal Interest Rate (Percent) After-Tax Real Interes (Percent)

tempts Keep the Highest/2 . Inflation-induced tax distortions Felix receives a portion of his income from his holdings of interest-bearing U.S. government bonds. The bonds offer a real interest rat wear. The nominal interest rate on the bonds adjusts automatically to account for the inflation rate. The government taxes nominal interest income at a rate of 10%. The following table shows two scenarios: a low-inflation scenario ar inflation scenario. Given the real interest rate of 4.5% per year, find the nominal interest rate on Felix's bonds, the after-tax nominal interest rate, and th interest rate under each inflation scenario. Inflation Rate Real Interest Rate Nominal Interest Rate (Percent) (Percent) 4.5 4.5 (Percent) 2.0 9.5 After-Tax Nominal Interest Rate (Percent) After-Tax Real Interes (Percent)

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter4: Gross Income

Section: Chapter Questions

Problem 3BD

Related questions

Question

3

Transcribed Image Text:Attempts

Keep the Highest/2

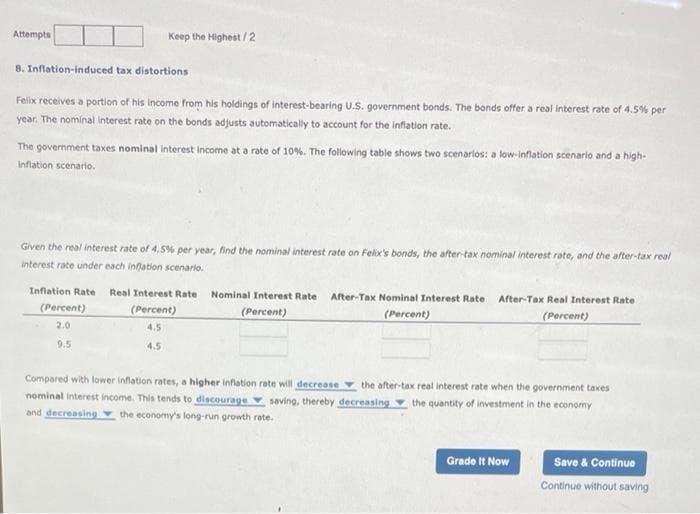

8. Inflation-induced tax distortions

Felix receives a portion of his income from his holdings of interest-bearing U.S. government bonds. The bonds offer a real interest rate of 4.5% per

year. The nominal interest rate on the bonds adjusts automatically to account for the inflation rate.

The government taxes nominal interest income at a rate of 10%. The following table shows two scenarios: a low-inflation scenario and a high-

inflation scenario.

Given the real interest rate of 4.5% per year, find the nominal interest rate on Felix's bonds, the after-tax nominal interest rate, and the after-tax real

interest rate under each inflation scenario.

Inflation Rate Real Interest Rate Nominal Interest Rate After-Tax Nominal Interest Rate After-Tax Real Interest Rate

(Percent)

(Percent)

(Percent)

(Percent)

(Percent)

2.0

4.5

4.5

9.5

Compared with lower inflation rates, a higher inflation rate will decrease the after-tax real interest rate when the government taxes

nominal interest income. This tends to discourage saving, thereby decreasing the quantity of investment in the economy

and decreasing the economy's long-run growth rate.

Grade It Now

Save & Continue

Continue without saving

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning