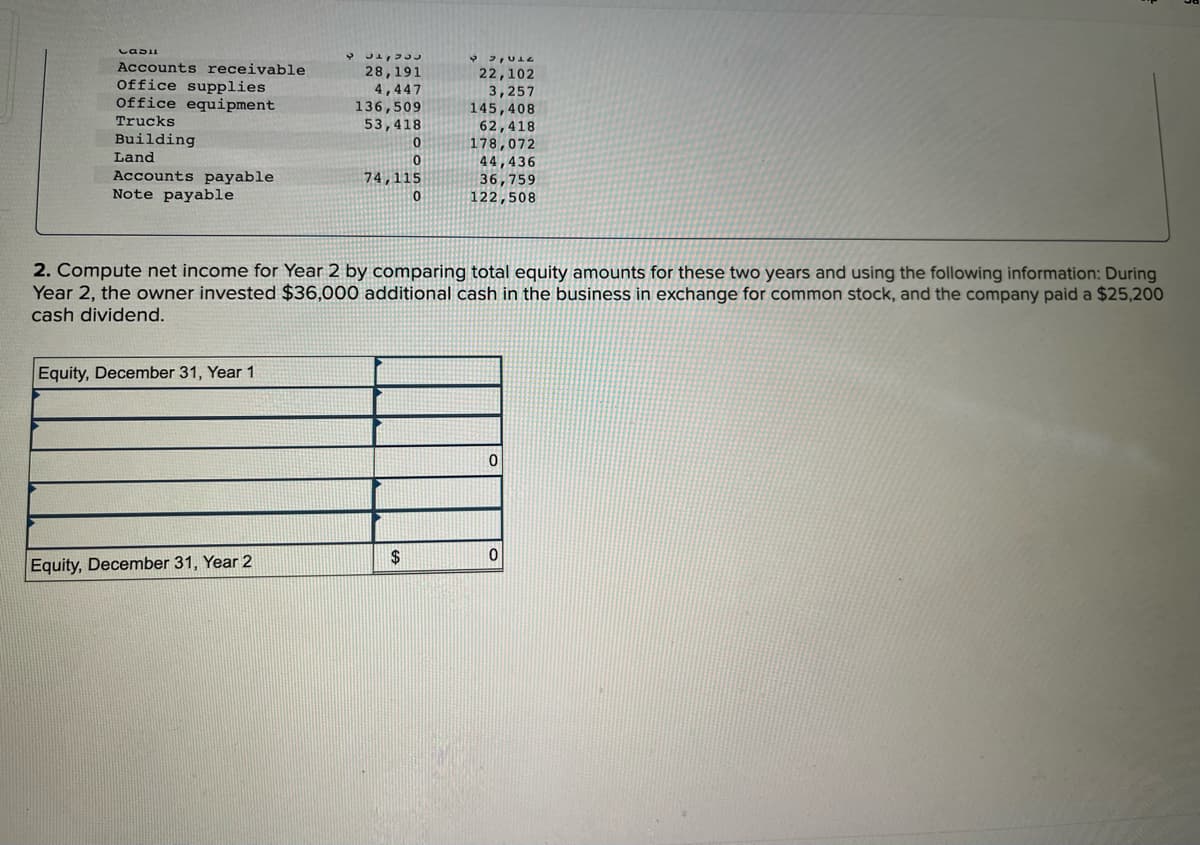

The accounting records of Nettle Distribution show the following assets and liabilities as of December 31 for Year 1 and Year 2. Year 2 $ 9,612 22,102 3,257 145,408 62,418 178,072 44,436 36,759 122,508 December 31 Year 1 $ 51,935 28,191 4,447 136,509 53,418 Cash Accounts receivable Office supplies Office equipment Trucks Building Land 74,115 Accounts payable Note payable Compute net income for Year 2 by comparing total equity amounts for these two years and using the following information: During ar 2, the owner invested $36,000 additional cash in the business in exchange for common stock, and the company paid a $25,200 h dividend.

The accounting records of Nettle Distribution show the following assets and liabilities as of December 31 for Year 1 and Year 2. Year 2 $ 9,612 22,102 3,257 145,408 62,418 178,072 44,436 36,759 122,508 December 31 Year 1 $ 51,935 28,191 4,447 136,509 53,418 Cash Accounts receivable Office supplies Office equipment Trucks Building Land 74,115 Accounts payable Note payable Compute net income for Year 2 by comparing total equity amounts for these two years and using the following information: During ar 2, the owner invested $36,000 additional cash in the business in exchange for common stock, and the company paid a $25,200 h dividend.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter2: Financial Statements And The Annual Report

Section: Chapter Questions

Problem 2.5E: Classification of Assets and Liabilities Indicate the appropriate classification of each of the...

Related questions

Question

Question 7

![Required information

[The following information applies to the questions displayed below.]

The accounting records of Nettle Distribution show the following assets and liabilities as of December 31 for Year 1 and

Year 2.

Year 1

$ 51,935

28,191

4,447

136,509

53,418

December 31

Year 2

$ 9,612

22,102

3,257

145,408

62,418

178,072

Cash

Accounts receivable

Office supplies

Office equipment

Trucks

Building

Land

44 ,436

74,115

36,759

Accounts payable

Note payable

122,508

2. Compute net income for Year 2 by comparing total equity amounts for these two years and using the

Year 2, the owner invested $36,000 additional cash in the business in exchange for common stock, and the company paid a $25,200

cash dividend.

lowing information: During

Equity, December 31, Year 1](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F950ccb0b-88f0-424e-a789-46ed3bd2a086%2F0bf850aa-2d6c-4bf5-9260-48f8264cb16c%2Fmqwr9qz_processed.jpeg&w=3840&q=75)

Transcribed Image Text:Required information

[The following information applies to the questions displayed below.]

The accounting records of Nettle Distribution show the following assets and liabilities as of December 31 for Year 1 and

Year 2.

Year 1

$ 51,935

28,191

4,447

136,509

53,418

December 31

Year 2

$ 9,612

22,102

3,257

145,408

62,418

178,072

Cash

Accounts receivable

Office supplies

Office equipment

Trucks

Building

Land

44 ,436

74,115

36,759

Accounts payable

Note payable

122,508

2. Compute net income for Year 2 by comparing total equity amounts for these two years and using the

Year 2, the owner invested $36,000 additional cash in the business in exchange for common stock, and the company paid a $25,200

cash dividend.

lowing information: During

Equity, December 31, Year 1

Transcribed Image Text:Accounts receivable

Office supplies

Office equipment

28,191

4,447

136,509

53,418

22,102

3,257

145,408

62,418

178,072

44,436

36,759

122,508

Trucks

Building

Land

Accounts payable

Note payable

74,115

2. Compute net income for Year 2 by comparing total equity amounts for these two years and using the following information: During

Year 2, the owner invested $36,000 additional cash in the business in exchange for common stock, and the company paid a $25,200

cash dividend.

Equity, December 31, Year 1

2$

Equity, December 31, Year 2

Expert Solution

Step 1

Net income refers to the earnings of the business after deducting all the direct and indirect expenses from total revenue.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning