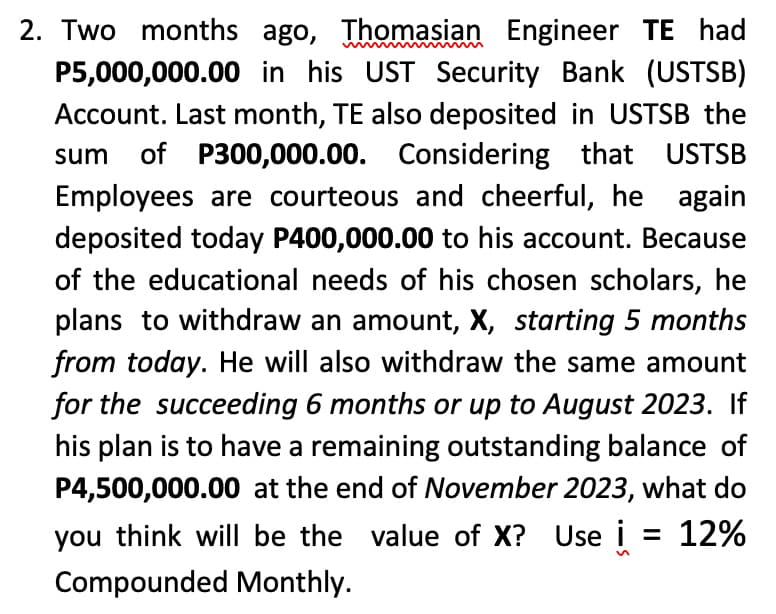

Two months ago, Thomasian Engineer TEH P5,000,000.00 in his UST Security Bank (UST Account. Last month, TE also deposited in USTSB sum of P300,000.00. Considering that UST Employees are courteous and cheerful, he ag deposited today P400,000.00 to his account. Becau of the educational needs of his chosen scholars,

Q: A security analyst has regressed the monthly returns on Exxon Mobil equity shares over the past five…

A: CAPM means capital asset pricing model. By using this model expected return can be calculated.…

Q: To secure the future of his son, a man plan to deposit P50,000 in a bank account every quarter for 5…

A: Effective interest rate There is different frequency of deposited amount and the compounding of…

Q: As debt payment, P315,000 is due in 4 years and 7 months. If the debtor wishes to repay the debt…

A: Future Value is the value which is measured at a specified date at a given interest rate, it can be…

Q: Risk premium is also called A• Risk addictive B• Credit spread C• Debt spread D• Risk spread

A: Risk premium:- Risk premium is the extra return on the risk security when compared to Risk free…

Q: Company DIMOND just paid annual dividend of $5 today. The dividend is expected to grow at 3% for the…

A: Years Dividends 0 5 1 5+5*3%=5.150 2 5.150+5.150*3%=5.305 3 5.305+5.305*3%=5.464 4…

Q: ABC Co. Stock Price XYZ Co. Stock Price ABC Co. Cash XYZ Co. Cash ABC Co. Shares Outstanding XYZ Co.…

A: Given, ABC Co. Stock Price = $26.00 XYZ Co. Stock Price = $10.00 ABC Co. Cash = $2,000,000 XYZ Co.…

Q: Michael bought a laptop and paid P12,000 down payment plus P10,000 at the end of each month for a…

A:

Q: On October 31, 2019, Strongman Samson borrowed P100,000.00 from Pretty Delilah subject to an…

A: The simple rate of interest means the interest amount is determined by the principal amount. The…

Q: an you describe with examples of the advantages and disadvantages of ratio analysis?

A: Ratio Analysis: Ratio analysis is a financial metric used by financial managers for analyzing and…

Q: What would be the payback period if the store's initial investment was 25 million pesos, their…

A: Pay back period one of the method of capital budgeting and this is time required to recover the…

Q: A strong economy leads to Group of answer choices lower productivity higher employment lower…

A: Strong economy means high growth in the economic activity. Economic activity will be improved when…

Q: The three parts of your balance sheet are Group of answer choices assets, liabilities, net worth.…

A: Balance Sheet is a snapshot of financial position of any entity. A balance sheet shows the financial…

Q: LTD company issued ten-year bond two years ago with a coupon interest of 13% paid every six-month,…

A: Given: Particulars Amount Years 10 Years completed 2 Coupon rate 13% Face value (FV)…

Q: A put option on Intel stock with an expiration date of January 20, 2023 has a strike price of $55.…

A: Given, Strike price is $55 Current market price is $53 Option premium is $5

Q: Lever Age pays an 9% rate of interest on $9.70 million of outstanding debt with face value $9.7…

A: Given, Rate of interest = 9%. Outstanding debt = $9.70 million. EBIT = $2.3 million. Depreciation =…

Q: one week (or else). a. If you were brave enough to ask, what APR would Friendly's say you (Do not…

A: The APR is just like nominal interest rate without compounding but effective interest rate is after…

Q: Michelle Walker is interested in buying a five year-zero coupon bond with a face value of $1000. She…

A: Face Value = $1,000 Time Period = 5 Years Interest Rate = 10%

Q: iven a bond with a coupon rate of 10% semi-annual interest, if the YTM is 11%, which statement is…

A: If the Coupon rate of the bond is less than YTM, then Bond is trading at Discount If the Coupon rate…

Q: NAMPAK has issued five-year bonds, with R1000 par value and a coupon interest rate of 12% paid…

A: Present Value of the bond is the sum of all Interest payments and principal repayment discounted at…

Q: A firm is considering renting a trailer at $300/mo. The unit is needed for 5 yr. The leasing company…

A:

Q: Emilia and Liam are purchasing a home. They wish to save money for 12 years and purchase a house…

A: Data given: Price of house= $190000 N=12 years r=4% compounded monthly Monthly rate…

Q: . What are the expected rate of return and standard deviation of the portfolio? (Do not round…

A: A portfolio is a collection of different type of investments or financial assets or financial…

Q: LTD company issued ten-year bond two years ago with a coupon interest of 13% paid every six-month,…

A: To calculate the price of bond we will use the below formula Price of bond =…

Q: A city engineer has estimated the annual toll revenues from a newly proposed highway construction…

A: The PV analysis shows the value of a project today. It is calculated by discounting future cash…

Q: What is the present value of $10,000 paid at the end of each of the next 68 years if the interest…

A: Present value of ordinary annuity may be calculated though following formula Present Value =…

Q: Explain economic exchanges that take place among producers, consumers, and resource owner

A: Economic Exchange - It refers to the change of resources from one hand to another hand, say for…

Q: Which of the statement is incorrect? i) Eurobond is a bond issued by an international investor and…

A: Eurobond is a bond that is issued and traded outside the host country, where the currency of the…

Q: This theory assumes that the driver of interest rates are the savings and investment flows. A•…

A: Market Theory states that exchange of goods and services takes place based on the price determined…

Q: The owner of a company plans to expand his firm 6 years from now so he plans to make quarterly…

A: To Find: Amout to withdraw at the end of year -6

Q: A piece of machinery can be bought for Php 10,000.00 cash, or for Php2,000.00 down and payments of…

A: Cash price or present Value of machinery is Php 10,000 Down payment is Php 2,000 Payments per year…

Q: Bronco Electronics' current assets consist of cash, short-term investments, accounts receivable, and…

A: Current ratio = Current asset / Current liability Current ratio = 3.6 Acid test ratio = (Current…

Q: If your ____, your net worth on the balance sheet would have increased from one period to the next.…

A: Net Worth = Total Assets - Total Liabilities

Q: Theresa invested $5,000 in an account she expects will earn 8% annually. Approximately how many…

A: Time value of money concept says that an amount invested today will have more value in future due to…

Q: Which of the following statements is true or false if the pecking order theory is correct ?

A: Pecking Order Theory: Also known as the pecking order model, and states that managers will prefer…

Q: If instead GBC were to offer investors an effective annual return of 3.3159%, what price should they…

A: Data given: The IIP will pay out $37 at the end of each year for 12 years The IIP will pay out a…

Q: Economics Margaret has a project with a £ 24,000 first cost that returns £ 4,900 per year over its…

A: Annual worth The difference between the costs and benefits a project incurs over its lifetime is…

Q: You are examining three different shares. Share A has expected return 5.20 %, beta 0.47, and…

A: Capital Asset pricing Model helps in determining the fair return of the investment. It determines…

Q: Question 11. Suppose that $14.000 is deposited for six years at 3 % APR. Calculate the interest…

A: Principal $ 14000 Interest = 3% Compounded Quartley

Q: You have just taken out a five-year loan from a bank to buy an engagement ring. The ring costs…

A: correct answer is option a) year 0 year 1 year 2 year 3 year 4 year 5 cash…

Q: In other words, if you borrow $100, you must pay back $117.55 two weeks later. If you can’t pay…

A: Characteristics of a payday loan are known. We have to find the APR and EAR of the loan. We have to…

Q: Which is least likely? A. For the risk-seeking manager, no change in return would be required for…

A: Risk and return both are related to each other and depending upon the nature of managers or…

Q: Your credit card has a balance of $3700 and an annual interest rate of 13%. You decide to pay off…

A: Given: Loan amount $3,700 Interest rate = 13% Years =1

Q: 1. Explain the importance of having an Escrow Checklist?

A: Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: Calculate the average daily balance and finance charge on the statement below. Note: Round your…

A: In Average daily balance method, daily balance in the credit card account is calculated and then is…

Q: plz solve question 2 with explanation. I will givw u multiple upvotes.

A: A fixed-rate loan is one in which the interest rate remains constant during the length of the loan.…

Q: You have invested in two shares, Tinkle.com and Circumbendibus Wheels. Tinkle.com has volatility…

A: To Find: Volatility of portfolio

Q: On July 12, 2019, Veronica borrowed P100,000 and agreed to pay the interest at 7% compounded…

A: A = P(1 + r/n)nt In the formula A = Accrued amount (principal + interest) P = Principal amount =…

Q: -2. The degree of financial leverage for all three methods after expansion. Assume sales of $8.5…

A: Given: Given Sales $7,500,000.00 Variable cost $3,750,000.00 Contribution $3,750,000.00…

Q: How would you find FW with excel functions?

A: MARR is 20% EOY Cash Flow 0 $ -70,000.00 1 $ 20,000.00 2…

Q: The area of finance address the issue of the efficiency of financial market in the allocation of…

A: Financial markets play a very important role in allocation of resources in an economy and also…

Step by step

Solved in 3 steps with 2 images

- PLEASE, PERFORM THE EXERCISE IN EXCEL AND SHOW THE FORMULAS When the world economic crisis began in the fall of 2008, Esteban Arenas decided to secure the future of his little granddaughter and in the spring (March 21), Florcita's fourth birthday (name given to his granddaughter, in honor and memory of Esteban's grandmother) he deposits $400,000.00, in an account that pays 7¼ % interest, capitalizable monthly; with the objective of giving that amount to Ingrid when she turns 21 and can have a big party in Las Vegas. At her father's request, he asked that the amount be delivered at the party that will be held when they are on vacation, on June 30 of the year she turns 21. How much will Florcita receive that day?, The Finance Company reinvests at simple interest when they are not full compounding periods. Note:In the image, this is the original exercise, it is in Spanish, but it is easy to understand. Very important Note:It is necessary that you make a solution approach and then the…Se Ri Pak, age 23, recently graduated with her bachelor’sdegree in library and information sciences. She is aboutto take her fi rst professional position as an archivist with a civil engineering fi rm in a rapidly expanding area in the U.S. Southwest. While in school, Se Ri worked part time,earning about $8000 per year. For the past two years, she has managed to put $1000 each year into an individual retirement account (IRA). Se Ri owes $15,000 in studentloans on which she is obliged now to begin makingpayments. Her new job will pay $45,000. Se Ri may beginparticipating in her employer’s 401(k) retirement planimmediately, and she can contribute up to 6 percent of her salary to the plan. Her employer will contribute 1/2 of 1 percent for every 1 percent that Se Ri contributes. Using time value of money considerations to project what her IRA might be worth at age 63?PLEASE, PERFORM THE EXERCISE IN EXCEL AND SHOW THE FORMULASProblem 4:A father dies on March 20, 2014, and leaves his daughter $100,000 to be given to her on her 21st birthday. The inheritance is deposited in an account earning 6%, compoundable annually. On September 22 of the year the father died, the daughter turned 10; calculate the amount she will receive at the set age. Note:In the image, this is the original exercise, it is in Spanish, but it is easy to understand. Very important Note:It is necessary that you make a solution approach and then the result. Above all, to check the procedure and/or the formulas used, especially when you use excel. TO CONSIDER THE YEAR AS 360 DAYS (WHICH IS COMMERCIAL) (only if required)

- More than 40 million Americans are estimated to have at least one outstanding student loan to help pay college expenses (40 Million Americans Now Have Student Loan Debt, CNNMoney, September 2014). Not all of these graduates pay back their debt in satisfactory fashion. Suppose that the following joint probability table shows the probabilities of student loan status and whether or not the student had received a college degree. a. What is the probability that a student with a student loan had received a college degree? b. What is the probability that a student with a student loan had not received a college degree? c. Given that the student has received a college degree, what is the probability that the student has a delinquent loan? d. Given that the student has not received a college degree, what is the probability that the student has a delinquent loan? e. What is the impact of dropping out of college without a degree for students who have a student loan?The President of the United States makes $400,000 annually. While still in office, the president's family has decided to purchase a home that has an estimated property tax of $50,000 and home insurance of $15,000 annually. Let's assume that the president's family has no loans or debt, and they have saved a 35,000 down payment. What monthly mortgage payment can the president's family afford? Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.1. K, an employee of a growing BPO earns a salary which is just a bit more than what he needs for a comfortable living. He maintains a P10,000 savings account, a P20,000 checking account, a P30,000 money market placement, and a P40,000 trust fund in BDO. Which of the four accounts are deemed insured by the PDIC?a. The P10,000 savings account and the P20,000 checking accountb. The P10,000 savings account and the P30,000 money market placementc. The P30,000 money market placement and the P40,000 trust fundd. The P20,000 checking account and the P40,000 trust fund 2. The corporation claimed that their officers were guilty of advancing their personal interests to the prejudice of the corporation and so upon lawful order of the court it was found that there was probable cause of unlawful activities in money laundering (AMLA).The corporation also submitted in evidence records of the officers‘ U.S. Dollar deposits in several banks in the Philippines. For their part, the officers alleged…

- Hilda received a research grant from the University of Timberland in amounts of $10,000 for her time and $3,000 for related supplies and expenses. She purchased a $28,000 Audi the day after depositing the school’s check. Hilda is a candidate for a PhD in philosophy and ethics. What is her gross income from the grant? Where did you locate your answer? If you located a case, Administrative Interpretation(s) or IRC section, is the authority still valid?On January 1, 2020, Norma Smith and Grant Wood formed a computer sales and service company in Soapsville, Arkansas, by investing $90,000 cash. The new company, Arkansas Sales and Service, has the following transactions during January. 1. Pays $6,000 in advance for 3 months’ rent of office, showroom, and repair space. 2. Purchases 40 personal computers at a cost of $1,500 each, 6 graphics computers at a cost of $2,500 each, and 25 printers at a cost of $300 each, paying cash upon delivery. 3. Sales, repair, and office employees earn $12,600 in salaries and wages during January, of which $3,000 was still payable at the end of January. 4. Sells 30 personal computers at $2,550 each, 4 graphics computers for $3,600 each, and 15 printers for $500 each; $75,000 is received in cash in January, and $23,400 is sold on a deferred payment basis. 5. Other operating expenses of $8,400 are incurred and paid for during January; $2,000 of incurred expenses are payable at January 31.…Your grandfather started his own business 52 years ago. He opened an investment account at the end of his third month of business and contributed $x. Every three months since then, he faithfully saved another $x. His savings account has earned an average rate of 5.73 percent annually. Today, his account is valued at $289.209.11. How much did your grandfather save every three months assuming he saved the same amount each time? Can the calculator and excel solution be provided?

- Se Ri Pak, age 23, recently graduated with her bachelor's degree in library and information sciences. She is about to take her first professional position as an archivist with a civil engineering firm in a rapidly expanding area in the U.S. Southwest. While in school, Se Ri worked part time, earning about $8000 per year. For the past two years, she has managed to put $1000 each year into an individual retirement account (IRA), Se Ri owes $15,000 in student loans on which she is obliged now to begin making payments. Her new job will pay $45,000. Se Ri may begin participating in her employer's 401(k) retirement plan immediately, and she can contribute up to 6 percent of her salary to the plan. Her employer will contribute 1/2 of 1 percent for every 1 percent that Se Ri contributes. What do you recommend to Se Ri on the importance of personal finance regarding: 3. Factoring the current state of the economy into her personal financial planning?You deposited P1,000 in a savings account that pays 8% interest, compounded quarterly, planning to use it to finish your last year in college. Eighteen months later, you decide to go to Quezon City to become a call center agent rather than continue in school, so you close out your account. How much money will you receive?Read the case and analyze. Identify which part of the case refers to the 5C’s of credit. Mr. Cruz is a scholar in one of the charitable organizations in the town. He is in 2nd year college and took up Bachelor of Science in Management. Even though he is receiving P10,000.00 per semester, Mr. Cruz realize that the money from his scholarship is not enough to provide his needs that is why he work as a part time worker in a computer shop as an encoder and earns P4,000.00 a month. During pandemic, Mr. Cruz was not able to earn from his sideline and was informed that his scholarship allowance will be delayed for one month. Mr. Cruz is really dedicated in enrolling; what do you think should Mr. Cruz do?