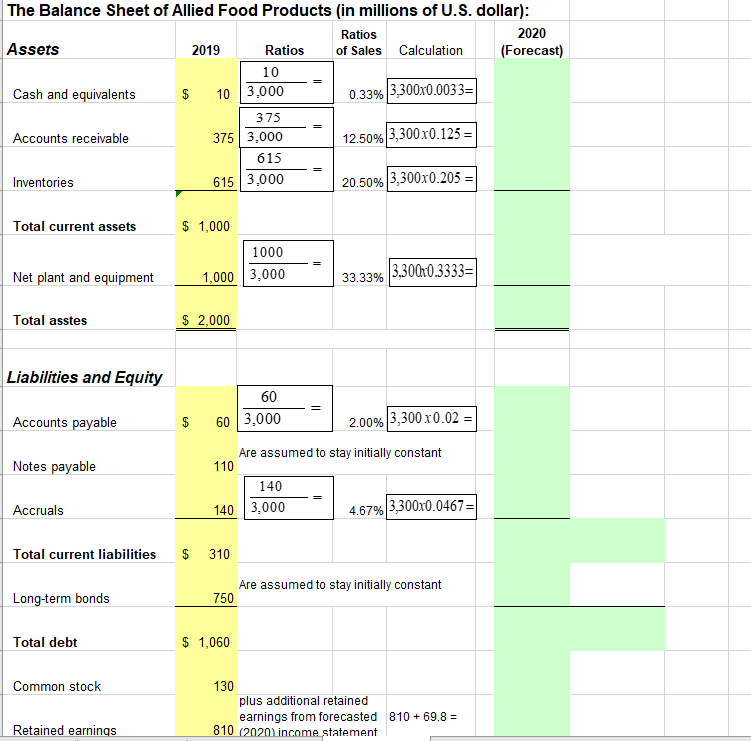

The Balance Sheet of Allied Food Products (in millions of U.S. dollar): Ratios 2020 Assets 2019 Ratios of Sales Calculation (Forecast) 10 Cash and equivalents 10 3,000 3,300x0.0033=| 0.33% 375 375 3,000 3,300x0.125 = Accounts receivable 12.50% 615 615 3,000 20.50% 3,300x0.205 = Inventories Total current assets $ 1,000 1000 3.300x0.3333= Net plant and equipment 1,000 3,000 33.33% Total asstes $ 2,000 Liabilities and Equity 60 Accounts payable 60 3,000 2.00% 3,300 x0.02 = Are assumed to stay initially constant 110 Notes payable 140 140 3,000 3,300x0.0467= Accruals 4.67% Total current liabilities 310 Are assumed to stay initially constant 750 Long-term bonds Total debt $ 1,060 130 plus additional retained earnings from forecasted 810 + 69.8 = 810 (2020) income statement Common stock Retained earnings %24 %24 615 615 3,000 20.50% 3,300x0.205 = Inventories Total current assets $ 1,000 1000 Net plant and equipment 1,000 3,000 3,300x0.3333=| 33.33% Total asstes $ 2,000 Liabilities and Equity 60 Accounts payable 60 | 3,000 2.00% 3,300 x0.02 = Notes payable Are assumed to stay initially constant 110 140 140 3,000 3,300x0.0467= Accruals 4.67% Total current liabilities 310 Are assumed to stay initially constant 750 Long-term bonds Total debt $ 1,060 Common stock 130 plus additional retained earnings from forecasted 810 + 69.8 = 810 (2020) income statement Retained earnings Total common equity 940 Total liabilities and equity $ 2,000 AFN Liquidity Ratio Debt Ratio 3.23 53.00%

The Balance Sheet of Allied Food Products (in millions of U.S. dollar): Ratios 2020 Assets 2019 Ratios of Sales Calculation (Forecast) 10 Cash and equivalents 10 3,000 3,300x0.0033=| 0.33% 375 375 3,000 3,300x0.125 = Accounts receivable 12.50% 615 615 3,000 20.50% 3,300x0.205 = Inventories Total current assets $ 1,000 1000 3.300x0.3333= Net plant and equipment 1,000 3,000 33.33% Total asstes $ 2,000 Liabilities and Equity 60 Accounts payable 60 3,000 2.00% 3,300 x0.02 = Are assumed to stay initially constant 110 Notes payable 140 140 3,000 3,300x0.0467= Accruals 4.67% Total current liabilities 310 Are assumed to stay initially constant 750 Long-term bonds Total debt $ 1,060 130 plus additional retained earnings from forecasted 810 + 69.8 = 810 (2020) income statement Common stock Retained earnings %24 %24 615 615 3,000 20.50% 3,300x0.205 = Inventories Total current assets $ 1,000 1000 Net plant and equipment 1,000 3,000 3,300x0.3333=| 33.33% Total asstes $ 2,000 Liabilities and Equity 60 Accounts payable 60 | 3,000 2.00% 3,300 x0.02 = Notes payable Are assumed to stay initially constant 110 140 140 3,000 3,300x0.0467= Accruals 4.67% Total current liabilities 310 Are assumed to stay initially constant 750 Long-term bonds Total debt $ 1,060 Common stock 130 plus additional retained earnings from forecasted 810 + 69.8 = 810 (2020) income statement Retained earnings Total common equity 940 Total liabilities and equity $ 2,000 AFN Liquidity Ratio Debt Ratio 3.23 53.00%

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter4: Analysis Of Financial Statements

Section: Chapter Questions

Problem 24P: Income Statement for Year Ended December 31, 2018 (Millions of Dollars) Net sales 795.0 Cost of...

Related questions

Question

I need help with Liabilities and down. I need the excel functions (answers by using excel)

Transcribed Image Text:The Balance Sheet of Allied Food Products (in millions of U.S. dollar):

Ratios

2020

Assets

2019

Ratios

of Sales Calculation

(Forecast)

10

Cash and equivalents

10 3,000

3,300x0.0033=|

0.33%

375

375 3,000

3,300x0.125 =

Accounts receivable

12.50%

615

615 3,000

20.50% 3,300x0.205 =

Inventories

Total current assets

$ 1,000

1000

3.300x0.3333=

Net plant and equipment

1,000 3,000

33.33%

Total asstes

$ 2,000

Liabilities and Equity

60

Accounts payable

60 3,000

2.00% 3,300 x0.02 =

Are assumed to stay initially constant

110

Notes payable

140

140 3,000

3,300x0.0467=

Accruals

4.67%

Total current liabilities

310

Are assumed to stay initially constant

750

Long-term bonds

Total debt

$ 1,060

130

plus additional retained

earnings from forecasted 810 + 69.8 =

810 (2020) income statement

Common stock

Retained earnings

%24

%24

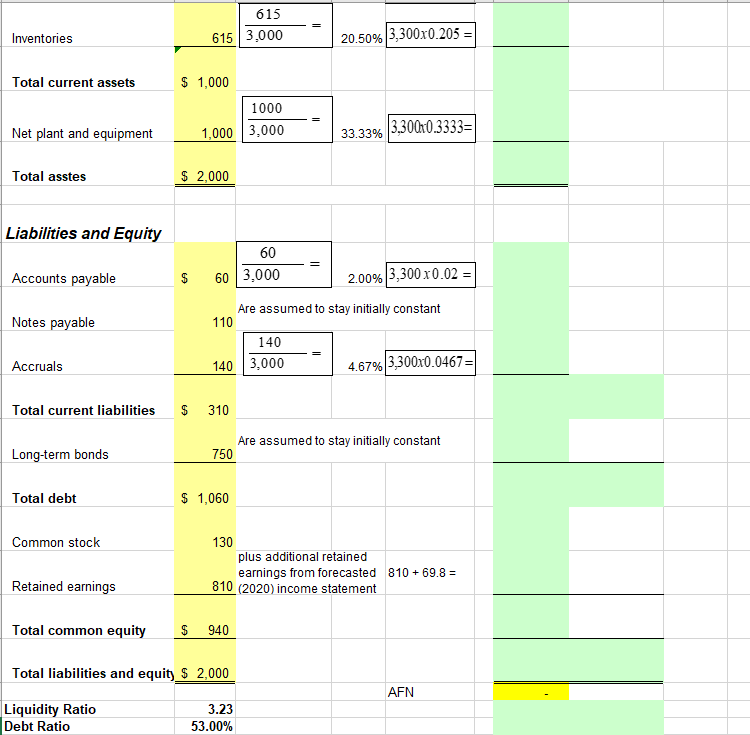

Transcribed Image Text:615

615 3,000

20.50% 3,300x0.205 =

Inventories

Total current assets

$ 1,000

1000

Net plant and equipment

1,000 3,000

3,300x0.3333=|

33.33%

Total asstes

$ 2,000

Liabilities and Equity

60

Accounts payable

60 | 3,000

2.00% 3,300 x0.02 =

Notes payable

Are assumed to stay initially constant

110

140

140 3,000

3,300x0.0467=

Accruals

4.67%

Total current liabilities

310

Are assumed to stay initially constant

750

Long-term bonds

Total debt

$ 1,060

Common stock

130

plus additional retained

earnings from forecasted 810 + 69.8 =

810 (2020) income statement

Retained earnings

Total common equity

940

Total liabilities and equity $ 2,000

AFN

Liquidity Ratio

Debt Ratio

3.23

53.00%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning