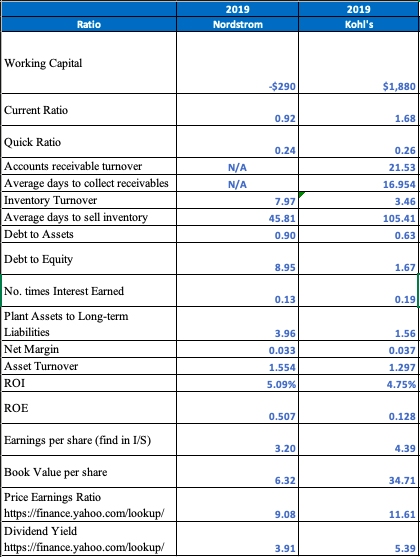

2019 2019 Ratio Nordstrom Kohl's Working Capital -$290 $1,880 Current Ratio 0.92 1.68 Quick Ratio 0.24 0.26 Accounts receivable turnover Average days to collect receivables Inventory Turnover Average days to sell inventory Debt to Assets Debt to Equity N/A 21.53 N/A 16.954 7.97 3.46 45.81 105.41 0.90 0.63 8.95 1.67 No. times Interest Earned Plant Assets to Long-term Liabilities Net Margin Asset Turnover ROI ROE 0.13 0.19 3.96 1.56 0.033 0.037 1.554 1.297 5.09% 4.75% 0.507 0.128 Earnings per share (find in I/S) 3.20 4.39 Book Value per share Price Earnings Ratio https://finance.yahoo.com/lookup/ Dividend Yield https://finance.yahoo.com/lookup/ 6.32 34.71 9.08 11.61 3.91 5.39

2019 2019 Ratio Nordstrom Kohl's Working Capital -$290 $1,880 Current Ratio 0.92 1.68 Quick Ratio 0.24 0.26 Accounts receivable turnover Average days to collect receivables Inventory Turnover Average days to sell inventory Debt to Assets Debt to Equity N/A 21.53 N/A 16.954 7.97 3.46 45.81 105.41 0.90 0.63 8.95 1.67 No. times Interest Earned Plant Assets to Long-term Liabilities Net Margin Asset Turnover ROI ROE 0.13 0.19 3.96 1.56 0.033 0.037 1.554 1.297 5.09% 4.75% 0.507 0.128 Earnings per share (find in I/S) 3.20 4.39 Book Value per share Price Earnings Ratio https://finance.yahoo.com/lookup/ Dividend Yield https://finance.yahoo.com/lookup/ 6.32 34.71 9.08 11.61 3.91 5.39

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 14P: Investments in Equity Securities Noonan Corporation prepares quarterly financial statements and...

Related questions

Question

Executive Summary of findings-assessment of which firm would be the better investment based on the above comparison.

If answered within 45mins,it would be helpful!!!

Transcribed Image Text:2019

2019

Ratio

Nordstrom

Kohl's

Working Capital

-$290

$1,880

Current Ratio

0.92

1.68

Quick Ratio

0.24

0.26

Accounts receivable turnover

N/A

21.53

Average days to collect receivables

Inventory Turnover

N/A

16.954

7.97

3.46

Average days to sell inventory

Debt to Assets

Debt to Equity

45.81

105.41

0.90

0.63

8.95

1.67

No. times Interest Earned

0.13

0.19

Plant Assets to Long-term

Liabilities

3.96

1.56

Net Margin

0.033

0.037

Asset Turnover

1.554

1.297

ROI

5.09%

4.75%

ROE

0.507

0.128

Earnings per share (find in I/S)

3.20

4.39

Book Value per share

Price Earnings Ratio

https://finance.yahoo.com/lookup/

6.32

34.71

9.08

11.61

Dividend Yield

https://finance.yahoo.com/lookup/

3.91

5.39

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning