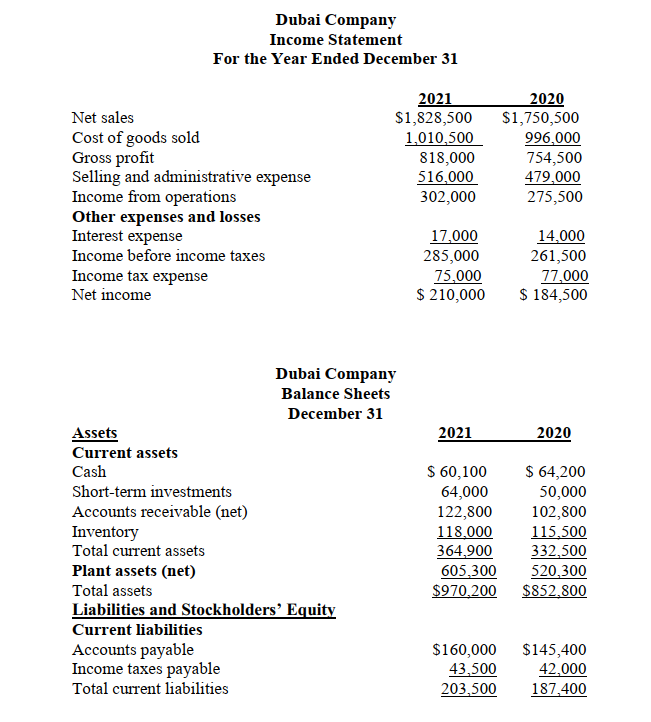

The comparative statements of Dubai Company are presented below. All sales were on account. The allowance for doubtful accounts was $3,200 on December 31, 2017, and $3,000 on December 31, 2020. Required: Compute the following ratios for 2021. (Weighted average common shares in 2021 were 62,500.) C

The comparative statements of Dubai Company are presented below. All sales were on account. The allowance for doubtful accounts was $3,200 on December 31, 2017, and $3,000 on December 31, 2020. Required: Compute the following ratios for 2021. (Weighted average common shares in 2021 were 62,500.) C

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter4: Analysis Of Financial Statements

Section: Chapter Questions

Problem 24P: Income Statement for Year Ended December 31, 2018 (Millions of Dollars) Net sales 795.0 Cost of...

Related questions

Question

The comparative statements of Dubai Company are presented below.

All sales were on account. The allowance for doubtful accounts was $3,200 on December 31, 2017, and $3,000 on December 31, 2020.

Required:

Compute the following ratios for 2021. (Weighted average common shares in 2021 were 62,500.)

- Current.

- Acid-test.

-

Accounts receivable turnover. - Inventory turnover.

Transcribed Image Text:Dubai Company

Income Statement

For the Year Ended December 31

2021

$1,828,500

1,010,500

818,000

516,000

302,000

2020

S1,750,500

996,000

754,500

479,000

275,500

Net sales

Cost of goods sold

Gross profit

Selling and administrative expense

Income from operations

Other expenses and losses

Interest expense

17,000

285,000

75,000

$ 210,000

14,000

261,500

Income before income taxes

Income tax expense

Net income

77,000

$ 184,500

Dubai Company

Balance Sheets

December 31

Assets

Current assets

Cash

2021

2020

$ 60,100

$ 64,200

50,000

102,800

115,500

332,500

520,300

$852,800

Short-term investments

64,000

122,800

118.000

364,900

605.300

$970,200

Accounts receivable (net)

Inventory

Total current assets

Plant assets (net)

Total assets

Liabilities and Stockholders’ Equity

Current liabilities

Accounts payable

Income taxes payable

$160,000

43,500

203,500

$145,400

42,000

187,400

Total current liabilities

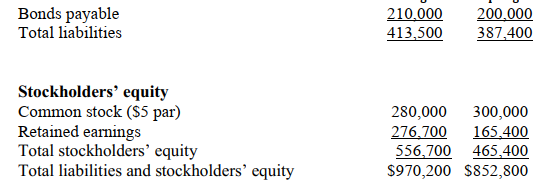

Transcribed Image Text:Bonds payable

Total liabilities

210,000

413,500

200,000

387,400

Stockholders' equity

Common stock (S5 par)

Retained earnings

Total stockholders' equity

Total liabilities and stockholders’ equity

280,000

276,700

556,700 465,400

$970,200 S852,800

300,000

165,400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning