The corporate valuation model, the price-to-earnings (P/E) multiple approach, and the economic value added (EVA) approach are some examples of valuation techniques. The corporate valuation model is similar to the dividend-based valuation that you've done in previous problems, but it focuses on a firm's free cash flows (FCFS) instead of its dividends. Some firms don't pay dividends, or their dividends are difficult to forecast. For that reason, some analysts use the corporate valuation model. Blur Corp. has an expected net operating profit after taxes, EBIT(1-T), of $7,600 million in the coming year. In addition, the firm is expected to have net capital expenditures of $1,140 million, and net operating working capital (NOWC) is expected to increase by $10 million. How much free cash flow (FCF) is Blur Corp. expected to generate over the next year? O $118,668 million O $6,470 million O $6,450 million O $8,730 million

The corporate valuation model, the price-to-earnings (P/E) multiple approach, and the economic value added (EVA) approach are some examples of valuation techniques. The corporate valuation model is similar to the dividend-based valuation that you've done in previous problems, but it focuses on a firm's free cash flows (FCFS) instead of its dividends. Some firms don't pay dividends, or their dividends are difficult to forecast. For that reason, some analysts use the corporate valuation model. Blur Corp. has an expected net operating profit after taxes, EBIT(1-T), of $7,600 million in the coming year. In addition, the firm is expected to have net capital expenditures of $1,140 million, and net operating working capital (NOWC) is expected to increase by $10 million. How much free cash flow (FCF) is Blur Corp. expected to generate over the next year? O $118,668 million O $6,470 million O $6,450 million O $8,730 million

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter21: Dynamic Capital Structures And Corporate Valuation

Section: Chapter Questions

Problem 9P

Related questions

Question

4

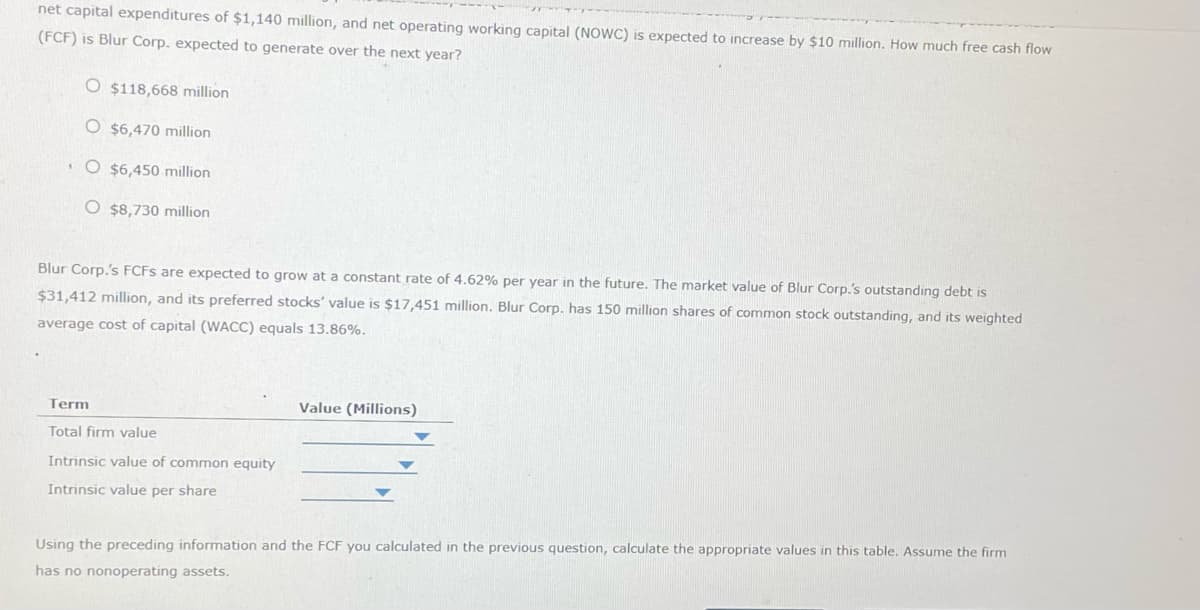

Transcribed Image Text:net capital expenditures of $1,140 million, and net operating working capital (NOWC) is expected to increase by $10 million. How much free cash flow

(FCF) is Blur Corp. expected to generate over the next year?

O $118,668 million

O $6,470 million

O $6,450 million

O $8,730 million

Blur Corp.'s FCFS are expected to grow at a constant rate of 4.62% per year in the future. The market value of Blur Corp.'s outstanding debt is

$31,412 million, and its preferred stocks' value is $17,451 million. Blur Corp. has 150 million shares of common stock outstanding, and its weighted

average cost of capital (WACC) equals 13.86%.

Term

Total firm value

Intrinsic value of common equity

Intrinsic value per share

Value (Millions)

Using the preceding information and the FCF you calculated in the previous question, calculate the appropriate values in this table. Assume the firm

has no nonoperating assets.

Transcribed Image Text:The corporate valuation model, the price-to-earnings (P/E) multiple approach, and the economic value added (EVA) approach are some

examples of valuation techniques. The corporate valuation model is similar to the dividend-based valuation that you've done in previous

problems, but it focuses on a firm's free cash flows (FCFS) instead of its dividends. Some firms don't pay dividends, or their dividends

are difficult to forecast. For that reason, some analysts use the corporate valuation model.

Blur Corp. has an expected net operating profit after taxes, EBIT(1-T), of $7,600 million in the coming year. In addition, the firm is expected to have

net capital expenditures of $1,140 million, and net operating working capital (NOWC) is expected to increase by $10 million. How much free cash flow

(FCF) is Blur Corp. expected to generate over the next year?

O $118,668 million

O $6,470 million

O $6,450 million

O $8,730 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning