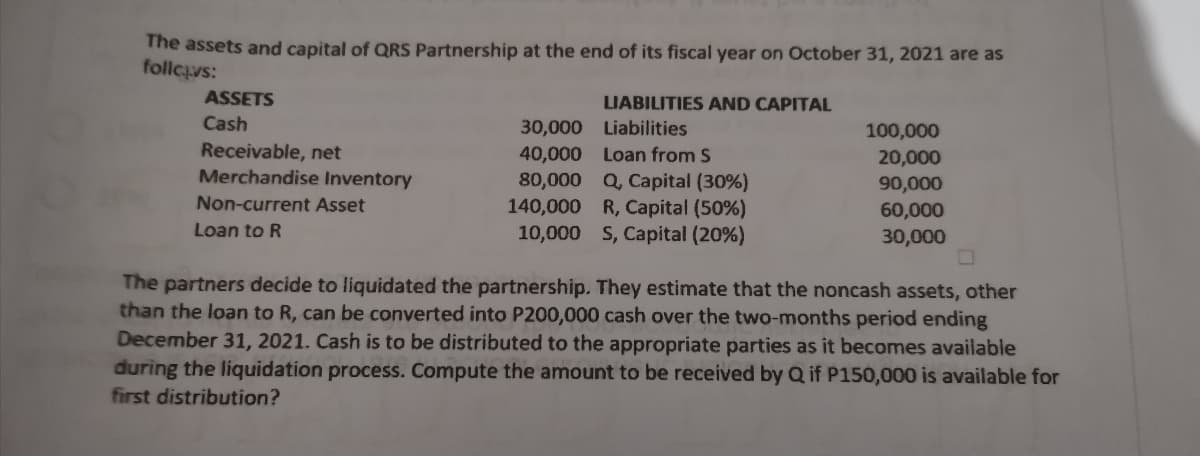

The assets and capital of QRS Partnership at the end of its fiscal year on October 31, 2021 are as follcus: ASSETS LIABILITIES AND CAPITAL Cash 30,000 Liabilities 100,000 Receivable, net Merchandise Inventory 40,000 Loan from S 80,000 Q, Capital (30%) 140,000 R, Capital (50%) 10,000 S, Capital (20%) 20,000 90,000 60,000 Non-current Asset Loan to R 30,000 The partners decide to liquidated the partnership. They estimate that the noncash assets, other than the loan to R, can be converted into P200,000 cash over the two-months period ending December 31, 2021. Cash is to be distributed to the appropriate parties as it becomes available during the liquidation process. Compute the amount to be received by Q if P150,000 is available for first distribution?

The assets and capital of QRS Partnership at the end of its fiscal year on October 31, 2021 are as follcus: ASSETS LIABILITIES AND CAPITAL Cash 30,000 Liabilities 100,000 Receivable, net Merchandise Inventory 40,000 Loan from S 80,000 Q, Capital (30%) 140,000 R, Capital (50%) 10,000 S, Capital (20%) 20,000 90,000 60,000 Non-current Asset Loan to R 30,000 The partners decide to liquidated the partnership. They estimate that the noncash assets, other than the loan to R, can be converted into P200,000 cash over the two-months period ending December 31, 2021. Cash is to be distributed to the appropriate parties as it becomes available during the liquidation process. Compute the amount to be received by Q if P150,000 is available for first distribution?

Chapter10: Partnerships: Formation, Operation, And Basis

Section: Chapter Questions

Problem 39P

Related questions

Topic Video

Question

Show the solution in good accounting form

Transcribed Image Text:The assets and capital of QRS Partnership at the end of its fiscal year on October 31, 2021 are as

follcvs:

ASSETS

LIABILITIES AND CAPITAL

Cash

30,000 Liabilities

Receivable, net

Merchandise Inventory

100,000

20,000

40,000 Loan from S

80,000 Q, Capital (30%)

140,000 R, Capital (50%)

10,000 S, Capital (20%)

90,000

Non-current Asset

60,000

Loan to R

30,000

The partners decide to liquidated the partnership. They estimate that the noncash assets, other

than the loan to R, can be converted into P200,000 cash over the two-months period ending

December 31, 2021. Cash is to be distributed to the appropriate parties as it becomes available

during the liquidation process. Compute the amount to be received by Q if P150,000 is available for

first distribution?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning