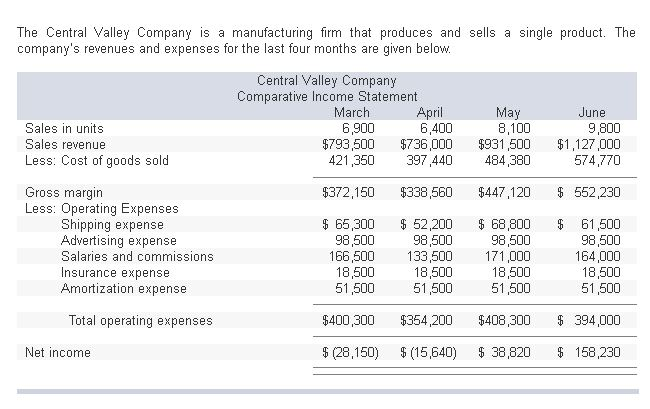

The Central Valley Company is a manufacturing firm that produces and sells a single product. The company's revenues and expenses for the last four months are given below. Sales in units Sales revenue Less: Cost of goods sold Gross margin Less: Operating Expenses Shipping expense Advertising expense Salaries and commissions Insurance expense Amortization expense Total operating expenses Net income Central Valley Company Comparative Income Statement March 6,900 April 6,400 $793,500 $736,000 421,350 397,440 $372,150 $338,560 $ 65,300 $ 52,200 98,500 98,500 166,500 133,500 18,500 18,500 51,500 51,500 $400,300 $354,200 $ (28,150) May 8,100 $931,500 484,380 $447,120 $ 68,800 98,500 171,000 18,500 51,500 $408,300 $ (15,640) $ 38,820 June 9,800 $1,127,000 574,770 $ 552,230 $ 61,500 98,500 164,000 18,500 51,500 $ 394,000 $ 158,230

The Central Valley Company is a manufacturing firm that produces and sells a single product. The company's revenues and expenses for the last four months are given below. Sales in units Sales revenue Less: Cost of goods sold Gross margin Less: Operating Expenses Shipping expense Advertising expense Salaries and commissions Insurance expense Amortization expense Total operating expenses Net income Central Valley Company Comparative Income Statement March 6,900 April 6,400 $793,500 $736,000 421,350 397,440 $372,150 $338,560 $ 65,300 $ 52,200 98,500 98,500 166,500 133,500 18,500 18,500 51,500 51,500 $400,300 $354,200 $ (28,150) May 8,100 $931,500 484,380 $447,120 $ 68,800 98,500 171,000 18,500 51,500 $408,300 $ (15,640) $ 38,820 June 9,800 $1,127,000 574,770 $ 552,230 $ 61,500 98,500 164,000 18,500 51,500 $ 394,000 $ 158,230

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter21: Variable Costing For Management

analysis

Section: Chapter Questions

Problem 4PB: Salespersons report and analysis Pachec Inc. employs seven salespersons to sell and distribute its...

Related questions

Question

100%

Please do not give solution in image format thanku

Transcribed Image Text:The Central Valley Company is a manufacturing firm that produces and sells a single product. The

company's revenues and expenses for the last four months are given below.

Sales in units

Sales revenue

Less: Cost of goods sold

Gross margin

Less: Operating Expenses

Shipping expense

Advertising expense

Salaries and commissions.

Insurance expense

Amortization expense

Total operating expenses

Net income

Central Valley Company

Comparative Income Statement

March

April

6,900

$793,500 $736,000

421,350

397,440

$372,150

$338,560

$ 65,300

$ 52,200

98,500

98,500

166,500

133,500

18,500

18,500

51,500

51,500

$400,300

$354,200

$ (28,150) $ (15,640)

6,400

May

8,100

$931,500

484,380

$447,120

$ 68,800

98,500

171,000

June

9,800

$1,127,000

574,770

$ 552,230

$ 61,500

98,500

164,000

18,500

18,500

51,500

51,500

$408,300 $ 394,000

$ 38,820 $ 158,230

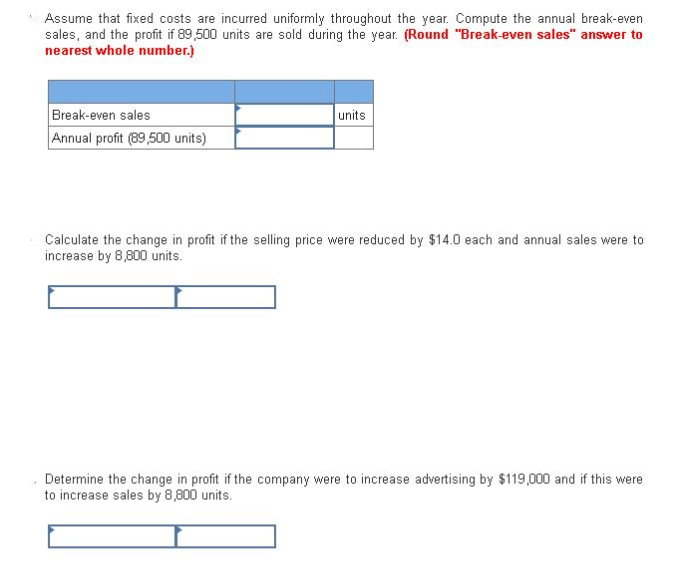

Transcribed Image Text:Assume that fixed costs are incurred uniformly throughout the year. Compute the annual break-even

sales, and the profit if 89,500 units are sold during the year. (Round "Break-even sales" answer to

nearest whole number.)

Break-even sales

Annual profit (89,500 units)

units

Calculate the change in profit if the selling price were reduced by $14.0 each and annual sales were to

increase by 8,800 units.

Determine the change in profit if the company were to increase advertising by $119,000 and if this were

to increase sales by 8,800 units.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning