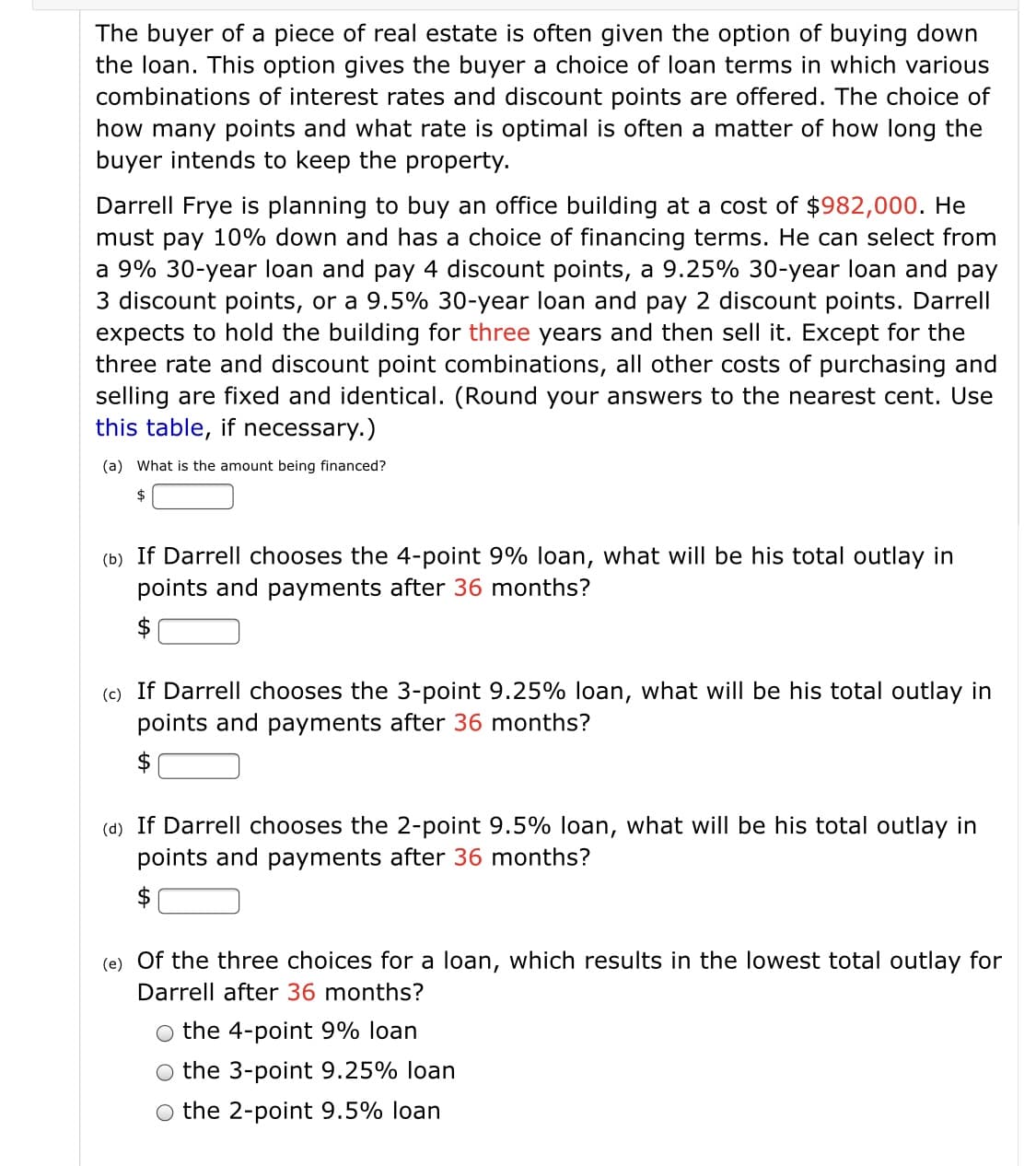

The buyer of a piece of real estate is often given the option of buying down the loan. This option gives the buyer a choice of loan terms in which various combinations of interest rates and discount points are offered. The choice of how many points and what rate is optimal is often a matter of how long the buyer intends to keep the property. Darrell Frye is planning to buy an office building at a cost of $982,000. He must pay 10% down and has a choice of financing terms. He can select from a 9% 30-year loan and pay 4 discount points, a 9.25% 30-year loan and pay 3 discount points, or a 9.5% 30-year loan and pay 2 discount points. Darrell expects to hold the building for three years and then sell it. Except for the three rate and discount point combinations, all other costs of purchasing and selling are fixed and identical. (Round your answers to the nearest cent. Use

The buyer of a piece of real estate is often given the option of buying down the loan. This option gives the buyer a choice of loan terms in which various combinations of interest rates and discount points are offered. The choice of how many points and what rate is optimal is often a matter of how long the buyer intends to keep the property. Darrell Frye is planning to buy an office building at a cost of $982,000. He must pay 10% down and has a choice of financing terms. He can select from a 9% 30-year loan and pay 4 discount points, a 9.25% 30-year loan and pay 3 discount points, or a 9.5% 30-year loan and pay 2 discount points. Darrell expects to hold the building for three years and then sell it. Except for the three rate and discount point combinations, all other costs of purchasing and selling are fixed and identical. (Round your answers to the nearest cent. Use

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter5: Business Deductions

Section: Chapter Questions

Problem 45P

Related questions

Question

Transcribed Image Text:The buyer of a piece of real estate is often given the option of buying down

the loan. This option gives the buyer a choice of loan terms in which various

combinations of interest rates and discount points are offered. The choice of

how many points and what rate is optimal is often a matter of how long the

buyer intends to keep the property.

Darrell Frye is planning to buy an office building at a cost of $982,000. He

must pay 10% down and has a choice of financing terms. He can select from

a 9% 30-year loan and pay 4 discount points, a 9.25% 30-year loan and pay

3 discount points, or a 9.5% 30-year loan and pay 2 discount points. Darrell

expects to hold the building for three years and then sell it. Except for the

three rate and discount point combinations, all other costs of purchasing and

selling are fixed and identical. (Round your answers to the nearest cent. Use

this table, if necessary.)

(a) What is the amount being financed?

2$

(b) If Darrell chooses the 4-point 9% loan, what will be his total outlay in

points and payments after 36 months?

$

(c) If Darrell chooses the 3-point 9.25% loan, what will be his total outlay in

points and payments after 36 months?

2$

(d) If Darrell chooses the 2-point 9.5% loan, what will be his total outlay in

points and payments after 36 months?

$

(e) Of the three choices for a loan, which results in the lowest total outlay for

Darrell after 36 months?

the 4-point 9% loan

O the 3-point 9.25% loan

the 2-point 9.5% loan

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning