The cost function is c =q². Therefore, marginal cost equals 2q. Quantity refersto square metre of road resurfacing. Note the Q denotes aggregate market demand and q denotes your production. Of course, if you are the only supplier than q = Q. a) Compute profit maximising price and output. Compute profits. b) The monopoly profit that you have been earning has attracted attention from another firm that will set up operations in South Koreaand compete for market share. You are concerned with losing market share and profit. So, you offer the potential entrant the following deal. Both firms agree to maximise industry profits (joint profits). The potential entrant wants to know: i. How much each firm will produce? What will be the market price? ii. iii. How much profit will each firm earn? iv. What will be industry profits? c) When you make the offer detailed in part b), the potential entrant observes that aggregate industry profits are different than when the market was supplied only by your firm. Explain the potential entrant why aggregate profits are not the same.

The cost function is c =q². Therefore, marginal cost equals 2q. Quantity refersto square metre of road resurfacing. Note the Q denotes aggregate market demand and q denotes your production. Of course, if you are the only supplier than q = Q. a) Compute profit maximising price and output. Compute profits. b) The monopoly profit that you have been earning has attracted attention from another firm that will set up operations in South Koreaand compete for market share. You are concerned with losing market share and profit. So, you offer the potential entrant the following deal. Both firms agree to maximise industry profits (joint profits). The potential entrant wants to know: i. How much each firm will produce? What will be the market price? ii. iii. How much profit will each firm earn? iv. What will be industry profits? c) When you make the offer detailed in part b), the potential entrant observes that aggregate industry profits are different than when the market was supplied only by your firm. Explain the potential entrant why aggregate profits are not the same.

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter16: Government Regulation

Section: Chapter Questions

Problem 10E

Related questions

Question

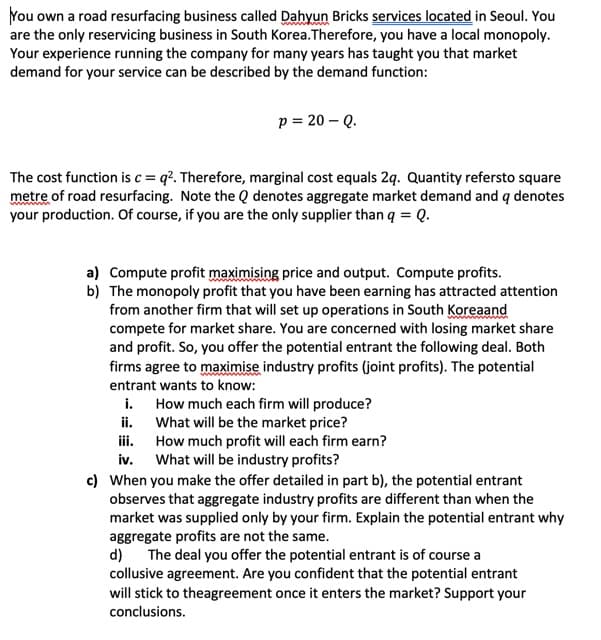

Transcribed Image Text:You own a road resurfacing business called Dahyun Bricks services located in Seoul. You

are the only reservicing business in South Korea. Therefore, you have a local monopoly.

Your experience running the company for many years has taught you that market

demand for your service can be described by the demand function:

p = 20 - Q.

The cost function is c =q². Therefore, marginal cost equals 2q. Quantity refersto square

metre of road resurfacing. Note the Q denotes aggregate market demand and q denotes

your production. Of course, if you are the only supplier than q = Q.

a) Compute profit maximising price and output. Compute profits.

b) The monopoly profit that you have been earning has attracted attention

from another firm that will set up operations in South Koreaand

compete for market share. You are concerned with losing market share

and profit. So, you offer the potential entrant the following deal. Both

firms agree to maximise industry profits (joint profits). The potential

entrant wants to know:

i.

How much each firm will produce?

What will be the market price?

ii.

iii.

How much profit will each firm earn?

iv. What will be industry profits?

c) When you make the offer detailed in part b), the potential entrant

observes that aggregate industry profits are different than when the

market was supplied only by your firm. Explain the potential entrant why

aggregate profits are not the same.

d) The deal you offer the potential entrant is of course a

collusive agreement. Are you confident that the potential entrant

will stick to theagreement once it enters the market? Support your

conclusions.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning