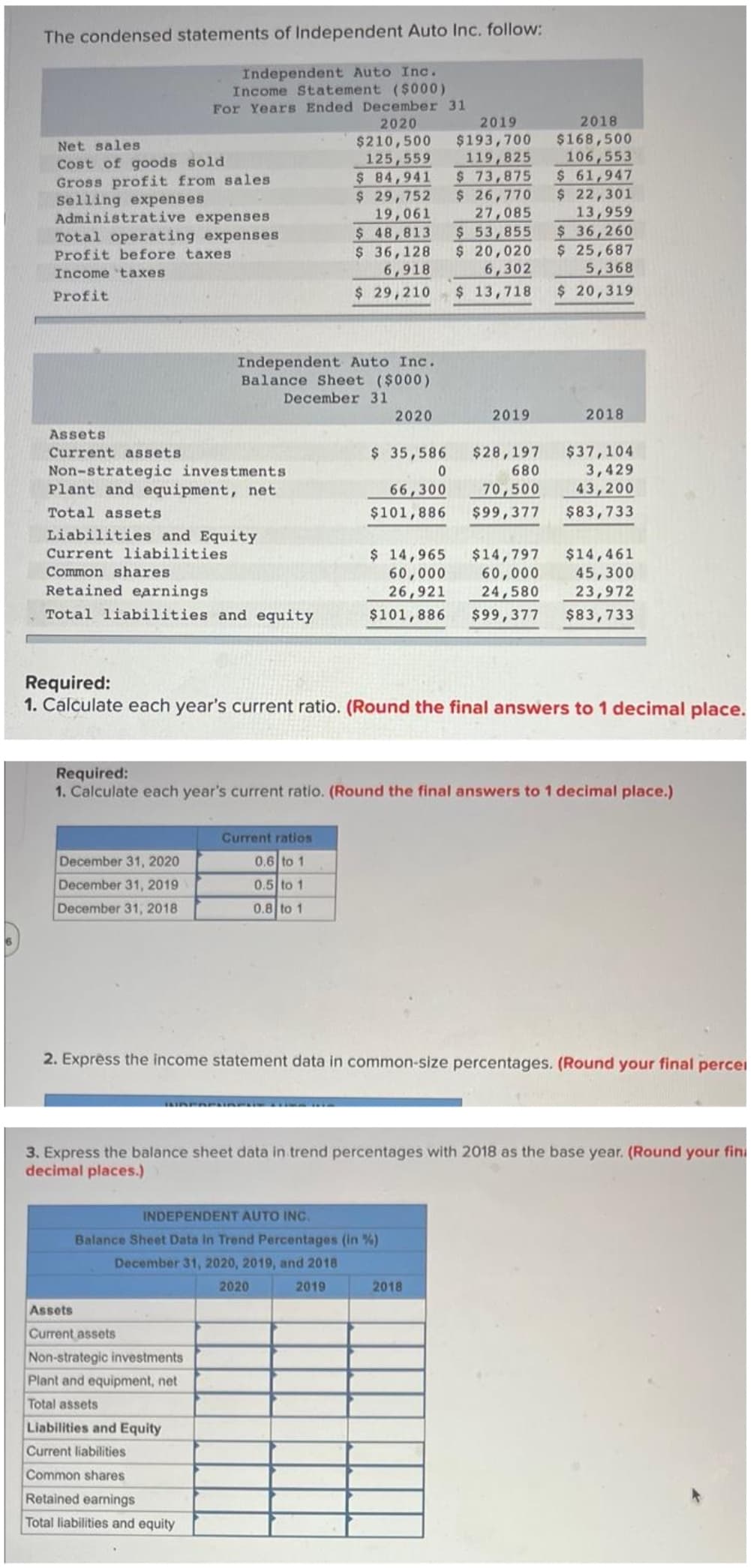

The condensed Net sales Cost of goods sold 2018 $168,500 106,553 $ 61,947 $ 22,301 Gross profit from sales Selling expenses Administrative expenses Total operating expenses Profit before taxes Income taxes 13,959 $36,260 $ 25,687 5,368 Profit $ 20,319 2018 Assets Current assets $37,104 Non-strategic investments 3,429 Plant and equipment, net 43,200 Total assets $83,733 Liabilities and Equity Current liabilities $14,461 Common shares 45,300 Retained earnings 23,972 Total liabilities and equity $101,886 $99,377 $83,733 Required: - Calculate each year's current ratio. (Round the final answers to 1 decimal plac Required: 1. Calculate each year's current ratio. (Round the final answers to 1 decimal place.) Current ratios December 31, 2020 0.6 to 1 December 31, 2019 0.5 to 1 December 31, 2018 0.8 to 1 Independent Auto Inc. Income Statement ($000) For Years Ended December 31 2020 $210,500 125,559 2019 $193,700 119,825 $ 73,875 $ 26,770 $ 84,941 $ 29,752 19,061 $48,813 $36,128 27,085 $ 53,855 $ 20,020 6,918 6,302 $ 29,210 $ 13,718 Independent Auto Inc. Balance Sheet ($000) December 31 2020 2019 $ 35,586 $28,197 0 680 66,300 70,500 $101,886 $99,377 $ 14,965 $14,797 60,000 60,000 26,921 24,580

The condensed Net sales Cost of goods sold 2018 $168,500 106,553 $ 61,947 $ 22,301 Gross profit from sales Selling expenses Administrative expenses Total operating expenses Profit before taxes Income taxes 13,959 $36,260 $ 25,687 5,368 Profit $ 20,319 2018 Assets Current assets $37,104 Non-strategic investments 3,429 Plant and equipment, net 43,200 Total assets $83,733 Liabilities and Equity Current liabilities $14,461 Common shares 45,300 Retained earnings 23,972 Total liabilities and equity $101,886 $99,377 $83,733 Required: - Calculate each year's current ratio. (Round the final answers to 1 decimal plac Required: 1. Calculate each year's current ratio. (Round the final answers to 1 decimal place.) Current ratios December 31, 2020 0.6 to 1 December 31, 2019 0.5 to 1 December 31, 2018 0.8 to 1 Independent Auto Inc. Income Statement ($000) For Years Ended December 31 2020 $210,500 125,559 2019 $193,700 119,825 $ 73,875 $ 26,770 $ 84,941 $ 29,752 19,061 $48,813 $36,128 27,085 $ 53,855 $ 20,020 6,918 6,302 $ 29,210 $ 13,718 Independent Auto Inc. Balance Sheet ($000) December 31 2020 2019 $ 35,586 $28,197 0 680 66,300 70,500 $101,886 $99,377 $ 14,965 $14,797 60,000 60,000 26,921 24,580

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter1: Introduction To Business Activities And Overview Of Financial Statements And The Reporting Process

Section: Chapter Questions

Problem 23E

Related questions

Question

Transcribed Image Text:The condensed statements of Independent Auto Inc. follow:

Independent Auto Inc.

Income Statement ($000)

For Years Ended December 31

2020

2019

Net sales

$210,500 $193,700

125,559

119,825

$ 84,941

$ 29,752

$ 73,875

$ 26,770

Cost of goods sold

Gross profit from sales

Selling expenses

Administrative expenses

Total operating expenses

Profit before taxes

Income taxes

2018

$168,500

106,553

$ 61,947

$ 22,301

13,959

$36,260

$ 25,687

19,061

$ 48,813

$36,128

27,085

$ 53,855

$ 20,020

6,918

6,302

5,368

Profit

$ 29,210

$ 13,718

$ 20,319

Independent Auto Inc.

Balance Sheet ($000)

December 31

2020

2019

2018

Assets

Current assets

$ 35,586

$28,197

$37,104

Non-strategic investments

0

680

3,429

Plant and equipment, net

66,300

70,500

43,200

Total assets

$101,886

$99,377

$83,733

Liabilities and Equity

Current liabilities

$ 14,965

$14,797

$14,461

Common shares

60,000

60,000

45,300

Retained earnings

26,921 24,580

23,972

Total liabilities and equity

$101,886

$99,377 $83,733

Required:

1. Calculate each year's current ratio. (Round the final answers to 1 decimal place.

Required:

1. Calculate each year's current ratio. (Round the final answers to 1 decimal place.)

Current ratios

December 31, 2020

0.6 to 1

December 31, 2019

December 31, 2018

0.5 to 1

0.8 to 1

2. Express the income statement data in common-size percentages. (Round your final percei

3. Express the balance sheet data in trend percentages with 2018 as the base year. (Round your fini

decimal places.)

INDEPENDENT AUTO INC.

Balance Sheet Data in Trend Percentages (in %)

December 31, 2020, 2019, and 2018

2020

2019

2018

Assets

Current assets

Non-strategic investments

Plant and equipment, net

Total assets

Liabilities and Equity

Current liabilities

Common shares

Retained earnings

Total liabilities and equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,