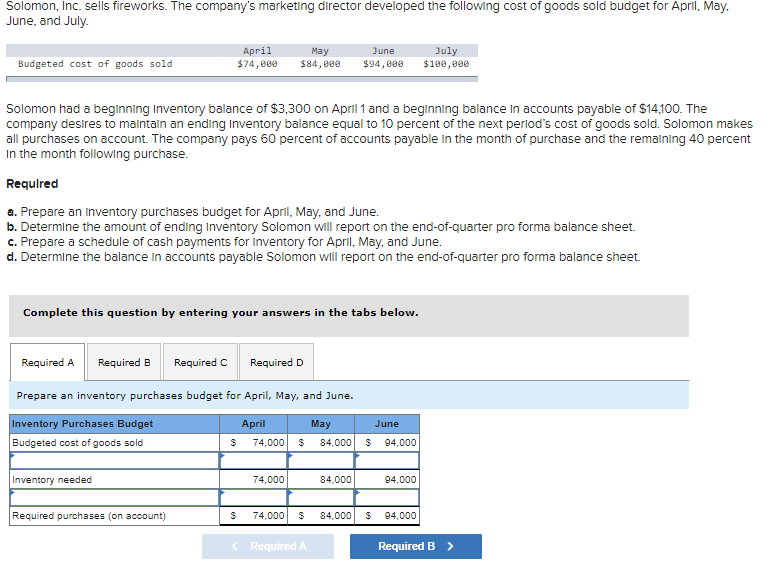

Solomon, Inc. sells fireworks. The company's marketing director developed the following cost of goods sold budget for April, May, June, and July. Budgeted cost of goods sold April $74,000 Solomon had a beginning Inventory balance of $3,300 on April 1 and a beginning balance in accounts payable of $14,100. The company desires to maintain an ending Inventory balance equal to 10 percent of the next period's cost of goods sold. Solomon makes all purchases on account. The company pays 60 percent of accounts payable in the month of purchase and the remaining 40 percent In the month following purchase. Required a. Prepare an Inventory purchases budget for April, May, and June. b. Determine the amount of ending Inventory Solomon will report on the end-of-quarter pro forma balance sheet. c. Prepare a schedule of cash payments for Inventory for April, May, and June. d. Determine the balance in accounts payable Solomon will report on the end-of-quarter pro forma balance sheet. Complete this question by entering your answers in the tabs below. Inventory needed Required A Required B Required C Prepare an inventory purchases budget for April, May, and June. Inventory Purchases Budget April Budgeted cost of goods sold Required purchases (on account) June May $84,800 $94,000 $ $ Required D 74,000 $ 74,000 May June 84,000 $ 94,000 84,000 July $100,000 94,000 74,000 $ 84,000 $ 94,000

Solomon, Inc. sells fireworks. The company's marketing director developed the following cost of goods sold budget for April, May, June, and July. Budgeted cost of goods sold April $74,000 Solomon had a beginning Inventory balance of $3,300 on April 1 and a beginning balance in accounts payable of $14,100. The company desires to maintain an ending Inventory balance equal to 10 percent of the next period's cost of goods sold. Solomon makes all purchases on account. The company pays 60 percent of accounts payable in the month of purchase and the remaining 40 percent In the month following purchase. Required a. Prepare an Inventory purchases budget for April, May, and June. b. Determine the amount of ending Inventory Solomon will report on the end-of-quarter pro forma balance sheet. c. Prepare a schedule of cash payments for Inventory for April, May, and June. d. Determine the balance in accounts payable Solomon will report on the end-of-quarter pro forma balance sheet. Complete this question by entering your answers in the tabs below. Inventory needed Required A Required B Required C Prepare an inventory purchases budget for April, May, and June. Inventory Purchases Budget April Budgeted cost of goods sold Required purchases (on account) June May $84,800 $94,000 $ $ Required D 74,000 $ 74,000 May June 84,000 $ 94,000 84,000 July $100,000 94,000 74,000 $ 84,000 $ 94,000

Chapter4: Financial Planning And Forecasting

Section: Chapter Questions

Problem 5P

Related questions

Question

Please answer all subparts because i cant post last sunlart separately because it is interlinked thanku

Transcribed Image Text:Solomon, Inc. sells fireworks. The company's marketing director developed the following cost of goods sold budget for April, May,

June, and July.

Budgeted cost of goods sold

Solomon had a beginning Inventory balance of $3,300 on April 1 and a beginning balance in accounts payable of $14,100. The

company desires to maintain an ending Inventory balance equal to 10 percent of the next period's cost of goods sold. Solomon makes

all purchases on account. The company pays 60 percent of accounts payable in the month of purchase and the remaining 40 percent

In the month following purchase.

Required

a. Prepare an Inventory purchases budget for April, May, and June.

b. Determine the amount of ending Inventory Solomon will report on the end-of-quarter pro forma balance sheet.

c. Prepare a schedule of cash payments for inventory for April, May, and June.

d. Determine the balance in accounts payable Solomon will report on the end-of-quarter pro forma balance sheet.

Complete this question by entering your answers in the tabs below.

Required A Required B Required C

April

May

June

$74,000 $84,000 $94,000

Inventory needed

Prepare an inventory purchases budget for April, May, and June.

Inventory Purchases Budget

April

May

Budgeted cost of goods sold

74,000 $ 84.000 $ 94,000

Required purchases (on account)

Required D

$

74,000

84,000

$ 74,000 $ 84,000

< Required A

June

94,000

July

$100,000

$ 94,000

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning