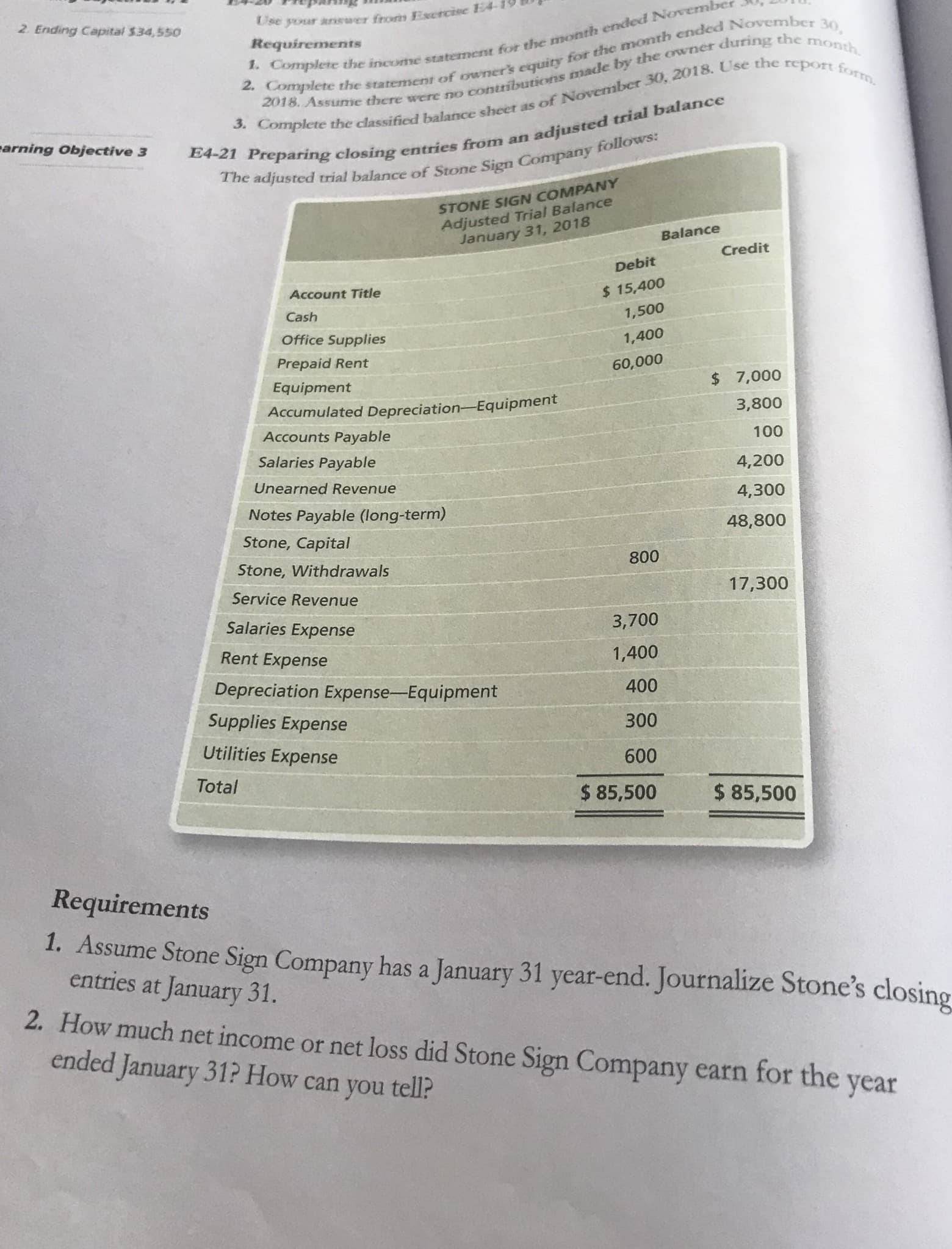

The adjusted trial balance of Stone Sign C STONE SIGN COMPANY Adjusted Trial Balance January 31, 2018 Balance Credit Debit Account Title $ 15,400 Cash 1,500 Office Supplies 1,400 Prepaid Rent 60,000 Equipment $ 7,000 Accumulated Depreciation-Equipment Accounts Payable 3,800 100 Salaries Payable 4,200 Unearned Revenue 4,300 Notes Payable (long-term) 48,800 Stone, Capital Stone, Withdrawals 800 Service Revenue 17,300 Salaries Expense 3,700 Rent Expense 1,400 Depreciation Expense-Equipment 400 Supplies Expense 300 Utilities Expense 600 Total $ 85,500 $ 85,500 Requirements 1. Assume Stone Sign Company has a January 31 year-end. Journalize Stone's closin entries at January 31. 2. How much net income or net loss did Stone Sign Company earn for the year ended January 31? How can you tell?

The adjusted trial balance of Stone Sign C STONE SIGN COMPANY Adjusted Trial Balance January 31, 2018 Balance Credit Debit Account Title $ 15,400 Cash 1,500 Office Supplies 1,400 Prepaid Rent 60,000 Equipment $ 7,000 Accumulated Depreciation-Equipment Accounts Payable 3,800 100 Salaries Payable 4,200 Unearned Revenue 4,300 Notes Payable (long-term) 48,800 Stone, Capital Stone, Withdrawals 800 Service Revenue 17,300 Salaries Expense 3,700 Rent Expense 1,400 Depreciation Expense-Equipment 400 Supplies Expense 300 Utilities Expense 600 Total $ 85,500 $ 85,500 Requirements 1. Assume Stone Sign Company has a January 31 year-end. Journalize Stone's closin entries at January 31. 2. How much net income or net loss did Stone Sign Company earn for the year ended January 31? How can you tell?

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter3: Basic Accounting Systems: Accrual Basis

Section: Chapter Questions

Problem 3.6.1P: Adjustment process and financial statements Adjustment data for Ms. Ellen’s Laundry Inc. for the...

Related questions

Question

Transcribed Image Text:The adjusted trial balance of Stone Sign C

STONE SIGN COMPANY

Adjusted Trial Balance

January 31, 2018

Balance

Credit

Debit

Account Title

$ 15,400

Cash

1,500

Office Supplies

1,400

Prepaid Rent

60,000

Equipment

$ 7,000

Accumulated Depreciation-Equipment

Accounts Payable

3,800

100

Salaries Payable

4,200

Unearned Revenue

4,300

Notes Payable (long-term)

48,800

Stone, Capital

Stone, Withdrawals

800

Service Revenue

17,300

Salaries Expense

3,700

Rent Expense

1,400

Depreciation Expense-Equipment

400

Supplies Expense

300

Utilities Expense

600

Total

$ 85,500

$ 85,500

Requirements

1. Assume Stone Sign Company has a January 31 year-end. Journalize Stone's closin

entries at January 31.

2. How much net income or net loss did Stone Sign Company earn for the year

ended January 31? How can you tell?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning