That was the total estimated gross profit recognized or realized as of December 31, 2018? What was the estimated gross profit (loss) recognized or realized for the year ended December 31, 2019?

That was the total estimated gross profit recognized or realized as of December 31, 2018? What was the estimated gross profit (loss) recognized or realized for the year ended December 31, 2019?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 9MC

Related questions

Question

That was the total estimated gross profit recognized or realized as of December 31, 2018?

What was the estimated gross

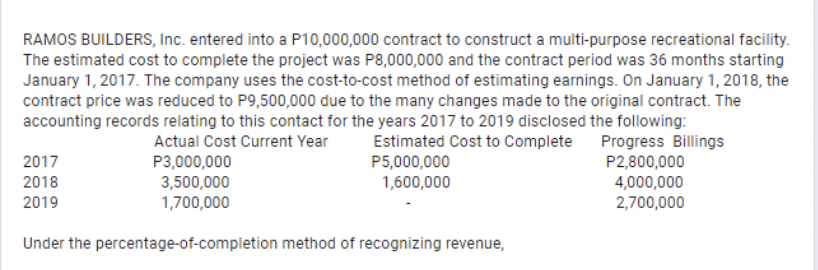

Transcribed Image Text:RAMOS BUILDERS, Inc. entered into a P10,000,000 contract to construct a multi-purpose recreational facility.

The estimated cost to complete the project was P8,000,000 and the contract period was 36 months starting

January 1, 2017. The company uses the cost-to-cost method of estimating earnings. On January 1, 2018, the

contract price was reduced to P9,500,000 due to the many changes made to the original contract. The

accounting records relating to this contact for the years 2017 to 2019 disclosed the following:

Progress Billings

P2,800,000

4,000,000

2,700,000

Actual Cost Current Year

Estimated Cost to Complete

P5,000,000

1,600,000

2017

P3,000,000

2018

3,500,000

1,700,000

2019

Under the percentage-of-completion method of recognizing revenue,

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning