The April 30 bank statement of Counselling Services Association (CSA) has just arrived from Scotiabank. To prepare the CSA bank reconciliation, you gather the following data: E (Click the icon to view the additional data for the bank reconciliation.) Required 1. Prepare the bank reconciliation for CSA. 2. Journalize the April 30 transactions needed to update CSA's Cash account. Include an explanation for each entry Requirement 1. Prepare the bank reconciliation for CSA, and then continue with the book side of the reconciliation. (Enter amounts to two decimal places. Leave unused cells blanh Data Table CSA's Cash account shows a balance of $6.610 64 on April 30. b. The April 30 bank balance is $8,501.15. c. The bank statement shows that CSA earned $16.55 of interest on its bank balance during April. This amount was added to CSA's bank balance. d. CSA pays utilities ($280) and insurance ($60) by EFT. e. The following CSA cheques did not clear the bank by April 30: a. Cheque No. Amount 237 24 46.10 288 142.00 291 578.05 293 11.97 294 609.22 295 5.88 296 103.54 The bank statement includes a donation of $840, electronically deposited to the bank for CSA The bank statement lists a $10.60 bank service charge. f. g. h. On April 30, the CSA treasurer deposited $15.35, which will appear on the May bank statement. The bank statement includes a $320 deposit that CSA did not make. The bank i. added $320 to CSA's account for another company's deposit. The bank statement includes two charges for returned cheques from donors. One is a $350 cheque received from a donor with the imprint "Unauthorized Signature." The other is a nonsufficient funds cheque in the amount of $66.85 received from a client Clear All File Explor w Word Do Home.. O O OM

The April 30 bank statement of Counselling Services Association (CSA) has just arrived from Scotiabank. To prepare the CSA bank reconciliation, you gather the following data: E (Click the icon to view the additional data for the bank reconciliation.) Required 1. Prepare the bank reconciliation for CSA. 2. Journalize the April 30 transactions needed to update CSA's Cash account. Include an explanation for each entry Requirement 1. Prepare the bank reconciliation for CSA, and then continue with the book side of the reconciliation. (Enter amounts to two decimal places. Leave unused cells blanh Data Table CSA's Cash account shows a balance of $6.610 64 on April 30. b. The April 30 bank balance is $8,501.15. c. The bank statement shows that CSA earned $16.55 of interest on its bank balance during April. This amount was added to CSA's bank balance. d. CSA pays utilities ($280) and insurance ($60) by EFT. e. The following CSA cheques did not clear the bank by April 30: a. Cheque No. Amount 237 24 46.10 288 142.00 291 578.05 293 11.97 294 609.22 295 5.88 296 103.54 The bank statement includes a donation of $840, electronically deposited to the bank for CSA The bank statement lists a $10.60 bank service charge. f. g. h. On April 30, the CSA treasurer deposited $15.35, which will appear on the May bank statement. The bank statement includes a $320 deposit that CSA did not make. The bank i. added $320 to CSA's account for another company's deposit. The bank statement includes two charges for returned cheques from donors. One is a $350 cheque received from a donor with the imprint "Unauthorized Signature." The other is a nonsufficient funds cheque in the amount of $66.85 received from a client Clear All File Explor w Word Do Home.. O O OM

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter5: Cash Control Systems

Section: Chapter Questions

Problem 1CP

Related questions

Question

Please prepare the bank reconciliation for CSA

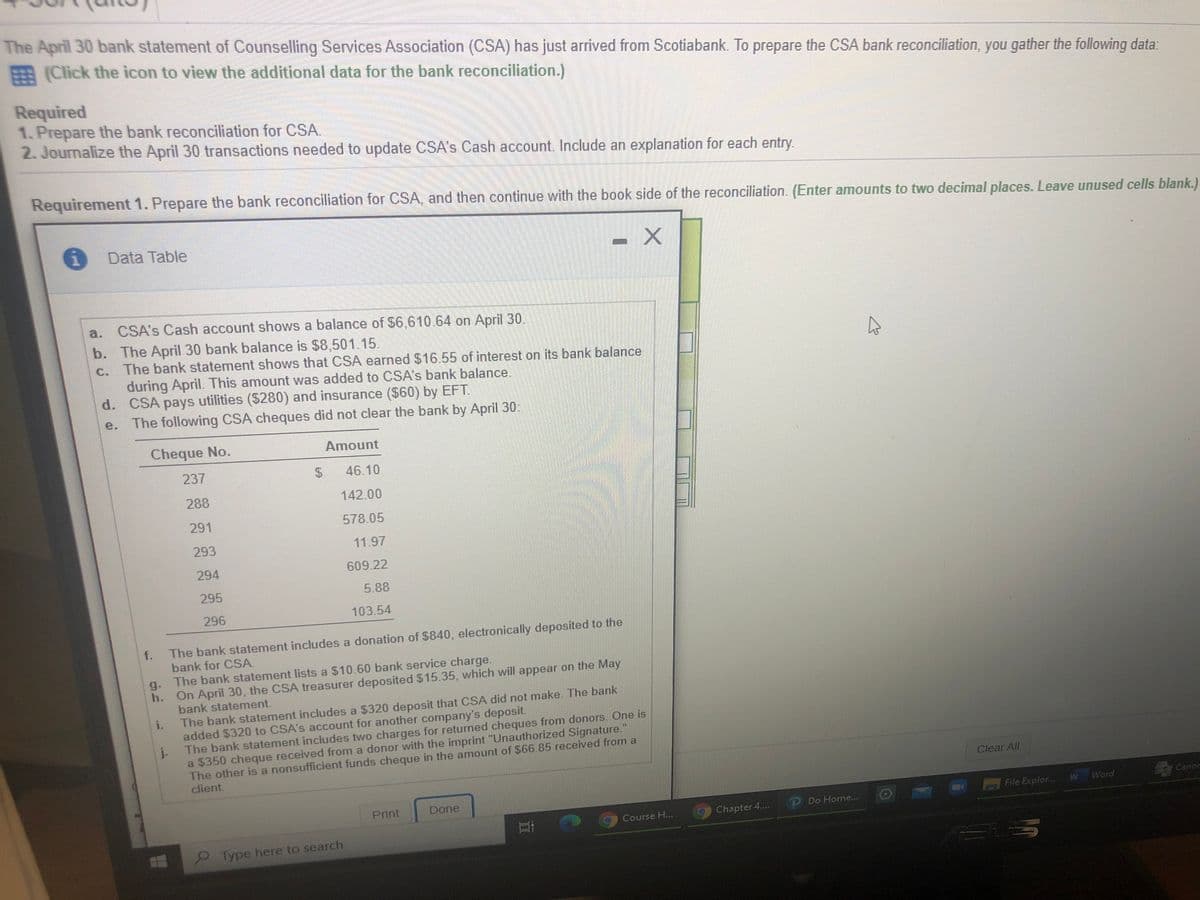

Transcribed Image Text:The April 30 bank statement of Counselling Services Association (CSA) has just arrived from Scotiabank. To prepare the CSA bank reconciliation, you gather the following data:

E (Click the icon to view the additional data for the bank reconciliation.)

Required

1. Prepare the bank reconciliation for CSA.

2. Journalize the April 30 transactions needed to update CSA's Cash account. Include an explanation for each entry.

Requirement 1. Prepare the bank reconciliation for CSA, and then continue with the book side of the reconciliation. (Enter amounts to two decimal places. Leave unused cells blank.)

Data Table

a. CSA's Cash account shows a balance of S6,610.64 on April 30.

b. The April 30 bank balance is $8,501.15.

c. The bank statement shows that CSA earned $16.55 of interest on its bank balance

during April. This amount was added to CSA's bank balance.

d. CSA pays utilities ($280) and insurance ($60) by EFT.

e. The following CSA cheques did not clear the bank by April 30:

Cheque No.

Amount

237

$4

46.10

288

142.00

291

578.05

293

11.97

294

609.22

295

5.88

296

103.54

The bank statement includes a donation of $840, electronically deposited to the

bank for CSA.

f.

g. The bank statement lists a $10.60 bank service charge.

On April 30, the CSA treasurer deposited $15.35, which will appear on the May

bank statement.

i.

The bank statement includes a $320 deposit that CSA did not make. The bank

added $320 to CSA's account for another company's deposit.

The bank statement includes two charges for returned cheques from donors. One is

j.

a $350 cheque received from a donor with the imprint "Unauthorized Signature."

The other is a nonsufficient funds cheque in the amount of $66.85 received from a

client.

Clear All

Print

Done

File Explo...

Word

Canor

Do Home...

Course H...

Chapter 4...

Type here to search

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,