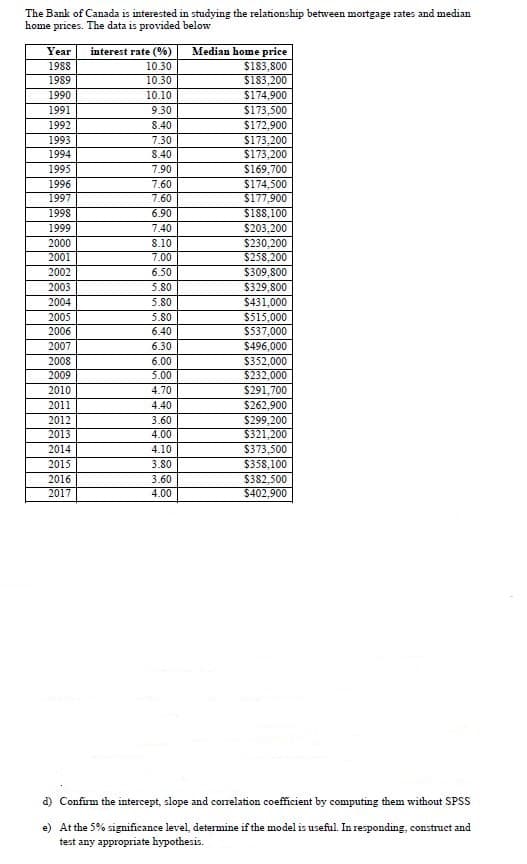

The Bank of Canada is interested in studying the relationship between mortgage rates and median home prices. The data is provided below Median home price $183,800 $183,200 $174,900 Year interest rate (%) 1988 10.30 1989 10.30 1990 10.10 1991 9.30 $173,500 $172,900 $173,200 $173,200 $169,700 1992 S.40 1993 7.30 1994 $.40 1995 7.90 1996 7.60 $174,500 $177,900 $188,100 $203,200 $230,200 1997 1998 7.60 6.90 1999 7.40 2000 S.10 2001 7.00 $258,200 $309,800 $329,800 2002 6.50 2003 2004 5.80 5.80 $431,000 $515,000 $537,000 2005 5.80 2006 6.40 2007 6.30 $496,000 2008 6.00 5.00 4.70 $352,000 2009 $232,000 2010 $291,700 $262,900 $299,200 $321,200 2011 4.40 2012 2013 3.60 4.00 2014 4.10 $373,500 $358,100 $382,500 $402.900 2015 3.80 3.60 4.00 2016 2017 d) Confum the intercept, slope and correlation coefficient by computing them without SPSS ) At the 5% significance level, determine if the model is useful. In responding, construct and test any appropriate hypothesis.

The Bank of Canada is interested in studying the relationship between mortgage rates and median home prices. The data is provided below Median home price $183,800 $183,200 $174,900 Year interest rate (%) 1988 10.30 1989 10.30 1990 10.10 1991 9.30 $173,500 $172,900 $173,200 $173,200 $169,700 1992 S.40 1993 7.30 1994 $.40 1995 7.90 1996 7.60 $174,500 $177,900 $188,100 $203,200 $230,200 1997 1998 7.60 6.90 1999 7.40 2000 S.10 2001 7.00 $258,200 $309,800 $329,800 2002 6.50 2003 2004 5.80 5.80 $431,000 $515,000 $537,000 2005 5.80 2006 6.40 2007 6.30 $496,000 2008 6.00 5.00 4.70 $352,000 2009 $232,000 2010 $291,700 $262,900 $299,200 $321,200 2011 4.40 2012 2013 3.60 4.00 2014 4.10 $373,500 $358,100 $382,500 $402.900 2015 3.80 3.60 4.00 2016 2017 d) Confum the intercept, slope and correlation coefficient by computing them without SPSS ) At the 5% significance level, determine if the model is useful. In responding, construct and test any appropriate hypothesis.

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter10: Statistics

Section10.6: Summarizing Categorical Data

Problem 4BGP

Related questions

Question

Transcribed Image Text:The Bank of Canada is interested in studying the relationship between mortgage rates and median

home prices. The data is provided below

Median home price

$183,800

$183,200

$174,900

$173,500

$172,900

$173,200

$173,200

$169,700

$174,500

$177,900

Year

interest rate (%)

10.30

1988

1989

10.30

1990

10.10

1991

9.30

1992

8.40

1993

7.30

1994

8.40

1995

7.90

1996

7.60

1997

7.60

$188,100

$203,200

$230,200

$258,200

1998

6.90

1999

7.40

2000

8.10

2001

7.00

$309,800

$329,800

$431.000

2002

6.50

2003

5.80

2004

5.80

$515,000

$537,000

2005

5.80

2006

6.40

2007

6.30

$496,000

$352,000

$232,000

$291.700

$262,900

2008

6.00

2009

5.00

2010

4.70

2011

4.40

$299,200

$321,200

$373,500

$358,100

$382,500

$402,900

2012

3.60

2013

4.00

2014

4.10

2015

3.80

2016

3.60

2017

4.00

d) Confirm the intercept, slope and correlation coefficient by computing them without SPSS

e) At the 5% significance level, determine if the model is useful. In responding, construct and

test any appropriate hypothesis.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 1 images

Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill