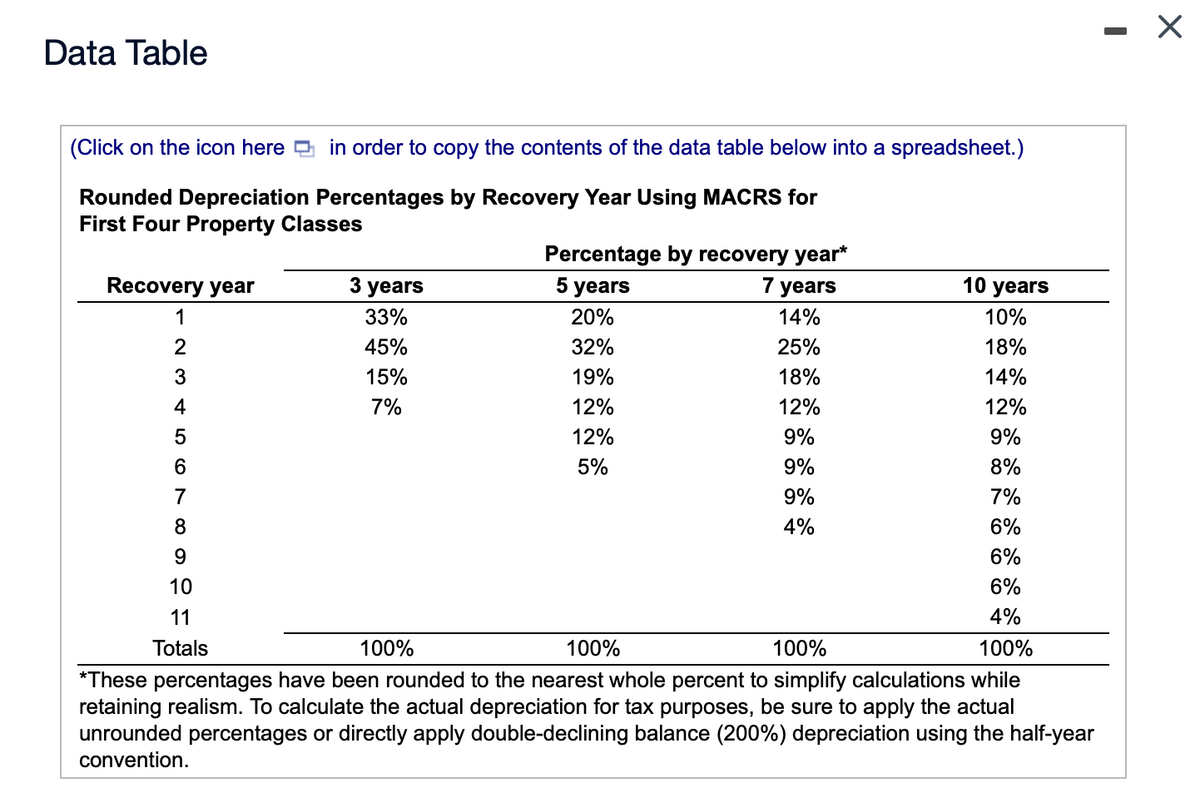

Terminal cash flow—Replacement decision Russell Industries is considering replacing a fully depreciated machine that has a remaining useful life of 10 years with a newer, more sophisticated machine. The new machine will cost $198,000 and will require $29,700 in installation costs. It will be depreciated under MACRS using a 5-year recovery period (see the table LOADING... for the applicable depreciation percentages). A $28,000 increase in net working capital will be required to support the new machine. The firm's managers plan to evaluate the potential replacement over a 4-year period. They estimate that the old machine could be sold at the end of 4 years to net $15,000 before taxes; the new machine at the end of 4 years will be worth $74,000 before taxes. Calculate the terminal cash flow at the end of year 4 that is relevant to the proposed purchase of the new machine. The firm is subject to a 40% tax rate.

Terminal cash

decision Russell Industries is considering replacing a fully

and will require

in installation costs. It will be depreciated under MACRS using a 5-year recovery period (see the table

for the applicable depreciation percentages). A

increase in net working capital will be required to support the new machine. The firm's managers plan to evaluate the potential replacement over a 4-year period. They estimate that the old machine could be sold at the end of 4 years to net

before taxes; the new machine at the end of 4 years will be worth

before taxes. Calculate the terminal cash flow at the end of year 4 that is relevant to the proposed purchase of the new machine. The firm is subject to a

tax rate.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images