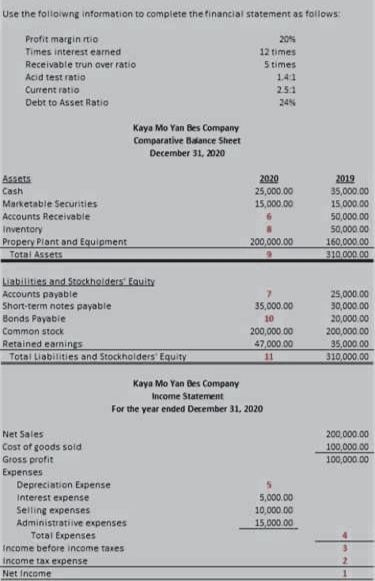

Use the folloiwng information to complete the financial statement as follows Profit margin rtio Times interest earned Receivable trun over ratio 20% 12 times 5times Acid test ratio 141 Current ratio 251 24% Debt to Asset Ratio Kaya Mo Yan Bes Company Comparative Baance Sheet December 31, 2020 2020 25,000.00 15,000.00 Assets 2019 Cash 35,000.00 15,000.00 50,000.00 Marketable Serurities Accounts Receivable Inventory Propery Plant and Equipment Total Assets 50,000.00 200,000.00 160,000.00 310.000 00 Liabilities and Stockholders Equity Accounts payable Short-term notes payable Bonds Payable 25,000.00 30,000.00 20,000.00 200,000.00 35,000 00 310.000 00 35,000.00 10 Common stock Retained earnings Total Liabilities and Stockholders Equity 200,000.00 47,000 00 11 Kaya Mo Yan Bes Company Income Statement For the year ended December 31, 2020 Net Sales 200,000.00 100,000 00 100,000.00 Cost of goods sold Gross profit Expenses Depreciation Expense Interest expense 5,000.00 10,000.00 15,000 00 Selling expenses Administrative expenses Total Expenses Income before income taxes income tax expense Net Income

Use the folloiwng information to complete the financial statement as follows Profit margin rtio Times interest earned Receivable trun over ratio 20% 12 times 5times Acid test ratio 141 Current ratio 251 24% Debt to Asset Ratio Kaya Mo Yan Bes Company Comparative Baance Sheet December 31, 2020 2020 25,000.00 15,000.00 Assets 2019 Cash 35,000.00 15,000.00 50,000.00 Marketable Serurities Accounts Receivable Inventory Propery Plant and Equipment Total Assets 50,000.00 200,000.00 160,000.00 310.000 00 Liabilities and Stockholders Equity Accounts payable Short-term notes payable Bonds Payable 25,000.00 30,000.00 20,000.00 200,000.00 35,000 00 310.000 00 35,000.00 10 Common stock Retained earnings Total Liabilities and Stockholders Equity 200,000.00 47,000 00 11 Kaya Mo Yan Bes Company Income Statement For the year ended December 31, 2020 Net Sales 200,000.00 100,000 00 100,000.00 Cost of goods sold Gross profit Expenses Depreciation Expense Interest expense 5,000.00 10,000.00 15,000 00 Selling expenses Administrative expenses Total Expenses Income before income taxes income tax expense Net Income

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 4PB

Related questions

Question

Please answer the missing element.

Thanks.

Number 1-11.

Transcribed Image Text:Use the folloiwng information to complete the financial statement as follows:

Profit margin rtio

Times interest earned

12 times

Receivable trun over ratio

5 times

Acid test ratio

141

Current ratio

251

Debt to Asset Ratio

24%

Kaya Mo Yan Bes Company

Comparative Balance Sheet

December 31, 2020

Assets

Cash

2020

25,000.00

2019

35,000.00

Marketable Securities

15,000.00

15,000.00

Accounts Receivable

Inventory

Propery Plant and Equipment

Total Assets

50,000.00

50,000.00

160,000 00

310.000 00

200,000.00

Liabilities and Stockholders' Equity

Accounts payable

Short-term notes payable

25,000.00

30,000.00

35,000.00

Bonds Payabie

10

20,000.00

200,000.00

35,000.00

310,000 .00

Common stock

200,000 .00

Retained earnings

Totai Liabilities and Stockholders Equity

47,000.00

11

Kaya Mo Yan Bes Company

Income Statement

For the year ended Derember 31, 2020

Net Sales

200,000.00

100,000.00

100,000.00

Cost of goods sold

Gross profit

Expenses

Depreciation Expense

Interest expense

Selling expenses

5,000.00

10,000.00

15,000 00

Administratiive expenses

Total Expenses

Income before income taxes

Income tax expense

Net Income

%3B

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning