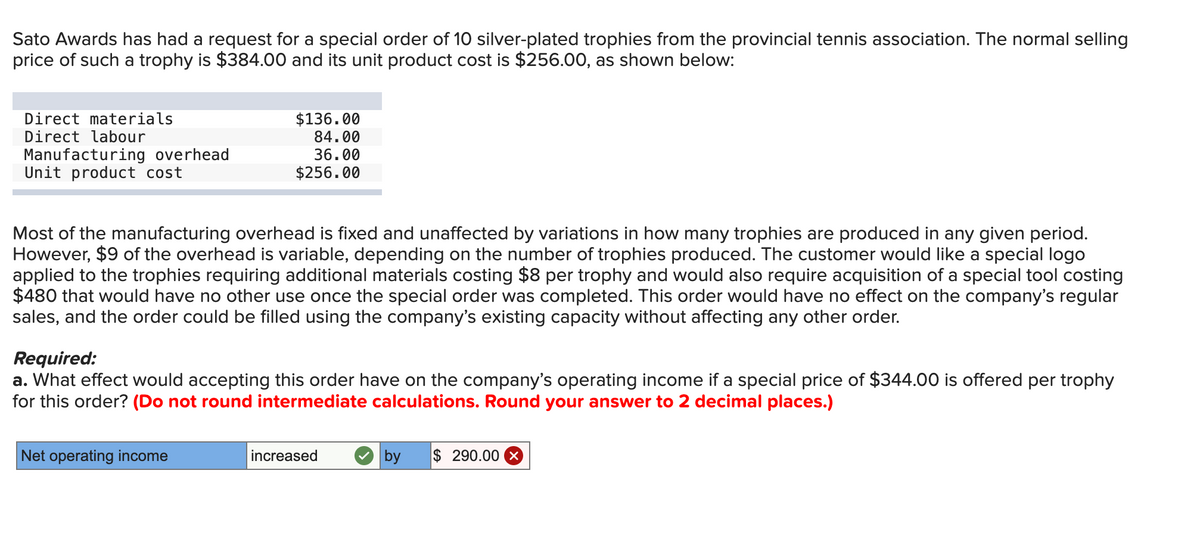

Sato Awards has had a request for a special order of 10 silver-plated trophies from the provincial tennis association. The normal selling price of such a trophy is $384.00 and its unit product cost is $256.00, as shown below: Direct materials Direct labour Manufacturing overhead Unit product cost $136.00 84.00 36.00 $256.00 Most of the manufacturing overhead is fixed and unaffected by variations in how many trophies are produced in any given period. However, $9 of the overhead is variable, depending on the number of trophies produced. The customer would like a special logo applied to the trophies requiring additional materials costing $8 per trophy and would also require acquisition of a special tool costing $480 that would have no other use once the special order was completed. This order would have no effect on the company's regular sales, and the order could be filled using the company's existing capacity without affecting any other order. Required: a. What effect would accepting this order have on the company's operating income if a special price of $344.00 is offered per trophy for this order? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Net operating income increased by $ 290.00 ×

Sato Awards has had a request for a special order of 10 silver-plated trophies from the provincial tennis association. The normal selling price of such a trophy is $384.00 and its unit product cost is $256.00, as shown below: Direct materials Direct labour Manufacturing overhead Unit product cost $136.00 84.00 36.00 $256.00 Most of the manufacturing overhead is fixed and unaffected by variations in how many trophies are produced in any given period. However, $9 of the overhead is variable, depending on the number of trophies produced. The customer would like a special logo applied to the trophies requiring additional materials costing $8 per trophy and would also require acquisition of a special tool costing $480 that would have no other use once the special order was completed. This order would have no effect on the company's regular sales, and the order could be filled using the company's existing capacity without affecting any other order. Required: a. What effect would accepting this order have on the company's operating income if a special price of $344.00 is offered per trophy for this order? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Net operating income increased by $ 290.00 ×

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter2: Accounting For Materials

Section: Chapter Questions

Problem 15P: One of the tennis rackets that Ace Sporting Goods manufactures is a titanium model (Slam) that sells...

Related questions

Question

Transcribed Image Text:Sato Awards has had a request for a special order of 10 silver-plated trophies from the provincial tennis association. The normal selling

price of such a trophy is $384.00 and its unit product cost is $256.00, as shown below:

Direct materials

Direct labour

Manufacturing overhead

Unit product cost

$136.00

84.00

36.00

$256.00

Most of the manufacturing overhead is fixed and unaffected by variations in how many trophies are produced in any given period.

However, $9 of the overhead is variable, depending on the number of trophies produced. The customer would like a special logo

applied to the trophies requiring additional materials costing $8 per trophy and would also require acquisition of a special tool costing

$480 that would have no other use once the special order was completed. This order would have no effect on the company's regular

sales, and the order could be filled using the company's existing capacity without affecting any other order.

Required:

a. What effect would accepting this order have on the company's operating income if a special price of $344.00 is offered per trophy

for this order? (Do not round intermediate calculations. Round your answer to 2 decimal places.)

Net operating income

increased

by $ 290.00 ×

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning