The following information has been extracted from the financial statements of Greenstar Limited. Statement of Financial Position as at 31 December 2020 ASSETS R Non -Current Assets 2 250 000 Current assets 1 656 000 Inventory 792 000 Accounts Receivable 648 000 Cash 216 000 Sales for 2020 amounted to R3 600 000 and is forecasted to increase to R4 200 000 in 2021. The company uses the percentage of sales to forecast current assets. In 2021 accounts receivable will be projected at an amount of: O A. R648 000 O B. R555 429 O C. R623 000 O D. R756 000

The following information has been extracted from the financial statements of Greenstar Limited. Statement of Financial Position as at 31 December 2020 ASSETS R Non -Current Assets 2 250 000 Current assets 1 656 000 Inventory 792 000 Accounts Receivable 648 000 Cash 216 000 Sales for 2020 amounted to R3 600 000 and is forecasted to increase to R4 200 000 in 2021. The company uses the percentage of sales to forecast current assets. In 2021 accounts receivable will be projected at an amount of: O A. R648 000 O B. R555 429 O C. R623 000 O D. R756 000

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter13: Financial Statement Analysis

Section: Chapter Questions

Problem 13.8E

Related questions

Question

Please answer both questions

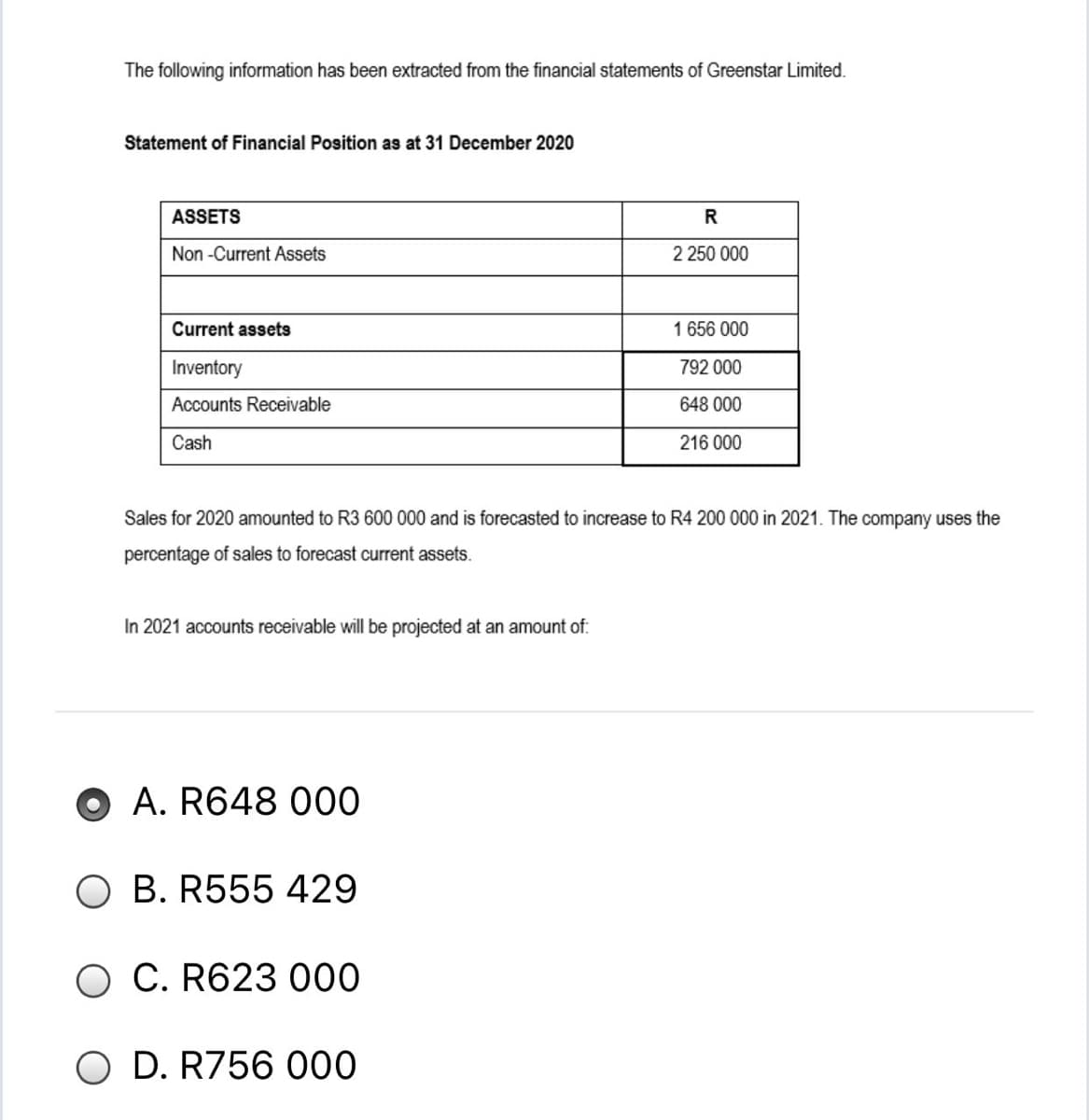

Transcribed Image Text:The following information has been extracted from the financial statements of Greenstar Limited.

Statement of Financial Position as at 31 December 2020

ASSETS

R

Non -Current Assets

2 250 000

Current assets

1 656 000

Inventory

792 000

Accounts Receivable

648 000

Cash

216 000

Sales for 2020 amounted to R3 600 000 and is forecasted to increase to R4 200 000 in 2021. The company uses the

percentage of sales to forecast current assets.

In 2021 accounts receivable will be projected at an amount of:

A. R648 000

O B. R555 429

O C. R623 000

D. R756 000

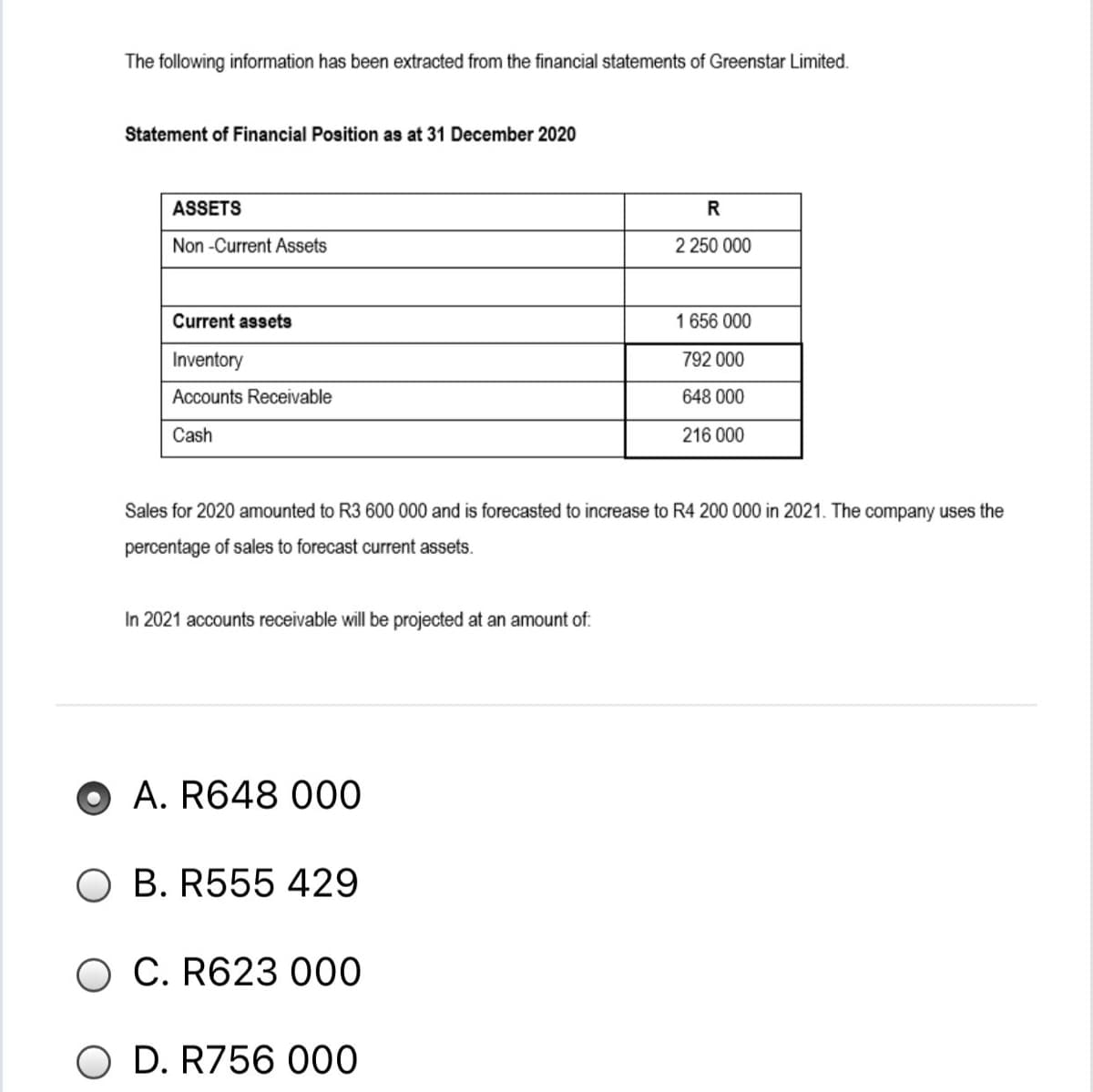

Transcribed Image Text:The following information has been extracted from the financial statements of Greenstar Limited.

Statement of Financial Position as at 31 December 2020

ASSETS

Non -Current Assets

2 250 000

Current assets

1 656 000

Inventory

792 000

Accounts Receivable

648 000

Cash

216 000

Sales for 2020 amounted to R3 600 000 and is forecasted to increase to R4 200 000 in 2021. The company uses the

percentage of sales to forecast current assets.

In 2021 accounts receivable will be projected at an amount of:

A. R648 000

O B. R555 429

O C. R623 000

O D. R756 000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning