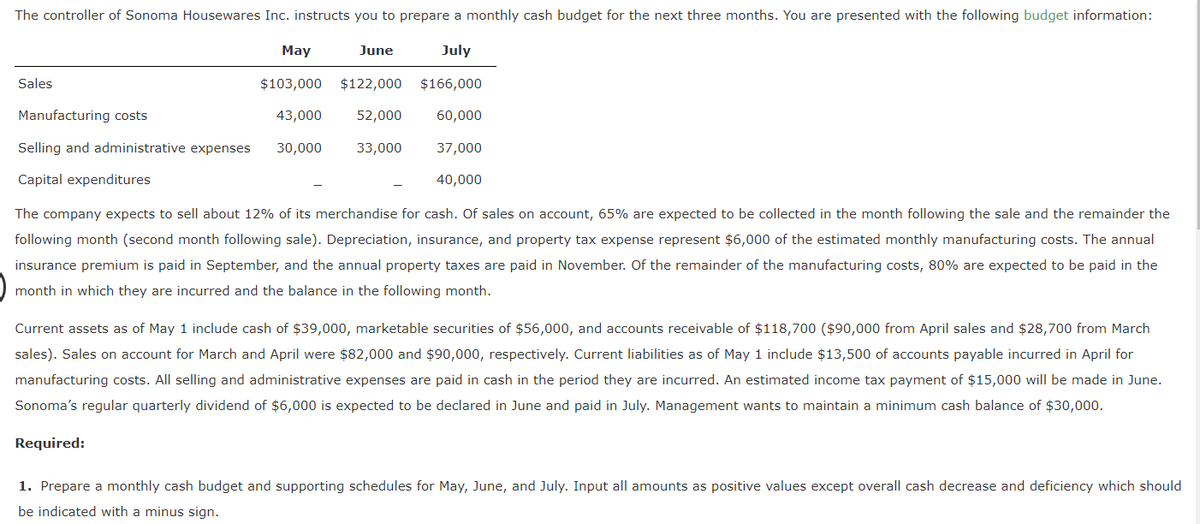

The controller of Sonoma Housewares Inc. instructs you to prepare a monthly cash budget for the next three months. You are presented with the following budget information: May June July Sales $103,000 $122,000 $166,000 Manufacturing costs 43,000 52,000 60,000 Selling and administrative expenses 30,000 33,000 37,000 Capital expenditures 40,000 The company expects to sell about 12% of its merchandise for cash. Of sales on account, 65% are expected to be collected in the month following the sale and the remainder the following month (second month following sale). Depreciation, insurance, and property tax expense represent $6,000 of the estimated monthly manufacturing costs. The annual insurance premium is paid in September, and the annual property taxes are paid in November. Of the remainder of the manufacturing costs, 80% are expected to be paid in the month in which they are incurred and the balance in the following month. Current assets as of May 1 include cash of $39,000, marketable securities of $56,000, and accounts receivable of $118,700 ($90,000 from April sales and $28,700 from March sales). Sales on account for March and April were $82,000 and $90,000, respectively. Current liabilities as of May 1 include $13,500 of accounts payable incurred in April for manufacturing costs. All selling and administrative expenses are paid in cash in the period they are incurred. An estimated income tax payment of $15,000 will be made in June. Sonoma's regular quarterly dividend of $6,000 is expected to be declared in June and paid in July. Management wants to maintain a minimum cash balance of $30,000. Required: 1. Prepare a monthly cash budget and supporting schedules for May, June, and July. Input all amounts as positive values except overall cash decrease and deficiency which should be indicated with a minus sign.

The controller of Sonoma Housewares Inc. instructs you to prepare a monthly cash budget for the next three months. You are presented with the following budget information: May June July Sales $103,000 $122,000 $166,000 Manufacturing costs 43,000 52,000 60,000 Selling and administrative expenses 30,000 33,000 37,000 Capital expenditures 40,000 The company expects to sell about 12% of its merchandise for cash. Of sales on account, 65% are expected to be collected in the month following the sale and the remainder the following month (second month following sale). Depreciation, insurance, and property tax expense represent $6,000 of the estimated monthly manufacturing costs. The annual insurance premium is paid in September, and the annual property taxes are paid in November. Of the remainder of the manufacturing costs, 80% are expected to be paid in the month in which they are incurred and the balance in the following month. Current assets as of May 1 include cash of $39,000, marketable securities of $56,000, and accounts receivable of $118,700 ($90,000 from April sales and $28,700 from March sales). Sales on account for March and April were $82,000 and $90,000, respectively. Current liabilities as of May 1 include $13,500 of accounts payable incurred in April for manufacturing costs. All selling and administrative expenses are paid in cash in the period they are incurred. An estimated income tax payment of $15,000 will be made in June. Sonoma's regular quarterly dividend of $6,000 is expected to be declared in June and paid in July. Management wants to maintain a minimum cash balance of $30,000. Required: 1. Prepare a monthly cash budget and supporting schedules for May, June, and July. Input all amounts as positive values except overall cash decrease and deficiency which should be indicated with a minus sign.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter8: Budgeting

Section: Chapter Questions

Problem 5PA: Cash budget The controller of Bridgeport Housewares Inc. instructs you to prepare a monthly cash...

Related questions

Question

I set my collectiosn of accounts as May-28700+58500,June 31500+66950, July 36050+79300. I must be missing something because it is wrong. Please help me fix the wrong answers. Thank you

Transcribed Image Text:The controller of Sonoma Housewares Inc. instructs you to prepare a monthly cash budget for the next three months. You are presented with the following budget information:

May

June

July

Sales

$103,000 $122,000

$166,000

Manufacturing costs

43,000

52,000

60,000

Selling and administrative expenses

30,000

33,000

37,000

Capital expenditures

40,000

The company expects to sell about 12% of its merchandise for cash. Of sales on account, 65% are expected to be collected in the month following the sale and the remainder the

following month (second month following sale). Depreciation, insurance, and property tax expense represent $6,000 of the estimated monthly manufacturing costs. The annual

insurance premium is paid in September, and the annual property taxes are paid in November. Of the remainder of the manufacturing costs, 80% are expected to be paid in the

month in which they are incurred and the balance in the following month.

Current assets as of May 1 include cash of $39,000, marketable securities of $56,000, and accounts receivable of $118,700 ($90,000 from April sales and $28,700 from March

sales). Sales on account for March and April were $82,000 and $90,000, respectively. Current liabilities as of May 1 include $13,500 of accounts payable incurred in April for

manufacturing costs. All selling and administrative expenses are paid in cash in the period they are incurred. An estimated income tax payment of $15,000 will be made in June.

Sonoma's regular quarterly dividend of $6,000 is expected to be declared in June and paid in July. Management wants to maintain a minimum cash balance of $30,000.

Required:

1. Prepare a monthly cash budget and supporting schedules for May, June, and July. Input all amounts as positive values except overall cash decrease and deficiency which should

be indicated with a minus sign.

Transcribed Image Text:Sonoma Housewares Inc.

Cash Budget

For the Three Months Ending July 31

May

June

July

Estimated cash receipts from:

Cash sales

12,360

14,640 V $

19,920

Collection of accounts receivable

68,340 X

98,450 X

115,350 X

Total cash receipts

80,700 x

113,090 x $ 135,270 X

Estimated cash payments for:

Manufacturing costs

27,500 x

101,600 x $

58,400 X

Selling and administrative expenses

30,000 V

33,000

37,000

Capital expenditures

40,000

Other purposes:

Income tax

15,000

Dividends

6,000

Total cash payments

37,500 x $ 149,600 X $ 141,400 X

Cash increase or (decrease)

43,200| Х $

36,510 | х $

-6,130 X

Cash balance at beginning of month

39,000 V

82,200 X

118,710 X

Cash balance at end of month

82,200 X

118,710 | Х $112,580|х

Minimum cash balance

30,000

30,000

30,000

Excess (deficiency)

52,200 X

88,710 X $

82,580 X

X >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College