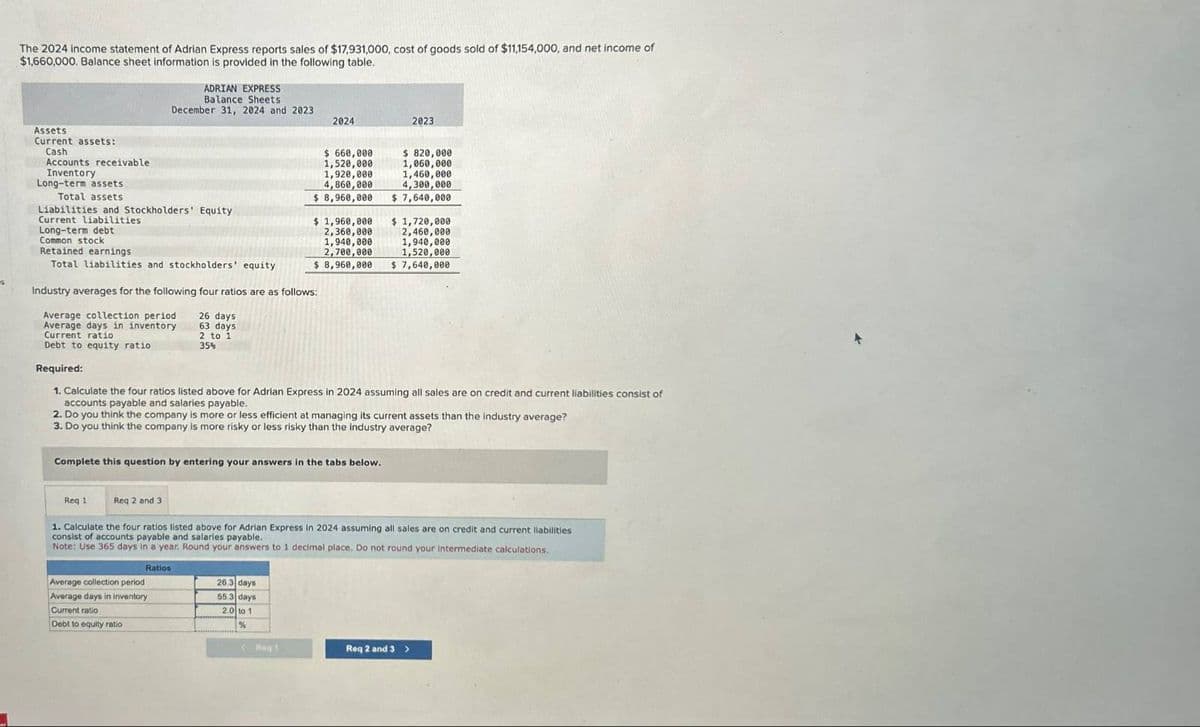

The 2024 income statement of Adrian Express reports sales of $17,931,000, cost of goods sold of $11,154,000, and net income of $1,660,000. Balance sheet information is provided in the following table. ADRIAN EXPRESS Balance Sheets Assets Current assets: Cash Accounts receivable December 31, 2024 and 2023 2024 $660,000 1,520,000 Inventory Long-term assets Total assets Liabilities and Stockholders' Equity Current liabilities Long-term debt Common stock Retained earnings 2023 1,920,000 4,860,000 $ 8,960,000 $ 1,960,000 2,360,000 1,940,000 2,700,000 $ 820,000 1,060,000 1,460,000 4,300,000 $ 7,640,000 $ 1,720,000 2,460,000 1,940,000 1,520,000 Total liabilities and stockholders' equity $ 8,960,000 $ 7,640,000 Industry averages for the following four ratios are as follows: Average collection period Average days in inventory Current ratio Debt to equity ratio Required: 26 days 63 days 2 to 1 35% 1. Calculate the four ratios listed above for Adrian Express in 2024 assuming all sales are on credit and current liabilities consist of accounts payable and salaries payable. 2. Do you think the company is more or less efficient at managing its current assets than the industry average? 3. Do you think the company is more risky or less risky than the industry average? Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 1. Calculate the four ratios listed above for Adrian Express in 2024 assuming all sales are on credit and current liabilities consist of accounts payable and salaries payable. Note: Use 365 days in a year. Round your answers to 1 decimal place. Do not round your intermediate calculations. Average collection period Ratios Average days in inventory Current ratio Debt to equity ratio 26.3 days 55.3 days 2.0 to 1 % Reg 1 Req 2 and 3>

The 2024 income statement of Adrian Express reports sales of $17,931,000, cost of goods sold of $11,154,000, and net income of $1,660,000. Balance sheet information is provided in the following table. ADRIAN EXPRESS Balance Sheets Assets Current assets: Cash Accounts receivable December 31, 2024 and 2023 2024 $660,000 1,520,000 Inventory Long-term assets Total assets Liabilities and Stockholders' Equity Current liabilities Long-term debt Common stock Retained earnings 2023 1,920,000 4,860,000 $ 8,960,000 $ 1,960,000 2,360,000 1,940,000 2,700,000 $ 820,000 1,060,000 1,460,000 4,300,000 $ 7,640,000 $ 1,720,000 2,460,000 1,940,000 1,520,000 Total liabilities and stockholders' equity $ 8,960,000 $ 7,640,000 Industry averages for the following four ratios are as follows: Average collection period Average days in inventory Current ratio Debt to equity ratio Required: 26 days 63 days 2 to 1 35% 1. Calculate the four ratios listed above for Adrian Express in 2024 assuming all sales are on credit and current liabilities consist of accounts payable and salaries payable. 2. Do you think the company is more or less efficient at managing its current assets than the industry average? 3. Do you think the company is more risky or less risky than the industry average? Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 1. Calculate the four ratios listed above for Adrian Express in 2024 assuming all sales are on credit and current liabilities consist of accounts payable and salaries payable. Note: Use 365 days in a year. Round your answers to 1 decimal place. Do not round your intermediate calculations. Average collection period Ratios Average days in inventory Current ratio Debt to equity ratio 26.3 days 55.3 days 2.0 to 1 % Reg 1 Req 2 and 3>

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter12: The Statement Of Cash Flows

Section: Chapter Questions

Problem 12.7E

Related questions

Question

Transcribed Image Text:The 2024 income statement of Adrian Express reports sales of $17,931,000, cost of goods sold of $11,154,000, and net income of

$1,660,000. Balance sheet information is provided in the following table.

ADRIAN EXPRESS

Balance Sheets

Assets

Current assets:

Cash

Accounts receivable

December 31, 2024 and 2023

2024

$660,000

1,520,000

Inventory

Long-term assets

Total assets

Liabilities and Stockholders' Equity

Current liabilities

Long-term debt

Common stock

Retained earnings

2023

1,920,000

4,860,000

$ 8,960,000

$ 1,960,000

2,360,000

1,940,000

2,700,000

$ 820,000

1,060,000

1,460,000

4,300,000

$ 7,640,000

$ 1,720,000

2,460,000

1,940,000

1,520,000

Total liabilities and stockholders' equity

$ 8,960,000

$ 7,640,000

Industry averages for the following four ratios are as follows:

Average collection period

Average days in inventory

Current ratio

Debt to equity ratio

Required:

26 days

63 days

2 to 1

35%

1. Calculate the four ratios listed above for Adrian Express in 2024 assuming all sales are on credit and current liabilities consist of

accounts payable and salaries payable.

2. Do you think the company is more or less efficient at managing its current assets than the industry average?

3. Do you think the company is more risky or less risky than the industry average?

Complete this question by entering your answers in the tabs below.

Req 1

Req 2 and 3

1. Calculate the four ratios listed above for Adrian Express in 2024 assuming all sales are on credit and current liabilities

consist of accounts payable and salaries payable.

Note: Use 365 days in a year. Round your answers to 1 decimal place. Do not round your intermediate calculations.

Average collection period

Ratios

Average days in inventory

Current ratio

Debt to equity ratio

26.3 days

55.3 days

2.0 to 1

%

Reg 1

Req 2 and 3>

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College