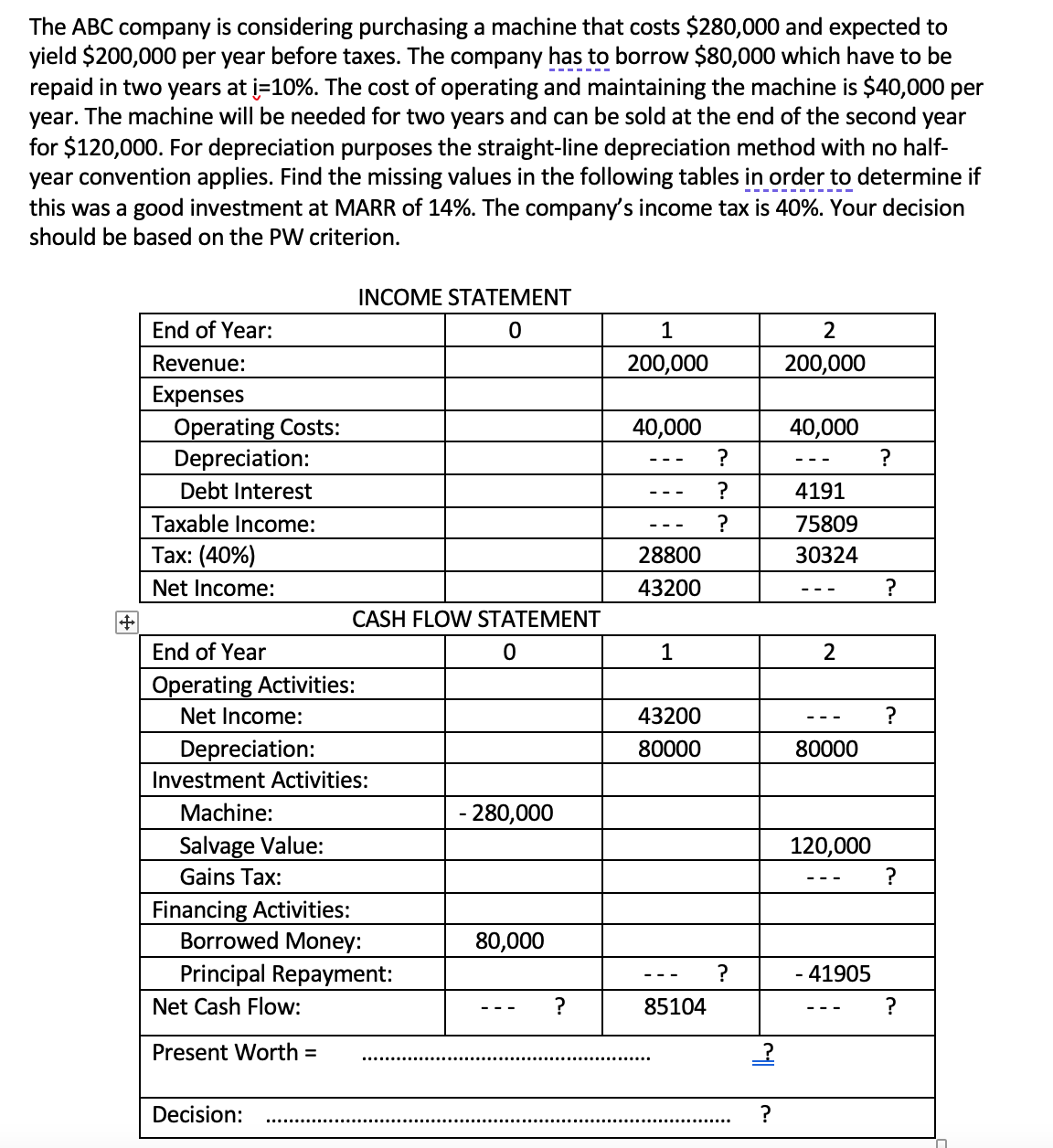

The ABC company is considering purchasing a machine that costs $280,000 and expected to yield $200,000 per year before taxes. The company has to borrow $80,000 which have to be repaid in two years at į=10%. The cost of operating and maintaining the machine is $40,000 per year. The machine will be needed for two years and can be sold at the end of the second year for $120,000. For depreciation purposes the straight-line depreciation method with no half- year convention applies. Find the missing values in the following tables in order to determine if this was a good investment at MARR of 14%. The company's income tax is 40%. Your decision should be based on the PW criterion.

The ABC company is considering purchasing a machine that costs $280,000 and expected to yield $200,000 per year before taxes. The company has to borrow $80,000 which have to be repaid in two years at į=10%. The cost of operating and maintaining the machine is $40,000 per year. The machine will be needed for two years and can be sold at the end of the second year for $120,000. For depreciation purposes the straight-line depreciation method with no half- year convention applies. Find the missing values in the following tables in order to determine if this was a good investment at MARR of 14%. The company's income tax is 40%. Your decision should be based on the PW criterion.

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 13P

Related questions

Question

I need this to be answered in this exact format and only the answers wherever there is a question mark

Transcribed Image Text:The ABC company is considering purchasing a machine that costs $280,000 and expected to

yield $200,000 per year before taxes. The company has to borrow $80,000 which have to be

repaid in two years at į=10%. The cost of operating and maintaining the machine is $40,000 per

year. The machine will be needed for two years and can be sold at the end of the second year

for $120,000. For depreciation purposes the straight-line depreciation method with no half-

year convention applies. Find the missing values in the following tables in order to determine if

this was a good investment at MARR of 14%. The company's income tax is 40%. Your decision

should be based on the PW criterion.

INCOME STATEMENT

End of Year:

1

2

Revenue:

200,000

200,000

Expenses

Operating Costs:

Depreciation:

Debt Interest

40,000

40,000

?

---

?

4191

---

Taxable Income:

75809

---

Таx: (40%)

28800

30324

Net Income:

43200

?

CASH FLOW STATEMENT

End of Year

1

2

Operating Activities:

Net Income:

43200

Depreciation:

80000

80000

Investment Activities:

Machine:

- 280,000

Salvage Value:

120,000

Gains Tax:

Financing Activities:

Borrowed Money:

80,000

Principal Repayment:

?

41905

Net Cash Flow:

?

85104

?

Present Worth =

Decision:

?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning