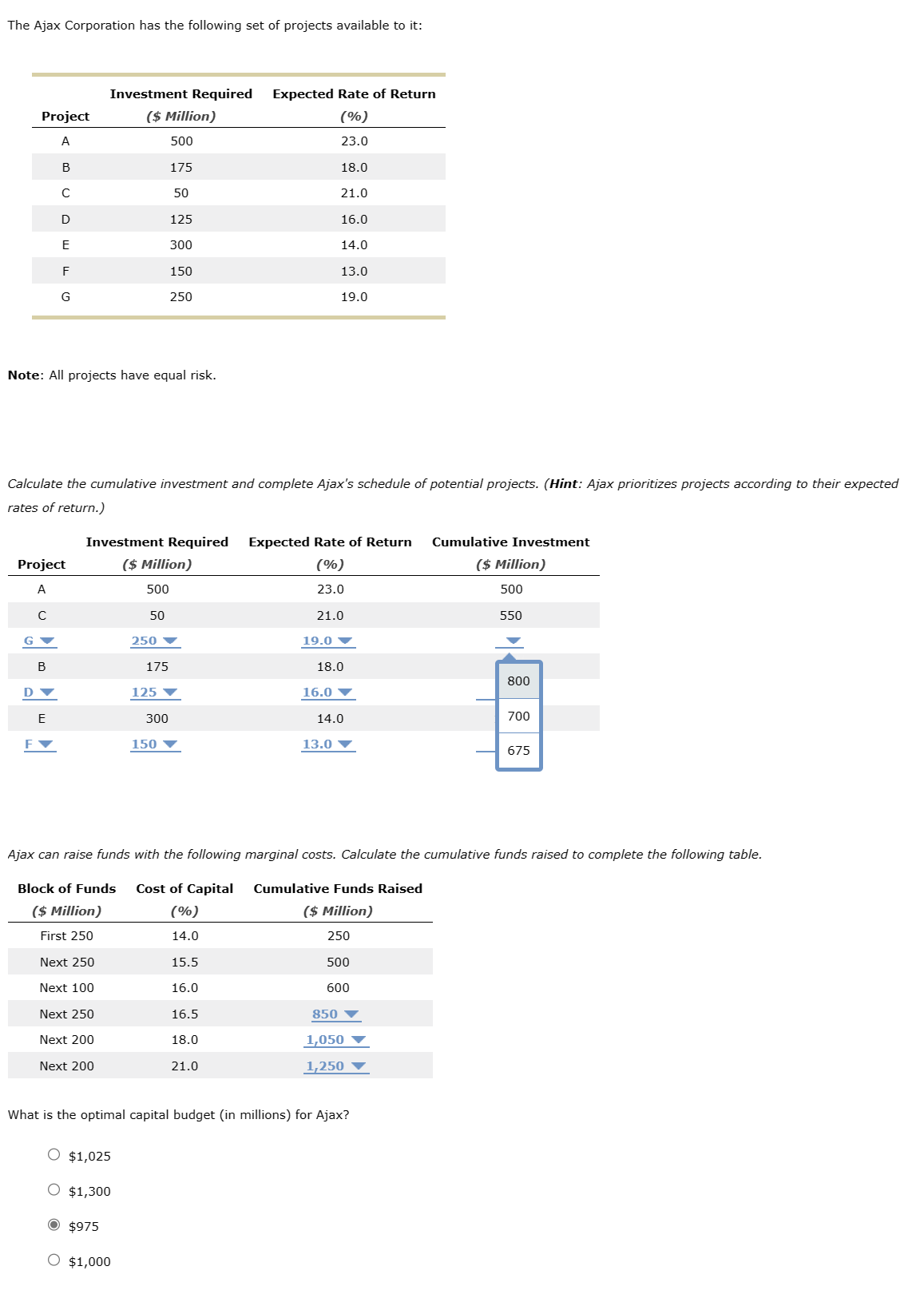

The Ajax Corporation has the following set of projects available to it: Project A D B с D E F G Note: All projects have equal risk. Project A с B Investment Required ($ Million) 500 175 50 125 300 Calculate the cumulative investment and complete Ajax's schedule of potential projects. (Hint: Ajax prioritizes projects according to their expected rates of return.) E 150 250 250 Investment Required Expected Rate of Return ($ Million) (%) 500 23.0 50 175 125 ▼ 300 Expected Rate of Return (%) 23.0 18.0 21.0 16.0 14.0 13.0 19.0 150 ▼ 21.0 19.0 18.0 16.0 ▼ 14.0 13.0 ▼ Cumulative Funds Raised ($ Million) 250 500 600 Cumulative Investment ($ Million) 500 550 850 1,050 1,250 800 700 Ajax can raise funds with the following marginal costs. Calculate the cumulative funds raised to complete the following table. Block of Funds Cost of Capital ($ Million) (%) First 250 14.0 Next 250 15.5 Next 100 16.0 Next 250 16.5 Next 200 18.0 Next 200 21.0 675

The Ajax Corporation has the following set of projects available to it: Project A D B с D E F G Note: All projects have equal risk. Project A с B Investment Required ($ Million) 500 175 50 125 300 Calculate the cumulative investment and complete Ajax's schedule of potential projects. (Hint: Ajax prioritizes projects according to their expected rates of return.) E 150 250 250 Investment Required Expected Rate of Return ($ Million) (%) 500 23.0 50 175 125 ▼ 300 Expected Rate of Return (%) 23.0 18.0 21.0 16.0 14.0 13.0 19.0 150 ▼ 21.0 19.0 18.0 16.0 ▼ 14.0 13.0 ▼ Cumulative Funds Raised ($ Million) 250 500 600 Cumulative Investment ($ Million) 500 550 850 1,050 1,250 800 700 Ajax can raise funds with the following marginal costs. Calculate the cumulative funds raised to complete the following table. Block of Funds Cost of Capital ($ Million) (%) First 250 14.0 Next 250 15.5 Next 100 16.0 Next 250 16.5 Next 200 18.0 Next 200 21.0 675

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter17: Long-term Investment Analysis

Section: Chapter Questions

Problem 1E: A firm has the opportunity to invest in a project having an initial outlay of $20,000. Net cash...

Related questions

Question

Transcribed Image Text:The Ajax Corporation has the following set of projects available to it:

Project

A

B

C

с

D

E

Note: All projects have equal risk.

G▼

F

Calculate the cumulative investment and complete Ajax's schedule of potential projects. (Hint: Ajax prioritizes projects according to their expected

rates of return.)

Project

A

B

DY

G

E

Investment Required Expected Rate of Return

($ Million)

(%)

500

23.0

175

18.0

50

21.0

125

16.0

300

14.0

150

13.0

250

19.0

Investment Required Expected Rate of Return

($ Million)

(%)

500

23.0

50

O $1,025

O $1,300

250

O $975

O $1,000

175

125 ▼

300

150 ▼

21.0

21.0

19.0

18.0

16.0 ▼

14.0

13.0 ▼

Cumulative Funds Raised

($ Million)

250

Ajax can raise funds with the following marginal costs. Calculate the cumulative funds raised to complete the following table.

Block of Funds Cost of Capital

($ Million)

(%)

First 250

14.0

Next 250

15.5

Next 100

16.0

Next 250

16.5

Next 200

18.0

Next 200

500

600

What is the optimal capital budget (in millions) for Ajax?

850

1,050

1,250

Cumulative Investment

($ Million)

500

550

800

700

675

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning