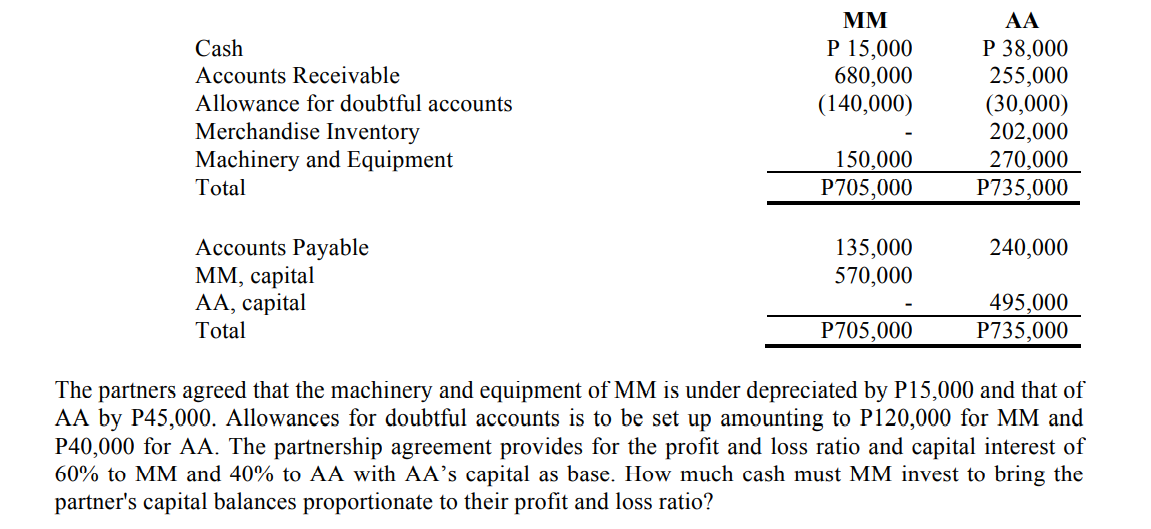

1. As of July 1, 2020, MM and AA decided to form a partnership. Their balance sheets on this date are: Cash P 15,000 P 38,000 Accounts Receivable 680,000 255,000 Allowance for doubtful accounts (140,000) (30,000) Merchandise Inventory 202,000 Machinery and Equipment 150,000 270,000 Total P705,000 P735,000 Accounts Payable 135,000 240,000 MM, capital 570,000 AA, capital - 495,000 Total P705,000 P735,000 The partners agreed that the machinery and equipment of MM is under depreciated by P15,000 and that of AA by P45,000. Allowances for doubtful accounts is to be set up amounting to P120,000 for MM and P40,000 for AA. The partnership agreement provides for the profit and loss ratio and capital interest of 60% to MM and 40% to AA with AA’s capital as base. How much cash must MM invest to bring the partner's capital balances proportionate to their profit and loss ratio?

1. As of July 1, 2020, MM and AA decided to form a

Cash P 15,000 P 38,000

Allowance for doubtful accounts (140,000) (30,000)

Merchandise Inventory 202,000

Machinery and Equipment 150,000 270,000

Total P705,000 P735,000

Accounts Payable 135,000 240,000

MM, capital 570,000

AA, capital - 495,000

Total P705,000 P735,000

The partners agreed that the machinery and equipment of MM is under

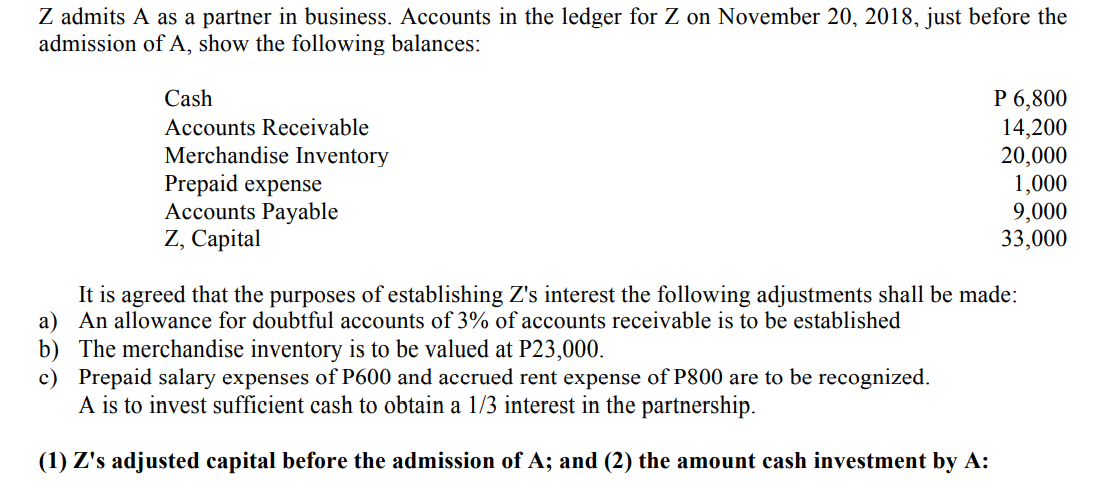

2. Z admits A as a partner in business. Accounts in the ledger for Z on November 20, 2018, just before the admission of A, show the following balances:

Cash P 6,800

Accounts Receivable 14,200

Merchandise Inventory 20,000

Prepaid expense 1,000

Accounts Payable 9,000

Z, Capital 33,000

It is agreed that the purposes of establishing Z's interest the following adjustments shall be made:

a) An allowance for doubtful accounts of 3% of accounts receivable is to be established

b) The merchandise inventory is to be valued at P23,000.

c) Prepaid salary expenses of P600 and accrued rent expense of P800 are to be recognized.

A is to invest sufficient cash to obtain a 1/3 interest in the partnership.

Question 1: Z's adjusted capital before the admission of A is?

Question 2: The amount cash investment by A is?

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images