the 2019, Figuero Fitness announced that its line of protein shakes (a major line of business which represented 15% of Figuer being discontinued. The line was ultimately sold in early 2020. Additional financial information for the protein shake product lines Operating loss in 2019 Operating loss in 2020 Impairment loss in 2019 Gain on sale of line in 2020 Figuero's tax rate for both 2019 and 2020 Figuero's year end $26,500 $11,000 $12,000 $8,000 25% 12/31 How much, in total, should be reported in Figuero Fitness' income statement as Discontinued operations for 2019? Select one:

the 2019, Figuero Fitness announced that its line of protein shakes (a major line of business which represented 15% of Figuer being discontinued. The line was ultimately sold in early 2020. Additional financial information for the protein shake product lines Operating loss in 2019 Operating loss in 2020 Impairment loss in 2019 Gain on sale of line in 2020 Figuero's tax rate for both 2019 and 2020 Figuero's year end $26,500 $11,000 $12,000 $8,000 25% 12/31 How much, in total, should be reported in Figuero Fitness' income statement as Discontinued operations for 2019? Select one:

Chapter7: Losses—deductions And Limitations

Section: Chapter Questions

Problem 17P

Related questions

Question

vd

subject-accounting

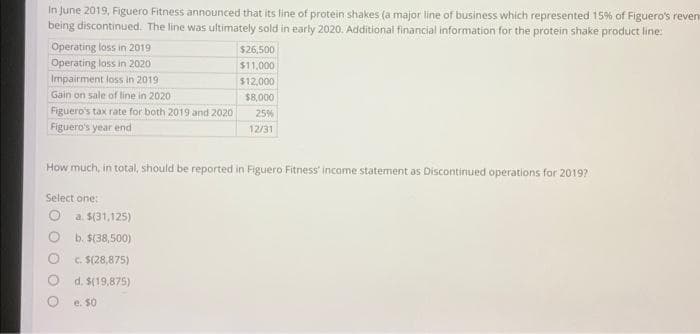

Transcribed Image Text:In June 2019, Figuero Fitness announced that its line of protein shakes (a major line of business which represented 15% of Figuero's reven

being discontinued. The line was ultimately sold in early 2020. Additional financial information for the protein shake product line:

Operating loss in 2019

Operating loss in 2020

Impairment loss in 2019

Gain on sale of line in 2020

Figuero's tax rate for both 2019 and 2020

Figuero's year end

How much, in total, should be reported in Figuero Fitness' income statement as Discontinued operations for 2019?

Select one:

$26,500

$11,000

$12,000

$8,000

25%

12/31

a. $(31,125)

b. $(38,500)

c. $(28,875)

d. $(19,875)

e. 50

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT