Q: What are the differences between a money market and a capital market?

A: Two main sources of finance are: Internal sources External sources. Company requires funds for…

Q: The purpose of a negative pledge on the borrower's assets in an unsecured bank loan agreement is to

A: Negative pledge is included in contracts to prevent the borrower from using their assets to obtain…

Q: s ago, Thomasian Engineer TE had P5,000,000.00 in his UST Security Bank (USTSB) Account. Last month,…

A: Future value of the amount includes the amount being deposited and the amount of interest being…

Q: Construct a differential equation for the changing mortgage balance. (Equation Must include r, A, P,…

A: We have to find the differential equation for the changing mortgage balance. All the relevant…

Q: inflation method of finding pv?

A: Solution:- When some amount of money is invested in real estate, the price of real estate either…

Q: You are trying to decide how much to save for retirement. Assume you plan tpo save $4.000 per year…

A: Here, To Find: Part A. No. of years required to exhaust the savings =? Part B. Rate of return need…

Q: A debt of P22,000.00 with 12% interest compounded semi-annually is to be amortized by semi-annual…

A: A debt is an obligation where a sum is borrowed by a party and has to be repaid along with interest…

Q: The New Fund had average daily assets of $2.2 billion in the past year. New Fund's expense ratio was…

A: The expense ratio of a fund is used to measure how much its assets are used for administrative and…

Q: A house costs $148,000. It is to be paid off in exactly ten years, with monthly payments of…

A:

Q: A bank offers an account with an APR of 5.8% and an EAR of 5.88%. How does the bank compound…

A: APR is the annual percentage rate. It refers to the quoted rate or the nominal rate. EAR is the…

Q: On October 31, 2019, Strongman Samson borrowed P100,000.00 from Pretty Delilah subject to an…

A: The FV of an asset refers to its value at a predetermined point in the future and an assumed rate of…

Q: A) Inflation rate; B) Interest rate; C) Not doing something; 2. People prefer to receive cash: A)…

A: (Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the…

Q: Cristina borrowed P50,000.00 from Social Security System in the form of calamity loan, with interest…

A: When a loan is taken by a person then the institution or the entity that gives the loan amortizes…

Q: Ramoncito deposited P15,000.00 today and he deposited the same equal amount each month for the next…

A: Future value of annuity due Annuity is a series of equal payments at equal interval for a specified…

Q: Mr. Cruz borrowed P50,000.00 with interest at the rate of 15% payable ar The debt will be paid,…

A: Loans are paid by the equal amount of installments that carry the payment of interest and payment of…

Q: You are using the CAPM to calculate a fair return for Stardust common stock. The shares have a…

A: Capital Asset Pricing Model helps in determining the fair value of the stock considering its…

Q: Which of the following BEST explains the difference between a corporation and an LLC? a) LLCs…

A: Corporation A corporation is a type of business that has its own identity and signature. Companies…

Q: a. The break-even point for operating expenses before and after expansion (in sales dollars). Note:…

A: Since you have posted a question with multiple sub-parts, we will solve first three subparts for…

Q: Mr. Padilla agrees to pay P1,300.00 at the end of each month for 20 years, in purchasing a house.…

A: The PV of an asset refers to the value of all its future cash flows discounted at an assumed rate of…

Q: 3. Carole is paid a monthly salary of $2011.10. Her regular workweek is 35 hours. (a) What is…

A: The hourly rate of pay refers to the salary that an individual receives for every extra hour they…

Q: What is the payback period at /= 0% per year? At / = 12% per year? (Note: Round your answers to the…

A: Payback period The time taken for a project to recover the initial capital that is invested is known…

Q: To secure the future of his son, a man plan to deposit P50,000 in a bank account every quarter for 5…

A: Future value of annuity means that deposits are made at the beginning of the period and one period…

Q: Find the periodic withdrawals PMT for the given annuity account. (Assume end-of-period withdrawals…

A: Present Value $ 3,00,000.00 Interest Rate 4% Compounded Monthly Time Period 15 Years

Q: Tem S. Your company is AA-rated by a credit-rating agency, and must borrow money according to the…

A: Projects should be accepted when expected return is greater than interest on money borrowed In the…

Q: Ted is an investor and has purchased an IIP for the original price of $984.31767830979. For your…

A:

Q: Consider the following table, which gives a security analyst’s expected return on two stocks and the…

A: Data given: Scenario Probability Market Return Aggressive Stock Defensive Stock 1 0.5 8% 3.50%…

Q: A computer with software costs $2,918, and Catherine Stevens has agreed to pay a 17% per year…

A: Solution:- When an amount is borrowed, it can either be repaid as a lump sum payment or in…

Q: Which of the following statements is true or false if the pecking order theory is correct ?

A: Pecking Order Theory: Also known as the pecking order model, and states that managers will prefer…

Q: Over the next year, there is a 75% chance of the market being in state 1, otherwise it is in state…

A: To Find: Expected return over the next year

Q: How much must be deposited today into an account earning 3% interest annually to support annual…

A: Interest Rate = 3% Annual Withdrawal = $1,550

Q: Two months ago, Thomasian Engineer TEH P5,000,000.00 in his UST Security Bank (UST Account. Last…

A: Future value of the amount depends on the amount deposited and amount of compounding interest being…

Q: Andrew deposits $1102.32 each quarter into an annuity account for his child's college fund in order…

A: Amount Deposited = Deposit amount per quarter * 4 quarters * Number of years =1,102.32 * 4 quarters…

Q: Which of the following statements is false? A. Internal controls are the processes by which…

A: In the above question the statement that is false is that Footnotes allow investors or any users to…

Q: Assuming there is no compound interest, let's say you pay $4,000 for a perpetual bond from…

A: The bonds carry the coupon and based on the coupon and face value of bond there are going to be…

Q: Luke, Ashley, Casandra, Daisy, Rylie, Lucas and Ryan are helping their fellow classmate Jose search…

A: Data given: Cost of New Honda Accord = $36,250 Purchase Incentive discount =$500 College Student…

Q: ENGINEERING ECONOMY UPVOTE WILL BE GIVEN. PLEASE WRITE THE COMPLETE SOLUTIONS LEGIBLE. FOLLOW THE…

A: Due to compounding of interest the amount being accumulated over the period of time is much more…

Q: To secure the future of his son, a man plan to deposit P50,000 in a bank account every quarter for 5…

A: Effective interest rate There is different frequency of deposited amount and the compounding of…

Q: Net cost of investment is 100,000. Profitability index is 1.3 while cost of capital is 10%. Useful…

A: The profitability index is a measure that is used to evaluate the profitability of investment. It…

Q: Please calulate the Clean Bank's maturity gap.What does the maturity gap imply about the interest…

A: Maturity Gap is the difference between the interest sensitive assets and liabilities with respect to…

Q: Miami Book Publishers (MBP) just reported earnings of $20 million, and it plans to retain 35 percent…

A: To calculate the growth rate we will use the below formula Growth rate = ROE*Retention ratio Where…

Q: If you put up $41,000 today in exchange for a 6.75 percent, 14-year annuity, what will the annual…

A: Information Provided: Present value = $41,000 Annuity period = 14 years Interest rate = 6.75%

Q: offer 30-year mortgage that requires annual payments and has an interest rate of 5% per year. What…

A: Mortgage amount are paid by monthly payment or annual payment these are fixed periodic instalments…

Q: A security that increases in price from $50 to $100 during year 1 and drops back to $50 during year…

A: To Find: HPR HPY Arithmaetic return Geometric return

Q: What is the accumulated value at the end of 10 years if Php 100 is invested at a rate of 12% per…

A: Here, Present value (PV) = P100 Interest rate (RATE) = 12% Time period (NPER) = 10 years To Find:…

Q: Profitability ratios help in the analysis of the combined impact of liquidity ratios, asset…

A: A group of financial measurements known as profitability ratios are employed to evaluate a company's…

Q: Your parents are considering a $75,000,30-year mortgage to purchase a new home. The bank at which…

A: To find out which option is best, Lets calculate monthly payment of each option and total amount…

Q: The first plan is to protect the reefs of Jaxaland by means of a marine park. The marine park…

A: As per our guidelines, we are supposed to answer only 3 sub-parts (if there are multiple sub-parts…

Q: Explain in a few sentences how discounting works. Illustrate how it works using an interest rate of…

A: Discounting is the conversion of a value received in the future into an equivalent value received in…

Q: Solve as soon as possible.

A: The concept of the time value of money states that money has an interest-earning capacity because of…

Q: .43% nominal yearly, compounded weekly, how much does this generator cost fam to purchase when…

A: Discount rate is interest rate on the amount and is the value of tomorrow money to be received now.…

Step by step

Solved in 4 steps

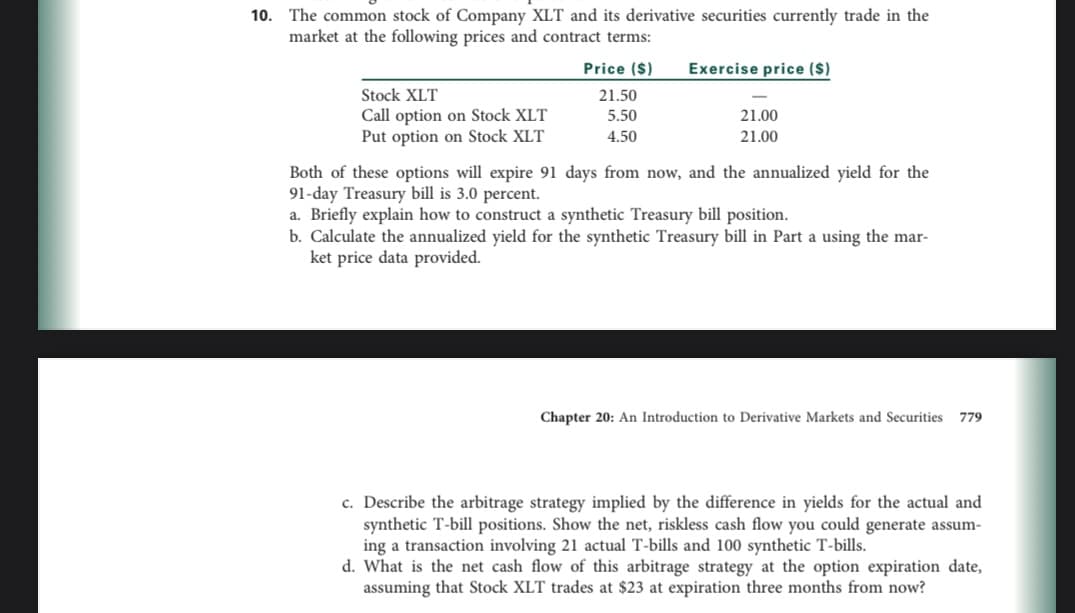

- The common stock of Company XLT and its derivative securities currently trade in the market at the following prices and contract terms: Price ($) Exercise Price ($) Stock XLT $ 21.50 $ - Call Option on Stock XLT $ 5.50 $ 21.00 Put Option on Stock XLT $ 4.50 $ 21.00 Both of these options will expire 91 days from now, and the annualized yield for the 91-day Treasury bill is 3.0 percent. a. Briefly explain how to construct a synthetic Treasury bill position. b. Calculate the annualized yield for the synthetic Treasury bill in part (a) using the market price data provided. c. Describe the arbitrage strategy implied by the difference in yields for the actual and synthetic T-bill positions. Show the net, riskless cash flow you could generate assuming a transaction involving 21 actual T-bills and 100 synthetic T-bills. d. What is the net cash flow of this arbitrage strategy at the option…The current value of BSE SENSEX is 10000 and the annualized dividend yield on the index is 5%. A six-month-futures contract on the BSE SENSEX is quoted at 10200. If the return on Treasury Bills available in the market for the same maturity is 5% and 25 % of the stocks included in the index will pay dividends during the next six months, you are required to a. Determine whether index futures is overpriced or under priced. b. Show risk-free arbitrage profits, if any, available to the investor irrespective of the value of the SENSEX on maturity with detail workings, assuming that the SENSEX on maturity can be i. 9900 orii. 10250 Solve fast pleaseYou enter into a 1-year futures contract on a non-dividend paying stock when the stock price is $100 and the risk-free interest rate is 5% per annum. Six months later the stock price has fallen to $90, and the interest rate is 4% per annum. Which of the answers below is closest to the change in the futures price? Assume discrete compounding and discounting. Question 6Answer a. -12.34 b. -11.40 c. -10.00 d. -13.20

- The stock index future contract involves buying and selling the stock index for a specified price at a specified date. How much will a contract price be if it involves the S&P SmallCap index with a current value of P200 times the index for 1700 points?* a. P340,000 b. P314,000 c. P8,500 d. P342,000The ASX200 index is currently sitting at 6458. The risk-free interest rate is 2% per annum. Exactly three months remain before the Nov-19 SPI200 futures contract expires. The SPI200 is quoted at 6410. This futures price implies that the dividend yield on the ASX200 market index is: The futures price tells us nothing about the dividend yield 2.00% 4.98% 2.48% 0.98%Assume that the current yield on one-year securities is 7 percent, and that the yield on a two-year security is 8 percent. If the liquidity premium on a two-year security is 0.6 percent, then the one-year forward rate is approximately: Group of answer choices 8.6 percent. 7.4 percent. 8.4 percent. 7.6 percent.

- Nanno Company offers its investors option contracts to buy their shares at a price of P50. Currently, the value of their stocks in the market stands at P60. The 52-week high of the share price is P83 and its 52-week low is P47. The treasury bill issued by the government yields 8.25% currently. REQUIRED: What’s the probability for the up move? What’s the probability for the down move? How much is the total option pay off for the stock? What should be the reasonable price of the option contracts of the company?The current price of a stock paying no income is 30. Assume the annually compounded zero rate will be 3% for the next 2 years. (a) Find the current value of a forward contract on the stock if the delivery price is 25 and maturity is in 2 years. (b) If the stock has price 35 at maturity, find the value of the forward from part (a) to the long counterparty at maturitySuppose a 10-year, $1,000 bond with a 10% coupon rate and semiannual coupons is trading for a price of $957.81. a. What is the bond's yield to maturity (expressed as an APR with semiannual compounding)? b. If the bond's yield to maturity changes to 8% APR, what will the bond's price be? a. What is the bond's yield to maturity (expressed as an APR with semiannual compounding)? The YTM is _____________(Round to two decimal places.) b. If the bond's yield to maturity changes to 8% APR, what will the bond's price be? The price is $______________ (Round to the nearest cent.)

- On 1 July 2023, Molly Ltd holds a well-diversified portfolio of shares that is valued at $1.55 million. On this date it enters into 60 futures contracts on All Ordinaries Share Price Index futures in which it takes a sell position. The All Ordinaries Index on 1 July 2023 is 2500 with $10 per index point. So the total price of the futures contract is calculated as 2500 × 60 × $10 contracts = $1,500,000. A total deposit of $100,000 is paid on the futures contracts. On 29 July 2023 Molly Ltd decides to sell its portfolio of shares and to close out its futures contracts. On this date, the market value of the share portfolio is $1.725 million and the All Ordinaries Index is 2720. Required: Prepare the entries of Molly Ltd for any financial assets or financial liabilities that arise in each case and show your working process.BCD Company offer its investors option contracts to buy their shares at a price of P50. Currently, the value of their stocks in the market stands at P60. The 52-week high of the share price is P83 and its 52-week low is P47. The treasury bill issued by the government yields 8.25% currently. What’s the probability for the up move?There is a futures contract available on a dividend paying stock. The current stock price is $7.25 and a dividend of $2 will be paid after 6 months. The interest rate is 12% per annum (assuming discrete compounding). The fair price of the futures for delivery one year ahead is closest to which of the values below? Question 8Answer a. $5.90 b. $8.12 c. $5.50 d. $10.40