Terminal cash flow-Replacement decision Russell Industries is considering replacing a fully depreciated machine that has a remaining useful life of 10 years with a newer, more sophisticated machine. The new machine will cost $192,000 and will require $30,200 in installation costs. It will be depreciated under MACRS using a 5-year recovery period (see the table E for the applicable depreciation percentages). A $30,000 increase in net working capital will be required to support the new machine. The firm's managers plan to evaluate the potential replacement over a 4-year period. They estimate that the old machine could be sold at the end of 4 years to net $14,200 before taxes; the new machine at the end of 4 years will be worth $80,000 before taxes. Calculate the terminal cash flow at the end of year 4 that is relevant to the proposed purchase of the new machine. The firm is subject to a 40% tax rate. The terminal cash flow for the replacement decision is shown below: (Round to the nearest dollar.) O Data Table Proceeds from sale of new machine Tax on sale of new machine Total after-tax proceeds-new asset (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Proceeds from sale of old machine Tax on sale of old machine Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Total after-tax proceeds-old asset 24 Percentage by recovery year* 5 years Change in net working capital Recovery year 3 years 33% 7 years 10 years Terminal cash flow 20% 14% 10% 2 45% 32% 25% 18% 3 15% 19% 18% 14% 4 7% 12% 12% 12% 12% 9% 9% 5% 9% 8% 7 9% 7% 8 4% 6% 9 6% 10 6% 11 4% Totals 100% 100% 100% 100% *These percentages have been rounded to the nearest whole percent to simplify calculations while

Terminal cash flow-Replacement decision Russell Industries is considering replacing a fully depreciated machine that has a remaining useful life of 10 years with a newer, more sophisticated machine. The new machine will cost $192,000 and will require $30,200 in installation costs. It will be depreciated under MACRS using a 5-year recovery period (see the table E for the applicable depreciation percentages). A $30,000 increase in net working capital will be required to support the new machine. The firm's managers plan to evaluate the potential replacement over a 4-year period. They estimate that the old machine could be sold at the end of 4 years to net $14,200 before taxes; the new machine at the end of 4 years will be worth $80,000 before taxes. Calculate the terminal cash flow at the end of year 4 that is relevant to the proposed purchase of the new machine. The firm is subject to a 40% tax rate. The terminal cash flow for the replacement decision is shown below: (Round to the nearest dollar.) O Data Table Proceeds from sale of new machine Tax on sale of new machine Total after-tax proceeds-new asset (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Proceeds from sale of old machine Tax on sale of old machine Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Total after-tax proceeds-old asset 24 Percentage by recovery year* 5 years Change in net working capital Recovery year 3 years 33% 7 years 10 years Terminal cash flow 20% 14% 10% 2 45% 32% 25% 18% 3 15% 19% 18% 14% 4 7% 12% 12% 12% 12% 9% 9% 5% 9% 8% 7 9% 7% 8 4% 6% 9 6% 10 6% 11 4% Totals 100% 100% 100% 100% *These percentages have been rounded to the nearest whole percent to simplify calculations while

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter11: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 9E: Machine replacement decision A company is considering replacing an old piece of machinery, which...

Related questions

Question

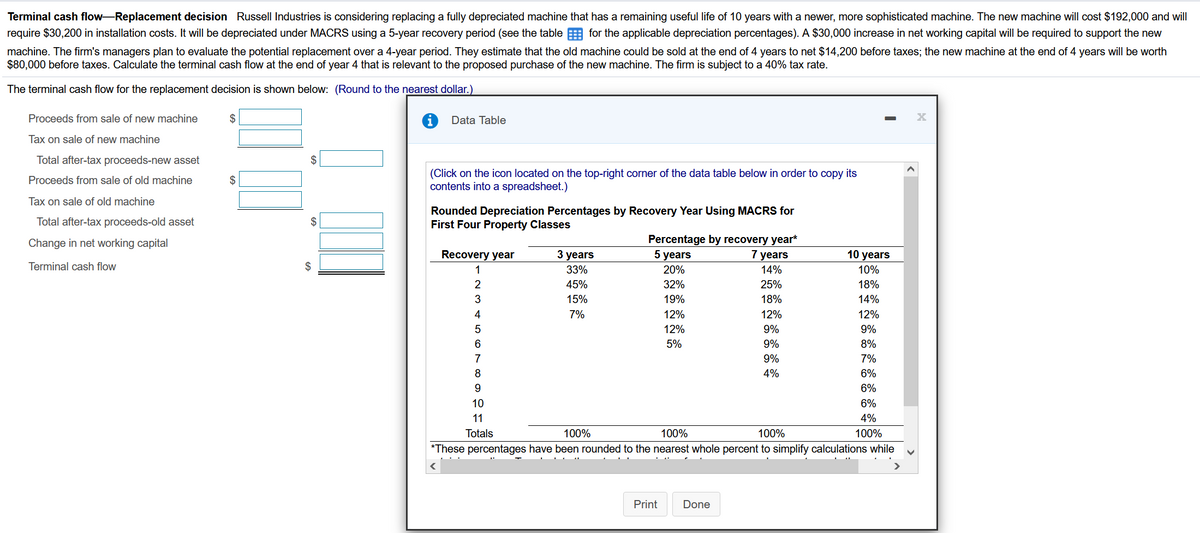

Transcribed Image Text:Terminal cash flow-Replacement decision Russell Industries is considering replacing a fully depreciated machine that has a remaining useful life of 10 years with a newer, more sophisticated machine. The new machine will cost $192,000 and will

require $30,200 in installation costs. It will be depreciated under MACRS using a 5-year recovery period (see the table E for the applicable depreciation percentages). A $30,000 increase in net working capital will be required to support the new

machine. The firm's managers plan to evaluate the potential replacement over a 4-year period. They estimate that the old machine could be sold at the end of 4 years to net $14,200 before taxes; the new machine at the end of 4 years will be worth

$80,000 before taxes. Calculate the terminal cash flow at the end of year 4 that is relevant to the proposed purchase of the new machine. The firm is subject to a 40% tax rate.

The terminal cash flow for the replacement decision is shown below: (Round to the nearest dollar.)

Proceeds from sale of new machine

$

Data Table

Tax on sale of new machine

Total after-tax proceeds-new asset

$

(Click on the icon located on the top-right corner of the data table below in order to copy its

contents into a spreadsheet.)

Proceeds from sale of old machine

$

Tax on sale of old machine

Rounded Depreciation Percentages by Recovery Year Using MACRS for

First Four Property Classes

Total after-tax proceeds-old asset

$

Percentage by recovery year*

5 years

Change in net working capital

Recovery year

3 years

7 years

10 years

Terminal cash flow

$

1

33%

20%

14%

10%

2

45%

32%

25%

18%

3

15%

19%

18%

14%

4

7%

12%

12%

12%

12%

9%

9%

5%

9%

8%

7

9%

7%

4%

6%

9.

6%

10

6%

11

4%

Totals

100%

100%

100%

100%

*These percentages have been rounded to the nearest whole percent to simplify calculations while

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College