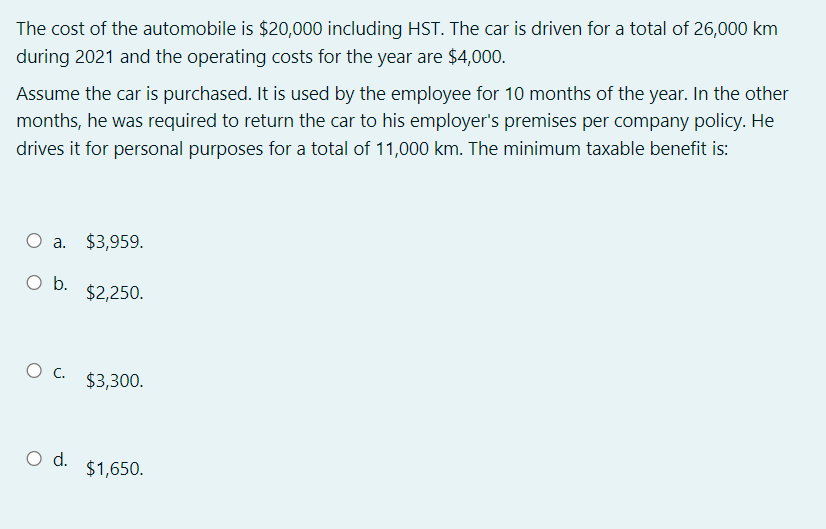

The cost of the automobile is $20,000 including HST. The car is driven for a total of 26,000 km during 2021 and the operating costs for the year are $4,000. Assume the car is purchased. It is used by the employee for 10 months of the year. In the other months, he was required to return the car to his employer's premises per company policy. He drives it for personal purposes for a total of 11,000 km. The minimum taxable benefit is: O a. $3,959. O b. O C. O d. $2,250. $3,300. $1.650.

The cost of the automobile is $20,000 including HST. The car is driven for a total of 26,000 km during 2021 and the operating costs for the year are $4,000. Assume the car is purchased. It is used by the employee for 10 months of the year. In the other months, he was required to return the car to his employer's premises per company policy. He drives it for personal purposes for a total of 11,000 km. The minimum taxable benefit is: O a. $3,959. O b. O C. O d. $2,250. $3,300. $1.650.

Chapter6: Deductions And Losses: In General

Section: Chapter Questions

Problem 31CE

Related questions

Question

A.3.

Transcribed Image Text:The cost of the automobile is $20,000 including HST. The car is driven for a total of 26,000 km

during 2021 and the operating costs for the year are $4,000.

Assume the car is purchased. It is used by the employee for 10 months of the year. In the other

months, he was required to return the car to his employer's premises per company policy. He

drives it for personal purposes for a total of 11,000 km. The minimum taxable benefit is:

O a. $3,959.

O b.

O C.

O d.

$2,250.

$3,300.

$1,650.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College