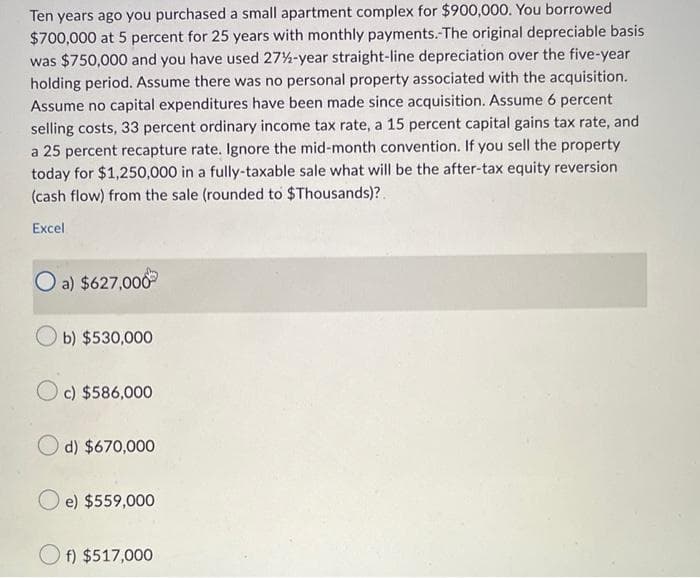

Ten years ago you purchased a small apartment complex for $900,000. You borrowed $700,000 at 5 percent for 25 years with monthly payments. The original depreciable basis was $750,000 and you have used 27%-year straight-line depreciation over the five-year holding period. Assume there was no personal property associated with the acquisition. Assume no capital expenditures have been made since acquisition. Assume 6 percent selling costs, 33 percent ordinary income tax rate, a 15 percent capital gains tax rate, and a 25 percent recapture rate. Ignore the mid-month convention. If you sell the property today for $1,250,000 in a fully-taxable sale what will be the after-tax equity reversion (cash flow) from the sale (rounded to $Thousands)?.

Ten years ago you purchased a small apartment complex for $900,000. You borrowed $700,000 at 5 percent for 25 years with monthly payments. The original depreciable basis was $750,000 and you have used 27%-year straight-line depreciation over the five-year holding period. Assume there was no personal property associated with the acquisition. Assume no capital expenditures have been made since acquisition. Assume 6 percent selling costs, 33 percent ordinary income tax rate, a 15 percent capital gains tax rate, and a 25 percent recapture rate. Ignore the mid-month convention. If you sell the property today for $1,250,000 in a fully-taxable sale what will be the after-tax equity reversion (cash flow) from the sale (rounded to $Thousands)?.

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 11P

Related questions

Question

Transcribed Image Text:Ten years ago you purchased a small apartment complex for $900,000. You borrowed

$700,000 at 5 percent for 25 years with monthly payments. The original depreciable basis

was $750,000 and you have used 27%-year straight-line depreciation over the five-year

holding period. Assume there was no personal property associated with the acquisition.

Assume no capital expenditures have been made since acquisition. Assume 6 percent

selling costs, 33 percent ordinary income tax rate, a 15 percent capital gains tax rate, and

a 25 percent recapture rate. Ignore the mid-month convention. If you sell the property

today for $1,250,000 in a fully-taxable sale what will be the after-tax equity reversion

(cash flow) from the sale (rounded to $Thousands)?.

Excel

O a) $627,000

b) $530,000

c) $586,000

d) $670,000

e) $559,000

Of) $517,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College