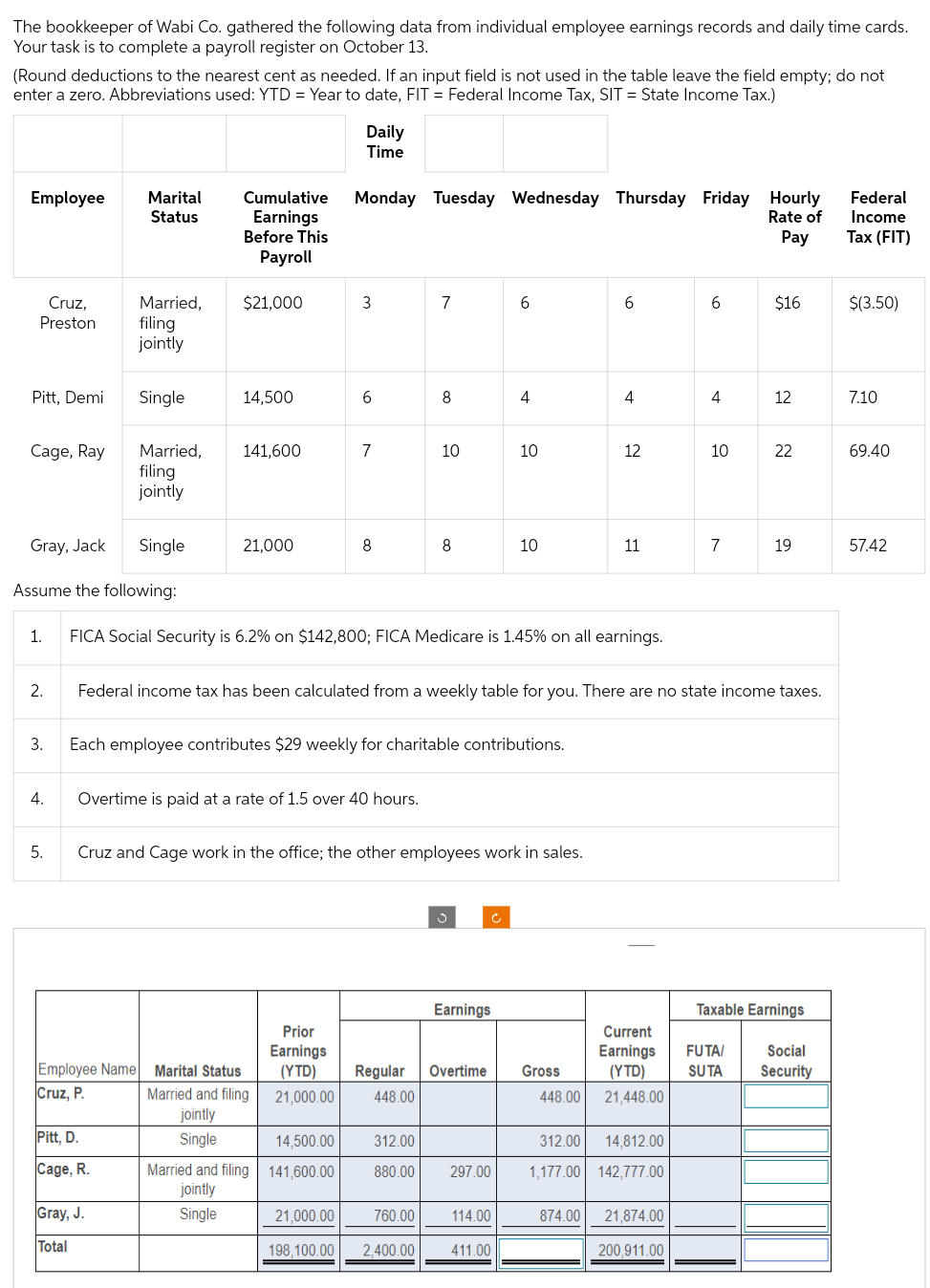

The bookkeeper of Wabi Co. gathered the following data from individual employee earnings records and daily time cards. Your task is to complete a payroll register on October 13. (Round deductions to the nearest cent as needed. If an input field is not used in the table leave the field empty; do not enter a zero. Abbreviations used: YTD=Year to date, FIT = Federal Income Tax, SIT = State Income Tax.) Daily

The bookkeeper of Wabi Co. gathered the following data from individual employee earnings records and daily time cards. Your task is to complete a payroll register on October 13. (Round deductions to the nearest cent as needed. If an input field is not used in the table leave the field empty; do not enter a zero. Abbreviations used: YTD=Year to date, FIT = Federal Income Tax, SIT = State Income Tax.) Daily

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter7: Employee Earnings And Deductions

Section: Chapter Questions

Problem 3PA

Related questions

Question

Aa 130.

Transcribed Image Text:The bookkeeper of Wabi Co. gathered the following data from individual employee earnings records and daily time cards.

Your task is to complete a payroll register on October 13.

(Round deductions to the nearest cent as needed. If an input field is not used in the table leave the field empty; do not

enter a zero. Abbreviations used: YTD = Year to date, FIT = Federal Income Tax, SIT = State Income Tax.)

Employee

Cruz,

Preston

Pitt, Demi

Cage, Ray

1.

2.

3.

4.

5.

Marital

Status

Married,

filing

jointly

Single

Married,

filing

jointly

Pitt, D.

Cage, R.

Single

Gray, J.

Total

Cumulative Monday Tuesday Wednesday Thursday Friday Hourly

Earnings

Rate of

Pay

Before This

Payroll

$21,000

14,500

141,600

21,000

Daily

Time

3

Employee Name Marital Status

Cruz, P.

Married and filing

jointly

Single

6

Gray, Jack

Assume the following:

FICA Social Security is 6.2% on $142,800; FICA Medicare is 1.45% on all earnings.

7

Overtime is paid at a rate of 1.5 over 40 hours.

Prior

Earnings

(YTD)

21,000.00

8

7

8

10

Each employee contributes $29 weekly for charitable contributions.

8

21,000.00

198,100.00 2,400.00

760.00

Cruz and Cage work in the office; the other employees work in sales.

6

Ć

4

Earnings

14,500.00

312.00

Married and filing 141,600.00 880.00 297.00

jointly

Single

10

10

Regular Overtime Gross

448.00

114.00

411.00

Federal income tax has been calculated from a weekly table for you. There are no state income taxes.

6

4

448.00

12

11

Current

Earnings

(YTD)

21,448.00

312.00 14,812.00

1,177.00 142,777.00

6

874.00 21,874.00

200,911.00

4

10

7

$16

12

FUTA/

SUTA

22

19

Taxable Earnings

Social

Security

Federal

Income

Tax (FIT)

$(3.50)

7.10

69.40

57.42

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning