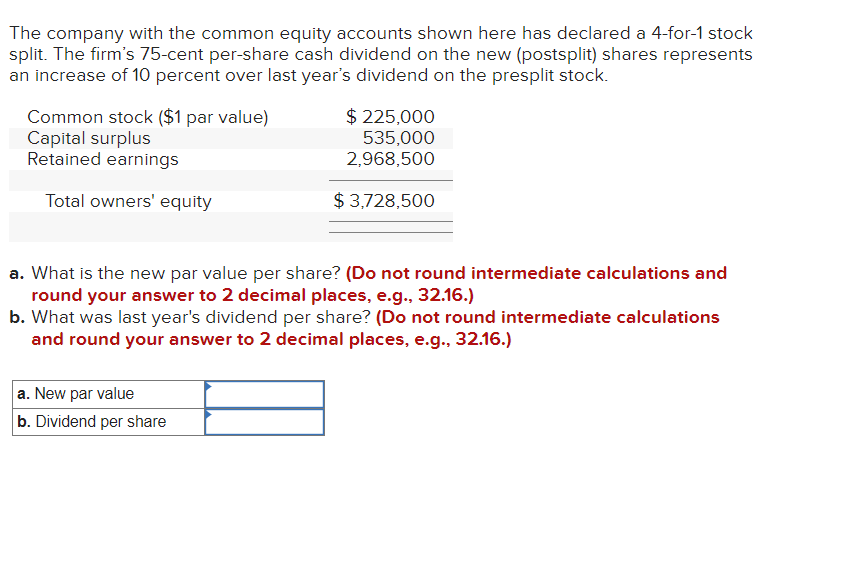

The company with the common equity accounts shown here has declared a 4-for-1 stock split. The firm's 75-cent per-share cash dividend on the new (postsplit) shares represents an increase of 10 percent over last year's dividend on the presplit stock. Common stock ($1 par value) Capital surplus Retained earnings Total owners' equity $ 225,000 535,000 2,968,500 $3,728,500 a. What is the new par value per share? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What was last year's dividend per share? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. New par value b. Dividend per share

The company with the common equity accounts shown here has declared a 4-for-1 stock split. The firm's 75-cent per-share cash dividend on the new (postsplit) shares represents an increase of 10 percent over last year's dividend on the presplit stock. Common stock ($1 par value) Capital surplus Retained earnings Total owners' equity $ 225,000 535,000 2,968,500 $3,728,500 a. What is the new par value per share? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What was last year's dividend per share? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. New par value b. Dividend per share

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 55E: Rebert Inc. showed the following balances for last year: Reberts net income for last year was...

Related questions

Question

100%

Transcribed Image Text:The company with the common equity accounts shown here has declared a 4-for-1 stock

split. The firm's 75-cent per-share cash dividend on the new (postsplit) shares represents

an increase of 10 percent over last year's dividend on the presplit stock.

Common stock ($1 par value)

Capital surplus

Retained earnings

Total owners' equity

$ 225,000

535,000

2,968,500

$ 3,728,500

a. What is the new par value per share? (Do not round intermediate calculations and

round your answer to 2 decimal places, e.g., 32.16.)

b. What was last year's dividend per share? (Do not round intermediate calculations

and round your answer to 2 decimal places, e.g., 32.16.)

a. New par value

b. Dividend per share

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College