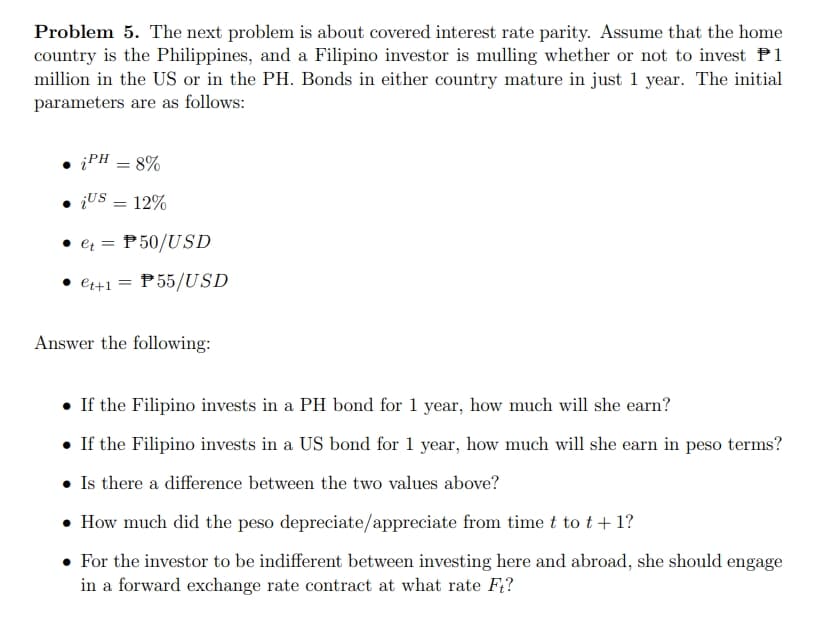

Problem 5. The next problem is about covered interest rate parity. Assume that the home country is the Philippines, and a Filipino investor is mulling whether or not to invest P1 million in the US or in the PH. Bonds in either country mature in just 1 year. The initial parameters are as follows: • iPH = 8% • US = 12% • et = P50/USD • et+1 P55/USD Answer the following: • If the Filipino invests in a PH bond for 1 year, how much will she earn? • If the Filipino invests in a US bond for 1 year, how much will she earn in peso terms? • Is there a difference between the two values above? • How much did the peso depreciate/appreciate from time t to t + 1? • For the investor to be indifferent between investing here and abroad, she should engage in a forward exchange rate contract at what rate Ft?

Problem 5. The next problem is about covered interest rate parity. Assume that the home country is the Philippines, and a Filipino investor is mulling whether or not to invest P1 million in the US or in the PH. Bonds in either country mature in just 1 year. The initial parameters are as follows: • iPH = 8% • US = 12% • et = P50/USD • et+1 P55/USD Answer the following: • If the Filipino invests in a PH bond for 1 year, how much will she earn? • If the Filipino invests in a US bond for 1 year, how much will she earn in peso terms? • Is there a difference between the two values above? • How much did the peso depreciate/appreciate from time t to t + 1? • For the investor to be indifferent between investing here and abroad, she should engage in a forward exchange rate contract at what rate Ft?

Chapter7: International Arbitrage And Interest Rate Parity

Section: Chapter Questions

Problem 30QA

Related questions

Question

Please dont reject. Help me answer this completely.

Transcribed Image Text:Problem 5. The next problem is about covered interest rate parity. Assume that the home

country is the Philippines, and a Filipino investor is mulling whether or not to invest P1

million in the US or in the PH. Bonds in either country mature in just 1 year. The initial

parameters are as follows:

iPH = 8%

¡US = 12%

• et = P50/USD

• et+1 = P55/USD

Answer the following:

• If the Filipino invests in a PH bond for 1 year, how much will she earn?

. If the Filipino invests in a US bond for 1 year, how much will she earn in peso terms?

• Is there a difference between the two values above?

• How much did the peso depreciate/appreciate from time t to t + 1?

• For the investor to be indifferent between investing here and abroad, she should engage

in a forward exchange rate contract at what rate Ft?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning