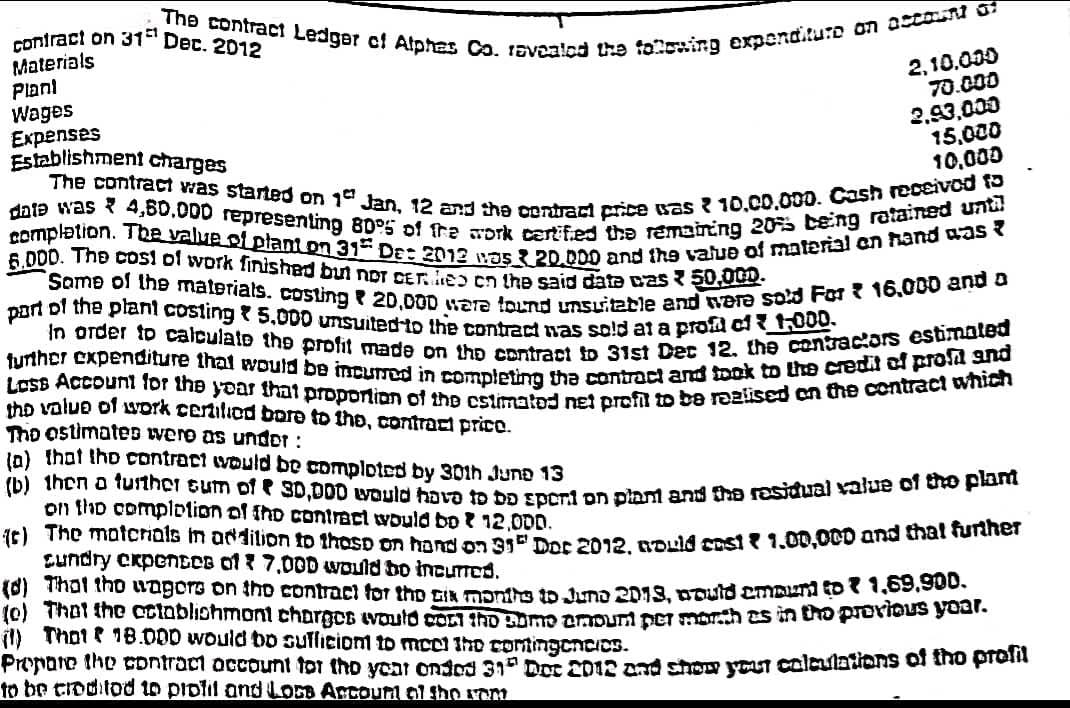

The contract Ledger of Alphas Co. revealed the following expenditure an account a contract on 31 Dec. 2012 Materials Plant Wages Expenses 2,10.000 70.000 2.93,000 15,000 10,000 Establishment charges The contract was started on 19 Jan, 12 and the contract price was 10.00,000. Cash received to date was 4,60.000 representing 80% of the work certified the remaining 20s being retained until completion. The value of plant on 31 Dec 2012 was 20.000 and the value of material on hand was 6.000. The cost of work finished but not Ceres on the said date was 50,000. Some of the materials. costing 20,000 were found unsuitable and were sold For 16,000 and a part of the plant costing & 5.000 unsuited to the contract nas sold at a profil of 1,000. In order to calculate the profit made on the contract to 31st Dec 12. the contractors estimated further expenditure that would be incurred in completing the contract and took to the credit of prof and Loss Account for the year that proportion of the estimated net profil to be realised on the contract which the value of work certified bare to the, contract price. The estimates were as under:

The contract Ledger of Alphas Co. revealed the following expenditure an account a contract on 31 Dec. 2012 Materials Plant Wages Expenses 2,10.000 70.000 2.93,000 15,000 10,000 Establishment charges The contract was started on 19 Jan, 12 and the contract price was 10.00,000. Cash received to date was 4,60.000 representing 80% of the work certified the remaining 20s being retained until completion. The value of plant on 31 Dec 2012 was 20.000 and the value of material on hand was 6.000. The cost of work finished but not Ceres on the said date was 50,000. Some of the materials. costing 20,000 were found unsuitable and were sold For 16,000 and a part of the plant costing & 5.000 unsuited to the contract nas sold at a profil of 1,000. In order to calculate the profit made on the contract to 31st Dec 12. the contractors estimated further expenditure that would be incurred in completing the contract and took to the credit of prof and Loss Account for the year that proportion of the estimated net profil to be realised on the contract which the value of work certified bare to the, contract price. The estimates were as under:

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter8: Revenue Recognition, Receivables, And Advances From Customers

Section: Chapter Questions

Problem 48P

Related questions

Question

Transcribed Image Text:The contract Ledger of Alphas Co. revealed the following expenditure an account a

contract on 31 Dec. 2012

Materials

Plani

Wages

Expenses

Establishment charges

2.93,000

15,000

10,000

The contract was started on 19 Jan, 12 and the contract price was 10,00,000. Cash received to

date was 4,60.000 representing 80% of the work certified the remaining 20s being ratained until

completion. The value of plant on 31 Dec 2012 was 20.000 and the value of material on hand was

6.000. The cost of work finished but NDT DER e cn the said date was 50,000.

Some of the materials. costing 20,000 were found unsuitable and were sold For 16,000 and a

part of the plant costing & 5.000 unsuited to the contract was sold at a profil of 1,000.

In order to calculate the profit made on the contract to 31st Dec 12, the contractors estimated

further expenditure that would be incurred in completing the contract and took to the credit of profit and

Loss Account for the year that proportion of the estimated net profil to be realised on the contract which

the value of work certified bare to the, contract price.

The estimates were as under :

(a) that the contract would be completed by 30th June 13

(b) then a further sum of 30,000 would have to bo spent on plant and the residual value of the plant

2,10,000

70.000

on the completion of the contract would

12,000.

(s) The materials in addition to those on hand on 31 Dec 2012, would cost € 1,00,000 and that further

Cundry expenses of 7,000 would be incurred.

(d) That the wagors on the contract for the six months to June 2013, would emount to 1,69,900.

(e) That the establishmont charges would cord the same amount per march as in the previous year.

(1) Thot 18.000 would bo sufficiont to meet the contingencies.

Prepare the contract account for the year onded 31 Dec 2012 and show your calculations of the profil

to be ciod tod to profil and Loss Account of the vam

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning